Weekly Market Update

Risk assets continue to march higher with cyclicals leading the way as hopes for more fiscal stimulus are revived in the U.S. Democrats have been using a bipartisan proposed $908 billion relief bill as the basis to bring the Republican Senate Leader to the negotiation table in the effort to get more stimulus over the line before the House breaks on December 11.

The ASX 200 is up 0.5% for the week, with the S&P 500 up 1.7%. Locally, miners have taken over from financials and energy as the market leader, with cyclicals continuing the outperformance over the past month. Defensives and growth continue to lag the market in Australia as investors remain optimistic of a strong recovery.

The rally in miners was driven by strong Chinese PMIs coupled with a weak production update and guidance from Vale, the major iron ore competitor with huge production in Brazil.

Oil firmed as OPEC+ came to an agreement despite some earlier wobbles that saw the official meeting delayed. The group announced that it has agreed to supply an additional 500,000 barrels per day starting January, with monthly meetings scheduled to assess any potential changes to the supply cuts as they continue to grapple with an uncertain recovery timeframe.

Westpac (WBC) announced the sale of its general insurance arm to Allianz for $725m, equivalent to 1.3x gross written premium for 2020. The sale is expected to add 0.12% to WBC’s Tier 1 Capital ratio.

Downer EDI (DOW) also announced a sale. After the ACCC scared the last round of bidders away by expressing concerns around the sale of its laundries business to competitors, private equity firm Adamantem Capital has agreed to buy 70% of the laundries business for $155 million at what looks to be a fairly attractive valuation of 12.5x EV/EBITA. Downer will retain the remaining 30% at this stage.

Optimism for Australia

We continue to see bifurcation in the economic recoveries between countries that have handled the spread of COVID well, with the Chinese economy performing very strongly after successfully preventing a major second wave to date. Europe, on the other hand, looks to be at risk of a double dip recession as a second wave of infections has resulted in a second wave of lockdowns. U.S. has not seen as big a slowdown in their recovery despite record high infections, but the pace and momentum of the recovery has definitely taken a big hit, as seen in last week’s poor employment figures.

At this stage, Australia’s recovery looks to be more like the former rather than the latter two, despite the second lockdown in Victoria. Third quarter GDP figures were better than initial readings, with the economy just 3.8% lower than the prior year. Retail sales grew 1.4% in the month of October as well, though below expectations, the growth is encouraging for the economy. Trade was also better than expected on commodity price and volume strength, a key area for the Australian economy, and one that is highly leveraged to the expected global recovery.

In all, Australia looks to be well-placed, on a relative basis, to recover strongly. Despite the very well covered disputes with China and the trade impact on several industries, it is unlikely that China and Australia can decouple significantly as some key commodities such as iron ore cannot be easily replaced or substituted from production elsewhere.

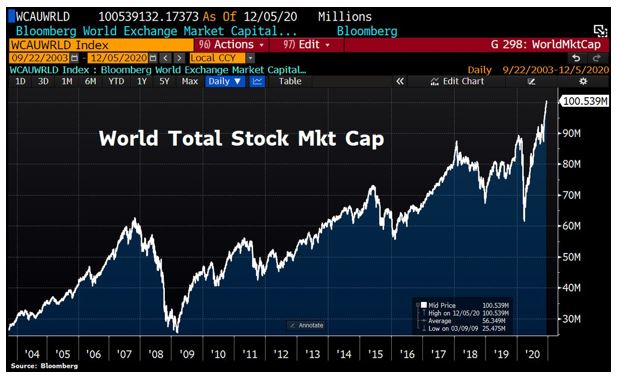

Breaking through $100 trillion

With this backdrop, the global stock market has hit another new milestone as the market capitalisation of all stocks hit USD 100 trillion, 15% above the value of global GDP.

The 100 trillion milestone itself doesn’t tell us much in terms of valuation or direction, but being 15% above the value of global GDP does bring up some viable valuation concerns. With central bank and governments providing lots of support through monetary and fiscal stimulus however, the market remains well supported, with strong global GDP growth anticipated over the next couple of years. Case in point, the European Central Bank is widely expected to announce further easing measures via the Quantitative Easing program at their meeting later this week.

Looking ahead

| Monday | AU AIG Services Index, AU ANZ Job Ads, CN Trade Balance |

| Tuesday | AU NAB Business Confidence, EU ZEW Economic Sentiment |

| Wednesday | AU Westpac Consumer Sentiment, CN CPI |

| Thursday | ECB Interest Rate Decision |

| Friday | US Core CPI, US Initial Jobless Claims |

–

Monday 7 December 2020, 5pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.