From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Key market themes

Update on the coronavirus

- Despite nearly 78,000 people in China being confirmed as infected and with an increasing number of viral outbreaks now occurring in places such as Italy, South Korea and Iran, equity markets have largely discounted any serious impact to equity market prospects as global equities remain within 5% of all time highs set just last week.

- The world’s largest company, Apple (AAPL) last week warned that on account of the virus the company would no longer be able to deliver on its first quarter revenue targets, but only fell -1% the day following the announcement

- Chinese data suggests that both train and road travel in the first two weeks of February is down between -80% and -90% on the previous year

US Politics

- After what was an embarrassing opening to the Democrat Party’s nominee process in Iowa, the following few weeks has seen left-leaning candidate Bernie Sanders surge into the lead with a particularly strong showing this weekend in Nevada.

- The South Carolina primary is this week before 14 states vote as part of next Tuesday March 3rd’s ‘so-called ‘Super Tuesday’ vote and where 1/3rd of delegates to the Democrat National Congress will get decided.

- Thus far, equity markets have chosen to view the surge in Bernie Sanders’ popularity perversely as a positive, presumably on the belief that his policy platforms are likely too radical to garner enough mainstream electoral support required to beat the President at November’s election

Economic data released

Australian employment trends look OK

- For the second month in a row, Australian skilled vacancies rose, but still remain -7.5% on January 2019

- Skilled vacancies had fallen 11 months in a row during 2019 before rising in December

- January employment posted another surprising jump with January full-time employment jumping by 46,200 jobs, largely at the expense of a fall in part-time employment

- The 2019 weakness in both skilled and unskilled job advertising has yet to be felt in the real employment figures and hence the unemployment rate remains within a whisker of its lows at 5.3%

- Interestingly the Australian ‘underemployment’ rate rose last month to 8.6%, its highest level in 18 months, perhaps in a sign that some of the jump in full-time employment might not be quite what it seems

US housing continues to boom

- January housing starts remain elevated at an annual rate of 1.567m and just off last month’s figure which was the highest since 2007

- In an even more encouraging sign for future residential construction, building permits jumped to an annual rate of 1.551m and this number has risen about +20% since mid-2019

- Unsurprisingly the NAHB Housing Market Index for February remains only marginally under its 20-year high achieved in January this year

Company News

IOOF (IFL) results were sound

- IFL had already guided on first half profits, but compositionally the platform business showed higher margin attrition than analysts expected but that investment management performed marginally better

- Encouragingly the $223m in remediation costs provisioned for did not change and for the time being IFL feel comfortable that this is an accurate assessment despite being optically significantly lower than its peer group on a ‘per-advisor’ basis

- There is no doubt that the financial advice industry is under severe margin pressure following on from the Royal Commission, and this is being felt in the IFL business, however as the 5th largest player and in an industry set to consolidate further (each of MLC, CFS and BT’s owners are sellers), we expect IFL to leverage its scale and continued ability to cross-subsidise for medium-term gain

- On <12x downgraded 2021 earnings and a 6%+ fully-franked and growing dividend yield, we believe the stock is good buying under $7

Boral (BLD) shares rose +8% last week after detailed interim results

- BLD interim results detail was announced and cashflows were weaker and net debt was higher (remember the company had already pre-announced).

- January Australian concrete volumes were down a staggering -30% YoY, in part impacted by the bushfire crisis on logistics

- Interestingly the BLD board also announced it had commenced a strategic review ahead of the appointment of a new CEO in a sign that the company understands it is under significant pressure to act given current results and the potential for a 3rd party to swoop in and take the company over

- We think the booming US housing market and weak Australian Dollar means BLD will be hard-pressed to avoid break up

Webjet (WEB) shares soared last week despite the guidance downgrade though it has since given back gains on Monday and Tuesday as COVID-19 headlines drive travel related equities lower

- Understandably after the impact of the coronavirus on global travel volumes, WEB cut 2020 earnings guidance by around -6-7%

- However, the shares jumped +10% on the day despite the downgrade as the results demonstrated that in the 7 months to the end of January before the virus impact, WEB total transaction values were +21% and annualising the 1H EBITDA would have seen analysts upgrading 2020 profits by +5% or more

- Such was the level of underlying momentum in the business pre-virus, that WEB have brought forward their 2022 guidance for ‘8/4/4’ by a year to 2021 – 8/4/4 implied 8% revenue per transaction value and 4% costs leaving 4% profit and a resultant 50% EBITDA margin

- The company highlighted that it had nothing additional to say on potential M&A, however with these results and the hope for a speedy end to the impact from coronavirus, there is strong potential WEB receives a bid from private equity

BHP (BHP) results were about as dull as they have been in some time

- BHP profit figures were largely in line with analyst forecasts although net debt was slightly higher than expected which meant interim dividend expectations proved high relative to the 65c per share result (75-80c forecast)

- The new CEO Mike Henry had little contribute to change analyst expectations and for now we see little reason to expect major outperformance from BHP as rising seaborne iron ore volumes in the coming years clash with a likely peak in Chinese steel production volumes

