From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Coronavirus Investment update

The grind higher continued modestly last week with most major indices pushing a further 2-4% upwards.

Volume remains significantly down on what was seen in the downtick, understandably, and the rally thus far continues to be driven in large part by a very narrow subset of stocks across most major indices, with technology notable as a key driver in the U.S.

The massive surge in liquidity provision that major central banks, led by the U.S Federal Reserve, have provided in the past month has taken financial market liquidity provision off the table as a risk for embattled corporates, but the issue remains as to how the transfer mechanism applies in getting this liquidity into the real world.

To that end its been notable that deeply cyclical parts of the market remain very much on the outer, indicating that as yet investors seem unwilling to ascribe much value to the idea of imminent cyclical recovery.

The lowest quality corporate debt on issue, such as CCC-rated bonds, have also been the weakest in the rally.

Where liquidity was a major issue 4 weeks ago, solvency has now become the predominant concern for investors.

This morning WTI oil prices have collapsed -15% to $15/barrel and their lowest level since 1999.

The demand destruction inflicted on oil markets by global airline travel bans and social-distancing rules has been immense and there is now concern that U.S storage capabilities might breach their limits causing producers to have to deeply discount current production in order to find buyers willing and able to store it.

Oil is a very central risk to wider markets in general given the major impact oil prices have on profitability of major U.S corporate borrowers and on the revenues of emerging market economies such as Russia and Brazil.

U.S high yield debt indices have approximately a 10% exposure to oil leaving investors here vulnerable to a run of bankruptcies and wider selling of non-investment grade debt.

The risk of a knock-on effect to other highly levered borrowers as investors exit the sector is real.

Confirming the ongoing issues of solvency in US credit markets was the announcement by Moody’s that it could cut the investment ratings on some US$22bn in collateralized loan obligations (CLO’s) it rated, or 19% of the total Moody’s covered.

A CLO is simply a portfolio of corporate loans packaged up to be sold to investors that aims to offer greater security to investors by way of diversification.

Once again this looks to be a highly questionable strategy and has the potential to cause significant investor selling across corporate credit as solvency issues loom with an economy stuck in lock down.

The issues in credit have not been solved by the Fed’s bold liquidity support of a few weeks ago, and only a re-opening of the world economy in quick step is likely to guard against rising insolvencies and the knock on effect to investors exposed.

This remains a considerable factor in our ongoing cautious outlook.

On a positive, and this is only a personal view, but I think locally here we might have reason to feel like the tide is turning in Australia on our battle to contain the rate of infection.

Everybody knows we have flattened the curve well, and with the prospect of contact tracing technology being rolled out in a fortnight, I would hazard a guess to say that small freedoms will be granted in as soon as 4 weeks.

Let’s keep an eye on how the Danes and Austrians do in the coming few weeks on their ‘opening up’, but with a little bit of luck, Australians are likely to see slightly less restrictions by mid-May and that, in my mind, is likely to include the resumption of school for junior and middle school students and perhaps even senior school students.

Just a personal view.

Hope all remain well.

Observations for the past week

China GDP in Q1 fell -6.8% and Retail Sales fell 15.8% annually

- Chinese electricity production fell -4.6% for March on an annual basis, up from -8% annual falls in January and February

- Encouragingly, the Chinese economy is slowly returning to normalcy albeit with significant restrictions and a focus on personal safety. However, its notable that activity on weekend’s remains well down and indicates a continued distrust of potential infection.

- Australian Business Confidence fell to its lowest level on record in March, well down on the levels seen during the GFC understandably – we continue to make that point that Australia is far less well prepared to execute a quick turnaround from this economic hit than it was in 2008-09

- Westpac Consumer Confidence also fell to its lowest level in history last month

- The CALTEX (CTX) takeover this morning was called off forcing the shares down by -8%. This outlook for M&A in the coming 6 months looks very low given concerns over target company profitability, but also simply due to the inability for foreign bidders in particular to conduct appropriate due diligence with travel restrictions.

