From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Key market themes

Update on the coronavirus

- As of Monday morning, 14,000+ people have been infected and 300+ people in China have died from the virus

- Travel restrictions are slowly ratcheting higher with some countries such as Italy ceasing direct travel links and many others such as Australia limiting entry from those travelling from China to permanent residents and citizens

- China has restricted all group travel overseas indefinitely until at least the end of February according to some reports, with some speculating it could be until the end of March. Group travel accounts for 25% of total outbound Chinese tourist travel to Australia.

- Chinese mainland share-markets resume trading today for the first time in over a week following the Chinese New Year Spring Holiday. Based upon how Hong Kong stocks traded late last week, and in light of the Chinese Government’s significant liquidity stimulus announced on Friday (see below), investors expect to see the mainland index down approximately -6% to -8%.

- On the weekend Chinese authorities announced a CNY1.2trillion liquidity injection to the financial system to ensure panic was limited, of which some CNY150bn is earmarked to support the share-market. This is sensible and well-timed policy.

- Australia’s economy and share-market will be significantly impacted by the virus outbreak, from our already wounded tourism sector post bushfire season, through to our mining stocks (industrial metals prices have fallen over -10% since the outbreak given China’s huge share of global demand) and education sector

- Knocked from the summer bushfires, there is a very real chance the double-hit from the virus and fires could elicit Australia’s first technical recession in 30 years in 2020.

US Politics

- This week is a major week in US politics with the Iowa Democrat caucus to be held overnight AEST Monday

- Both Sanders and Biden remain front-runners and commentators have highlighted the significance of Iowa in the race to be the Democrat Presidential nominee having predicted the 4 last nominees and 7 of the last 9

- On Thursday Democrat candidates will contest a town hall debate in New Hampshire ahead of that state’s caucus to be held next Tuesday the 11th February

- The Presidential State of the Union address will also be delivered on Tuesday night this week (Wednesday morning AEST) by President Trump

Australian profit warning season

- Treasury Wines (TWE) and Nearmap (NEA) were the latest companies to announce disappointing profits for the period to December 2019

- Warnings thus far have come from the likes of Nufarm (NUF), Downer (DOW), CIMIC (CIM), NIB Holdings (NHF), Insurance Australia (AIG), Suncorp (SUN), Kogan.com (KGN) and Super Cheap Auto (SUL)

Economic data released

Australian Business Confidence falls to a 6-year low in December

- Following on from last week’s soft Consumer Confidence number, the December NAB Business Confidence figures offered up a similar level of pessimism with the data showing confidence at its lowest ebb since mid-2013

- Forward orders, capital expenditures and profitability all remain under pressure and in dire need of stimulatory efforts

- Of most concern in the release was the statement accompanying the report which highlighted that the impact of the national bushfire crisis had yet to be felt in the survey data, suggesting that the January and February releases could see even greater weakness arise

Company News

Oil Search (OSH) announce disappointing outcome of negotiations with PNG Government

- OSH announced the disappointing pause in negotiations between the PNG Government and its major partner in the PNG LNG project, Exxon Mobil (XOM), over plans to develop the major P’nyang gas field.

- Sadly OSH are the meat in this sandwich with the PNG Government seeking improved royalty terms on production from the field and XOM unwilling to renegotiate, emboldened by the developing global LNG glut and their resulting lack of urgency to develop the substantial reserve

- Given that resolving terms on Pn’yang were seen as key to the economics of expanded production from the PNG LNG project and indeed to optimal returns through shared infrastructure on the Papua LNG project being developed by Total, this is a major blow for OSH who has a substantial stake in both key PNG projects.

- It remains to be seen whether the groups can find grounds for re-negotiation and how French oil major Total choose to react to this news

Observations for the past week

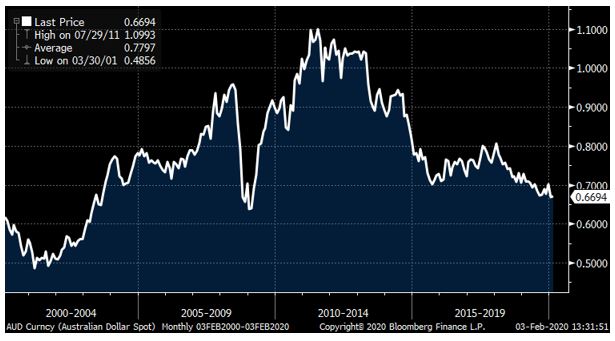

Australian Dollar lurking at 10-year low

This week the AUD near enough reached its lowest point since the GFC, falling under 67c.

The combined impact of the coronavirus on Australia’s tourism industry alongside the destruction inflicted by our ongoing summer bushfire crisis leaves the domestic economy on the brink of losing its unbroken 30-year track record of positive economic growth.

With the economy unlikely to take heart from additional RBA interest rate cuts and the Federal Government unlikely to offer any material fiscal stimulus ahead of the May Budget, the local economy has been cast adrift in what could prove to be a lost year for economic progress.

Unsurprisingly the AUD is now weighing heavily at 67c and seems set to push towards its GFC low point in the 60-63c range.

Looking ahead

| Monday | AU Australian Industry Group and CBA Manufacturing Indices (JAN), AU Building Approvals (DEC), AU ANZ Job Advertisements (JAN), CH Caixin Manufacturing & Services Indices (JAN), US ISM Manufacturing Index (JAN) |

| Tuesday | AU RBA Meeting |

| Wednesday | AU Australian Industry Group Construction Index (JAN), CBA Services Index (JAN), US ADP Employment (JAN), US Markit Services Index (JAN), US ISM Non-Manufacturing Index (JAN) |

| Thursday | AU Retail Sales (DEC), NAB Business Confidence (Q4) |

| Friday | AU Australian Industry Group Services Index (JAN), AU RBA Monetary Policy Statement, US Employment (JAN) |

This will be a major week for investment markets for multiple reasons, not least of which will be the re-opening of Chinese share-markets for trade following the week-long holiday for Chinese New Year.

With the ongoing spread of the coronavirus, investors will be watching closely to see where markets open.

Beyond Asia, it is a major week in US politics with the Iowa caucus to be held Monday night (Tuesday morning AEST) and the President’s State of the Union address to the nation on Tuesday (Wednesday morning AEST).

Alphabet (GOOG) lead a long list of North American and European companies to report December quarter earnings, and in Australia it is highly likely we will see more early profit warning announcements from companies ahead of the formal start of reporting season next week.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 7121 | -82 | -1.1% |

| S&P / ASX 200 | 7017 | -73 | -1.0% |

| Property Trust Index | 1668 | -11 | -0.6% |

| Utilities Index | 8205 | +12 | +0.1% |

| Financials Index | 6255 | -9 | -0.1% |

| Materials Index | 14062 | -442 | -3.0% |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 3225 | -70 | -2.1% |

| London’s FTSE | 7286 | -299 | -3.9% |

| Japan’s Nikkei | 23205 | -622 | -2.6% |

| Hang Seng | 26312 | -1637 | -5.9% |

| China’s Shanghai | 2976 | closed | – |

Key dividends

| Date | Header |

| Mon 3 Feb 2020 | N/A |

| Tue 4 Feb 2020 | N/A |

| Wed 5 Feb 2020 | N/A |

| Thu 6 Feb 2020 | N/A |

| Fri 7 Feb 2020 | N/A |

Monday 03 February 2020, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.