Observations from the past week

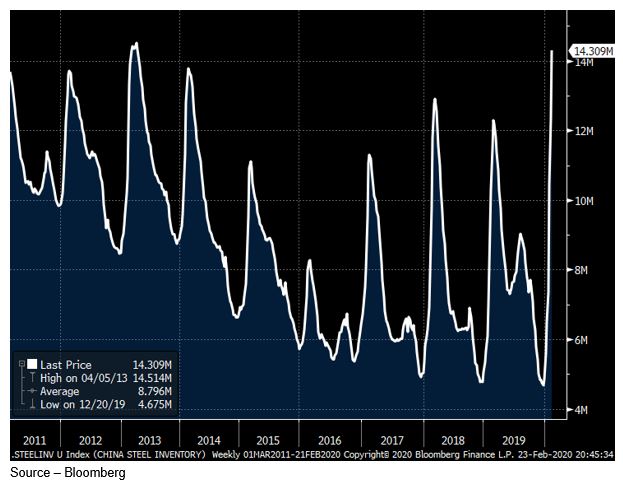

Chinese steel inventories

As per the chart below, Chinese finished steel inventories have risen to a 6-year high and brokers are reporting that industry experts Mysteel are suggesting a likely 2% impact on total Chinese steel production in 2020.

The escalating inventory and 3 weeks of lost demand has left the spot Hot Rolled Coil (HRC) steel price -10% in a month and to its lowest level since mid-2017.

Though the iron ore price remains elevated due to inventory constraints, the impact of lost end-user demand will likely begin to weigh on prices in the coming weeks as commodity inventory improves.

Australian steel manufacturer Bluescope (BSL) reports on Monday this week and will likely shed further light on expectations for regional steel prices.

Australian weekly auction clearance rates back at their highs

Last weekend Australian national auction clearance rates jumped to 78.6% and within a whisker of the highest level achieved this decade.

Following on from the steep jump in mortgage financing through Q4 2019, the Australian housing market is back in red-hot form.

National house prices have gathered positive weekly momentum since July last year and as a guide for the rapid rebound, the median Sydney house price has rebounded +13% from its lows last year to be only -4% from its 2017 peak.

Looking ahead

| Monday | US Chicago Fed national Activity Index (JAN), Earnings from Bluescope (BSL), Worley (WOR), Reliance (RWC) |

| Tuesday | US Consumer Confidence (FEB), Richmond Fed Manufacturing (FEB), Earnings from Blackmores (BKL), QUBE (QUB), CALTEX (CTX) Appen (APX), Oil Search (OSH) and SEEK (SEK) |

| Wednesday | US New Home Sales (JAN), Earnings from Woolworths (WOW), Healius (HLS), Rio Tinto (RIO), Adelaide Brighton (ABC) |

| Thursday | US GDP (Q4), Durable Goods (JAN), Earnings from A2 Milk (A2M), Ramsay (RHC), Flight Centre (FLT), Costa Group (CGC), Afterpay (APT) |

| Friday | AU Private Sector Credit (JAN), US MNI Chicago PMI (FEB), Earnings from NEXTDC (NXT) |

Beyond the run down in Australian corporate earnings, investment markets will continue to focus on the potential economic ramifications of lost Chinese production due to corona-virus quarantines.

The L1 Long Short Fund (LSF) also reports its annual figures this Thursday.

Next week sees the important Super Tuesday (March 3rd) Democratic primaries in which 14 states (including California and Texas) will vote for their favoured Democrat challenger and virtually 1/3rd of all the delegates to the Democratic National Congress will be decided.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 7230 | +3 | – |

| S&P / ASX 200 | 7138 | +8 | +0.1% |

| Property Trust Index | 1718 | +12 | +0.7% |

| Utilities Index | 8377 | +32 | +0.4% |

| Financials Index | 6494 | +8 | +0.1% |

| Materials Index | 13875 | +45 | +0.3% |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 3337 | -43 | -1.3% |

| London’s FTSE | 7403 | -6 | -0.1% |

| Japan’s Nikkei | 23386 | -301 | -1.3% |

| Hang Seng | 27308 | -507 | -1.9% |

| China’s Shanghai | 3039 | +122 | +4.2% |

Key dividends

| Date | |

| Mon 24th February 2020 | Dividends Ex-Date – Ansell (ANN), Aurizon (AZJ), Tabcorp (TAH), Wesfarmers (WES), Woodside (WPL) |

| Tue 25h February 2020 | Dividends Ex-Date – Challenger (CGF), Downer (DOW), IOOF (IFL) |

| Wed 26th February 2020 | Dividends Ex-Date – AGL (AGL), Domain (DHG), Telstra (TLS) |

| Thu 27th February 2020 | Dividends Ex-Date – Coles (COL), Lend Lease (LLC)

Dividends Pay Date – Magellan (MFG) |

| Fri 28th February 2020 | Dividends Ex-Date – Altium (ALU), MQGPD, NABPB

Dividends Pay Date – Charter Hall (CHC) |

Wednesday 26 February 2020, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.