Global equities were largely flat as the U.S. market stormed back in late Friday trading. The MSCI World was down 0.1% for the week despite huge intraday volatility throughout the week as the U.S. S&P 500 rose 0.8%. Most other major markets were closed by the time the late rally occurred and generally finished the week with losses of more than 1%. With the U.S. quarterly earnings season picking up, investors found some solace in strong earnings from key large-caps across a variety of sectors. Microsoft and Apple reassured tech investors, Visa and Mastercard showed continued strength in spending trends, while Caterpillar’s strong sales were indicative of strong economic activity. However, supply chains issues and rising costs remain significant issues holding back the likes of Apple and Caterpillar.

The S&P/ASX 200 was one of the worse performers, falling 2.6% as Technology crumpled 8%. Defensives outperformed with Consumer Staples flat and Utilities down just 0.5%. The recent strength of the Materials sector faded, as the sector was the second worst for the week with a 3.5% drawdown.

Bond yields were mostly higher as domestic inflation came in hotter than expected at 3.5% for 2021. The shorter end reacted more significantly, with the Australian 2-year bond yield rising by 10 basis points (0.1%) to 0.95% as markets priced in an earlier domestic rate hike.

On the corporate front, half-year reports are starting to roll-in alongside production updates from resource companies. Premier Investments (PMV) was an outperformer last week on the back of a strong first half as sales rose 0.5% to $769 million despite lockdowns, driven by online sales that grew 27%. Resmed (RMD) missed consensus estimates but still put out a strong quarterly update, growing revenue by 12% and operating profit by 5%. It continues to benefit from Philips’ device recall but is being limited by supply constraints. Management noted that production is struggling to meet the higher demand but expects supply to improve in the second half of 2022. Though it is not currently in our models, we think RMD is a quality company with great management that is starting to look attractive following the recent sell-off.

Elsewhere, Newcrest Mining (NCM) and OZ Minerals (OZL) provided disappointing quarterly production figures and soft guidance, leading to a sell-off in both names. Despite this, both have had improving operational performance over the medium term under current management teams. Therefore, we retain a largely positive view for both companies relative to domestic peers.

On the macro side, Australia is feeling the impact of omicron as the NAB business confidence survey showed a sharp drop, with the reading worse than July 2021 when both NSW and VIC went into lockdowns. The duration of the omicron impact remains to be seen but last week’s preliminary readings for Purchasing Manager Indices (PMIs), a key economic indicator, were weak globally. This did not dampen the U.S. Federal Reserve’s hawkish tilt as Chairman Powell’s post-meeting speech noted a stronger economy and labour market relative to the start of its previous rate hike cycle in 2015, with “quite a bit of room to raise rates without hurting jobs”. Consumer confidence data supported this view, with a stronger than expected reading indicating a still upbeat U.S. consumer.

Looking to the week ahead, earnings season kicks on, with Amcor (AMC) and REA Group (REA) reporting domestically while tech giants Alphabet, Amazon and Meta Platforms (formerly Facebook) are also set to report. Central banks are also back on watch, with the Reserve Bank of Australia and the European Central Bank holding policy meetings this week. U.S. employment data will also be of key focus at the end of the week.

The long-term perspective amid short-term volatility

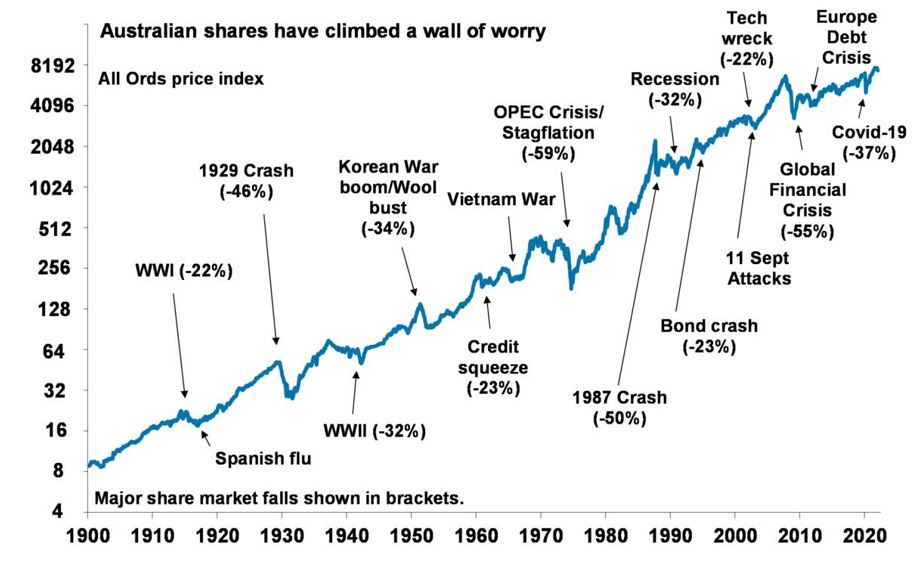

With equity markets selling-off to start 2022, we thought that it would be good to zoom out and look at things from a long-term perspective, given that the short-term are more for speculators than investors. Sell-offs are not uncommon. Historically, equities tend to see drawdowns of more than 5% pretty much every year, while corrections of at least 10% occur every 1.6 years on average and bear markets, defined as falls of more than 20%, on average, happen every four years or so. Despite large sell-offs during the tech wreck, Sept 11 terrorist attacks, global financial crisis and COVID-19, returns over the last 30 years from 1991 to the end of 2021 for the S&P/ASX All-Ordinaries index was 9.7% per annum.

To reiterate the overarching message from last week, it serves investors well to remain invested, considering that time in the market drives returns, while trying to time the market is folly. Instead, investors should look to remain calm by zooming out and taking a long-term perspective.

For those that have shorter investment timeframes or lower risk appetite, diversification is key. Having defensive assets such as bonds or cash help to mitigate the impact of sell-offs in the equity market and reduce the overall risk of a portfolio. Investors with a well-planned portfolio that has been designed based on the relevant objective, timeframe and risk appetite should not panic during these drawdowns.

Instead, these drawdowns can be seen as an opportunity as they provide diversified investors with an opportunity to rotate from their defensive allocations and add to equities. Whilst it is foolish to try to time a bottom, investors can re-balance portfolios after significant falls, adding to assets as they get cheaper and trimming those that have become less attractive on a relative basis.

Drawdowns also present an opportunity to rotate within the asset class itself. Equities alone are a huge and diverse universe, and while certain segments of equities remain overpriced in our eyes, weak investor sentiment has caused a broader market sell-off. As a result, we are starting to see value emerge in some high-quality companies with strong management and sustainable earnings. Therefore, we continue to see strong reasons to remain invested and to look for opportunities to rotate our portfolios into compelling opportunities.

–

Tuesday 01 February 2022, 11.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.