The Australian S&P/ASX 200 fell 1.3% last week. The market is digesting higher than expected inflation data releases and expectations of earlier than expected interest rate rises. The S&P Small Ordinaries index fell slightly more, declining 1.4%. The Healthcare sector was the best performing, rising 1.3%, while the Consumer Staples sector was the worst-performing sector losing 4.1%. The U.S. S&P500 rose 1.1% on the back of continued strong earnings results, led by the outperformance of the Tech sector driven by a 22% surge in Tesla. Big tech reported last week, with Microsoft and Google posting solid earnings. Facebook was weak after warning new privacy rules would weigh on its digital business. Apple and Amazon missed market expectations on supply chain issues and labour costs.

In economic news, the Australian September quarter headline inflation was 3%, meeting market expectations. However, “trimmed mean” inflation, which excludes the most volatile sectors and is considered a better indicator of underlying inflation trends, rose 2.1%, well above expectations of 1.8%. The higher reading led economists and traders to move forward their timeline for predicted interest rate rises. As a result, the 10-year bond yield rose again in Australia, hitting an intraday high of over 2%, the highest level in over 2 ½ years.

US consumer confidence remains strong in broader economic news, new home sales rose, and jobless claims fell. US September quarter GDP growth of 2% annualised was below expectations of 2.7%. However, this was driven by motor vehicle and parts sales which fell 53% as supply chain issues continued to escalate. The European Central Bank (ECB) kept stimulus flowing and maintained that a recent spike in inflation would continue into next year but ultimately prove temporary. The 10-year yield pulled back in the US and Europe.

In company news, Macquarie (MQG) posted a better-than-expected net profit of $2.04 billion for 1H2021, up from $985 million in last year’s corresponding period. The company announced a capital raise for $1.5 billion as it continues to see attractive investment opportunities. We continue to regard MQG as a high-quality company with excellent management and strong growth opportunities, but these favourable attributes are being increasingly priced in.

ANZ Bank (ANZ) posted FY21 results and cash profits of $6.2 billion from continuing operations, above consensus estimates. However, home loan volumes were disappointing as ANZ’s slow approval times and capacity constraints saw them lose market share to their competing lenders. While ANZ remains attractive on a relative valuation basis and the earnings result was positive, we were disappointed with the operational result that highlighted it has much to improve on in terms of automation, efficiency, and planning.

Coles (COL) Q12022 sales grew slightly year-over-year as it continued to benefit from lockdowns, partially offset by rising costs related to the pandemic. Positively, sales growth in early October was in-line with Q1 trends despite some easing of restrictions. We expect COL to outperform competitors as restrictions ease, owing to a more metro footprint. On the negative side, pallet shortages are causing issues though there was no specific guidance on impact.

Elsewhere, Telstra (TLS) agreed to acquire Digicel Pacific in a deal alongside the Australian government. The deal looks to be on favourable terms and is expected to be earnings accretive and we remain overweight. Newcrest Mining (NCM) maintained full-year production guidance despite a weak first quarter driven by planned maintenance. Suncorp (SUN) flagged that with five declared storm events in October, claims have the potential for exceeding their full-year disaster budget of $980m, however, we note that SUN has comprehensive reinsurance that should help to limit losses. At this stage, we do not expect SUN to provision for claims above their budget and continue to see SUN benefitting from policy repricing and rising yields.

For the week ahead, all eyes will be on Central Bank meetings. The Reserve Bank of Australia (RBA) meets on Tuesday. There are expectations that the RBA will announce an end to its yield target framework. The US Federal Reserve meets on Thursday and is likely to announce the commencement of its tapering program. The Bank of England also meets, with economists split on whether they will raise rates. Manufacturing and services purchasing managers indices will also be released and show the severity of supply chain issues.

Supply Chain issues

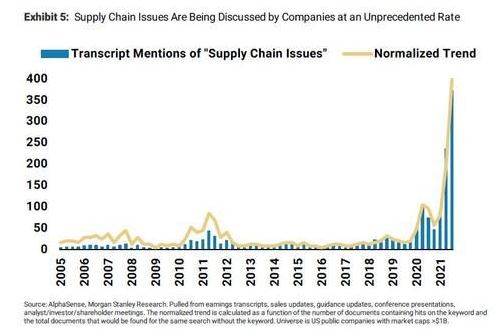

Unprecedented supply chain disruptions are causing headaches for companies around the world. Companies from varied industries such as Apple, Woolworths, and Caterpillar have flagged supply chain issues in the last week. And they are not alone, with the chart below showing mentions of supply chain issues from US earnings calls at record highs.

Freight prices remain at elevated levels near record highs, shipping ports are clogged, and it is more complex than ever to move goods worldwide. These delays and shortages lead to price inflation, as companies raise the price of goods to offset these higher costs. Coupled with pent-up demand, supply chains will remain pressured into Christmas as economies reopen and consumers spend built up savings. US Federal Reserve Chairman Jerome Powell recently noted, “The risks are clearly now to longer and more persistent bottlenecks, and thus higher inflation”.

While economists and central bankers believe these supply chain issues will prove transitory, the exact length is unknown. The longer they persist, the more likely inflation could take a foothold, and lead to higher interest rates. We continue to closely monitor these global supply chain issues and are looking to invest in quality companies that demonstrate pricing power. These companies would be able to mitigate rising costs by raising prices if these supply chain issues prove to be persistent.

–

Monday 01 November 2021, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.