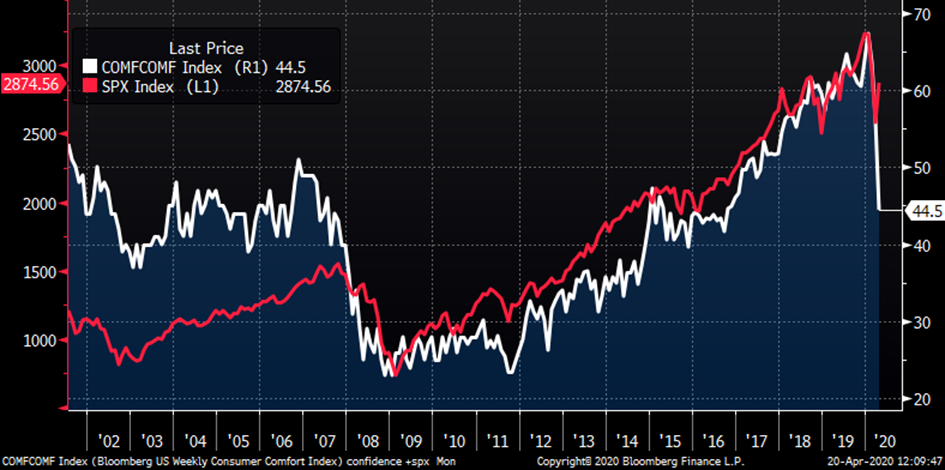

US Consumer Confidence beginning to unwind

- We have commented at how surprised we have been by the seemingly modest impact the crisis has had on US consumer confidence in recent weeks, however last week’s Bloomberg confidence reading did continue to fall, reaching levels last seen before the election of President Trump in Q4 2016

- Compared to other countries such as Australia, China and Europe the fall remains a positive outlier, but all the same the negativity is slowly seeping into the U.S consumer psyche and certainly explains why the President is keen to get the economy back moving again sooner than later

- The chart below shows Weekly Consumer Confidence (in white) overlaid against the S&P 500 (red), demonstrating again the resilience of U.S equity markets to the COVID-19 shock.

Looking ahead

| Monday | US Chicago Fed National Activity Index (MAR) |

| Tuesday | AU ANZ Weekly Consumer Confidence, AU RBA Meeting minutes |

| Wednesday | AU Westpac Leading Index (MAR), AU Skilled Vacancies (MAR) |

| Thursday | AU CBA PMI Manufacturing & Services PMI (APR) US Weekly Jobless Claims (4.5m expected), US Weekly Bloomberg Consumer Confidence, US Markit Manufacturing & Services PMI (APR) |

| Friday | US Michigan Consumer Confidence (APR) |

As with the previous weeks, the key focus will be on the weekly jobless claims and consumer confidence figures in the United States as this data is the most current.

The April purchasing manager data to be released worldwide on Thursday will also be closely watched to see the extent of the fall-off in April activity.

US corporate reporting season continues this week with many industrial companies such as Halliburton (HAL), PACCAR (PAC), Dover (DOV), Freeport (FCX), Illinois Toolworks (ITW) and 3M (MMM) reporting, alongside tech companies such as Netflix (NFLX), IBM (IBM) and Intel (INTC).

We will get some sense of economic reality from many of these companies, but market direction is still likely to be dictated by the major tech giants next week.

Amazon (AMZN), Tesla (TSLA), Google (GOOG), Microsoft (MSFT), Apple (AAPL) and Facebook (FB) all report next week and will be a major focus for investors given these stocks have contributed so much of the market’s rebound from its March lows.

There is risk of disappointment here clearly.

The first of the three major Australian banks reporting, being (ANZ) reports next Thursday.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 5544 | +105 | +1.9% |

| S&P / ASX 200 | 5487 | +100 | +1.9% |

| Property Trust Index | 1173 | +7 | +0.7% |

| Utilities Index | 7730 | +126 | +1.6% |

| Financials Index | 4302 | +9 | +0.2% |

| Materials Index | 11780 | +238 | +2.1% |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 2874 | +113 | +4% |

| London’s FTSE | 5787 | -55 | -0.9% |

| Japan’s Nikkei | 19897 | +855 | +4.2% |

| Hang Seng | 24380 | +80 | +0.3% |

| China’s Shanghai | 2839 | +43 | +1.4% |

Key dividends

| Date | |

| Mon 20 April | Div Pay Date – Vanguard ETF’s + Betashares ETF’s |

| Tue 21 April | Div Pay Date – I-shares ETF’s |

| Wed 22 April | n/a |

| Thu 23 April | n/a |

| Fri 24 April | n/a |

–

Monday 20 April 2020, 3pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.