From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Coronavirus Investment Playbook edition 2.

As per last week, we feel it appropriate for the interim to continue to focus on markets from the prism of the coronavirus and its impact.

Equity markets were significantly weak in the U.S and Australia particularly, but all asset markets including safe havens such as gold, bonds and cryptocurrency all lost value.

Selling of safe haven assets is indicative of widespread liquidation – gold is -10% from its highs, Bitcoin -40% from its highs and even the composite Australian bond index lost -2% last week.

Locally, Australian banks saw heavy selling as concerns over the severity of the quarantine period and its impact on employment reached a fever pitch.

The Thursday RBA announcement committing to domestic QE (dedicated interest rate targeting on 3-year bonds at 0.25%) and with it a $90bn facility for banks to keep small and medium size businesses liquid through the virus crisis saw major banks lose -10% or so as investors began to fathom the impact on sector profitability, particularly as it seemed the banks were being dragged into national service to protect the economy.

It was noted by top-rated banks analysts at UBS, that Australian banks are now trading below book value for the first time since 1993 – the end of the last recession.

Across the board companies withdrew earnings guidance faced with the complete uncertainty as to when governments will ease quarantine restrictions on their constituents.

Despite the heavy losses last week and emerging value in some major Australian shares, we believe patience will be rewarded.

We continue to believe that the market will not find its feet for longer than 1-2 days until the United States infection rate looks to have peaked, and regrettably that still looks 4-6 weeks away.

The U.S and Spain and the U.K are broadly a week behind Italy in the infection curve and with the U.S having dragged their heels both on quarantine measures and testing, it feels nigh on inevitable that the coming fortnight will see a major deterioration in the case numbers there.

Until such time as the world’s biggest economy looks to have the virus under some control, all risky assets will remain under pressure.

Equally, the news out of Europe remains negative – this weekend Italian and Spanish governments extended mandatory quarantine for a further fortnight until April 3rd with no promise that at that point it won’t be extended further.

The signs point toward an extended quarantine globally which in turn makes the liquidity crunch all the more acute for businesses and households affected.

Portfolio Thoughts

As above, we retain the view that remain defensive until such time as the United States situation has stabilised feels most appropriate.

Investors are seeking liquidity right now and we feel that recommended portfolios are appropriately defensive and liquid.

Our preference for international equities has been rewarded with the fall in the Australian Dollar last week to as low as 55-56c – the MSCI World ex-Australia equity index is down -13% YTD, less than half that of the ASX200’s -28% fall with dividends.

However, we are increasingly of the view that the AUD is now reaching a low point and so are actively considering switching part of our international equity funds into hedged versions.

In the defensive portfolio’s we remain very comfortable with how we are positioned and would encourage investors to do their best to ignore the share prices of listed fixed income trusts such as the Metrics Master Income Trust (MXT), Metrics Opportunities Trust (MOT) and Qualitas Real Income Fund (QRI).

Whilst it is uncomfortable seeing these trusts trade 15-30% under net asset value, we do believe the current size of the discounts to be excessive and temporary and we believe strongly that these trusts are managed in a manner that exceeds their listed peer group.

In the case of MXT investors should remember that 60%+ of the portfolio is in senior loans and over half of the portfolio is investment grade lending. The remaining balance is in senior private debt and real estate debt with strong equity protection.

Whilst we have been thrilled with the performance of the Ardea Real Outcome fund thus far, we believe the opportunity looks incredibly strong for gains in the months ahead.

The dislocation in asset fixed income markets currently was described as the most fertile investment opportunity set these managers had seen in their careers, and accordingly we are looking to increase our allocation here in recommended portfolios.

Lastly, on the Australian equity portfolio performance has been hampered by the large exposures we have had to mid-cap stocks.

In recent days we have made increased room to take advantage of opportunities following the market fall and feel strongly that not only will many of our positions see improving performance, but that our cash weightings can be put to good use upgrading the quality of the portfolio holdings in the weeks and months ahead.

Some good news

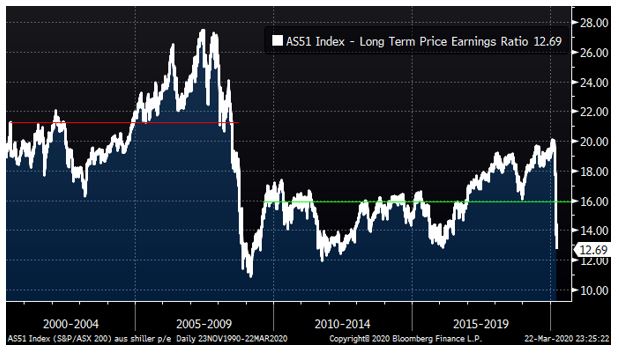

The chart below is of the Australian share-market valuation using the average corporate earnings over the past decade rather than the current year earnings.

The aim is to smooth out the earnings cycle and is called the Shiller P/E.

As you can see, the Australian share-market is fast approaching the low point it achieved back in the GFC.

Given that Australia’s economy has been quite soft for much of the last 5-6 years, this is a reasonable sign that equity valuations, particularly of major Australian companies, are becoming more attractive.

Looking ahead

| Monday | US Chicago Fed National Activity Index (Feb)

|

| Tuesday | *** AU CBA Manufacturing & Service sector PMI’s (Mar), US Markit Service & Manufacturing PMI’s (Mar), Richmond Fed Manufacturing PMI (Mar) |

| Wednesday | AU Skilled Vacancies (Feb)

|

| Thursday | *** US Weekly Jobless Claims, US Weekly Bloomberg Consumer Confidence |

| Friday | US Michigan Consumer Confidence (Mar) |

This week the major focus will be on the initial March economic data due Tuesday, but then on the weekly jobless claim figures due Thursday night.

Weekly jobless claims measure those seeking welfare benefits for the first time, and it is predicted that this week will see a flood of 2m+ new applicants, making the past week the largest jump in welfare in history by a factor of almost 3x.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 4854 | -736 | -13.2% |

| S&P / ASX 200 | 4816 | -723 | -13.1% |

| Property Trust Index | 988 | -374 | -27.5% |

| Utilities Index | 7011 | -11 | -1.5% |

| Financials Index | 4075 | -645 | -13.7% |

| Materials Index | 10112 | -386 | -3.8% |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 2304 | -407 | -15% |

| London’s FTSE | 5190 | -176 | -3.3% |

| Japan’s Nikkei | 16552 | -879 | -5% |

| Hang Seng | 22805 | -1227 | -5.1% |

| China’s Shanghai | 2745 | -142 | -4.9% |

Key dividends

| Date | |

| Mon 23 March 2020 | Div Pay Date – NABPC, WBCPE, WBCPF, WBCPH |

| Tue 24 March 2020 | Div Ex-Date – Cochlear (COH)

Div Pay Date – AMCOR (AMC), ANZPE, ANZPF, BHP (BHP), Challenger (CGF), Oil Search (OSH) |

| Wed 25 March 2020 | Div Ex-Date – SEEK (SEK), Webjet (WEB)

Div Pay Date – Altium (ALU), ASX (ASX), Downer (DOW), Insurance Australia (IAG), Sonic Healthcare (SHL), Worley (WOR) |

| Thu 26 March 2020 | Div Ex-Date – Flight Centre (FLT)

Div Pay Date – Medibank (MPL), Reece (REH), SANTOS (STO) |

| Fri 27 March 2020 | Div Ex-Date – NABPD

Div Pay Date – AGL (AGL), Coles (COL), Origin (ORG), Telstra (TLS) |

–

Monday 23 March 2020, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.