Happy new year to all!

International equity markets had a strong end to last year but a difficult start to this one, selling off on the release of the minutes from the US Federal Reserve’s (Fed) December meeting.

The US S&P500 Index fell 1.9% over the week and the Nasdaq composite index fell 4.5% for its biggest weekly slump since February 2021. Richly valued technology shares were hit hard by rising bond yields which discounts that value of future earnings. The 10-year US bond yield rose to 1.76%, up from its 2021 close of 1.51%. The Australian 10-year yield rose to 1.85%. The Australian ASX200 performed much better and managed to eek out a weekly gain, recovering on the Friday session from falls earlier in the week. Miners and major financial stocks were amongst the best performers for the week and tech stocks were the worst performers.

In economic news, the rise of house prices in Australia continued to slow, rising by 0.6% nationally in December off the back of rising fixed mortgage rates, poor affordability, and more listings hitting the market. Australian job advertisements fell slightly last month; however, they remain high by historical standards. The US added 199,000 jobs in December which was below the 400,000 that was expected. However, the unemployment rate fell below 4% and wages jumped more than expected which demonstrates a tight labour market and further supports the Fed’s decision for a quicker tightening, which could mean raising interest rates as soon as March. The Fed’s meeting minutes were more hawkish than expected, signaling that it may look to reduce the size of their balance sheet shortly after its first rate hike.

In company news, James Hardie (JHX) dismissed their CEO Jack Truong due to persistently poor workplace behaviour that breached the company’s code of conduct. Non-executive director Harold Wiens has assumed the role of interim CEO and the search for a new permanent CEO has commenced, with the Chairman hoping this will be completed in the next 6 months. We rated the former CEO as a strong leader particularly for his strategic turnaround of the business, but the board flagged a marked shift in the CEO’s behaviour in recent months which has continued despite various efforts to resolve the issue. The open and honest communication from the board was refreshing and shows the board’s commitment to its governance policies. We will closely monitor how the leadership change progresses over the coming months, but believe the business is well placed to continue building on positive momentum, as demonstrated by another guidance upgrade that accompanied this announcement.

Aristocrat Leisure’s (ALL) planned takeover of Playtech PLC (PTEC London) has been delayed, with Playtech’s shareholder approval vote to now occur on 26 January after another bidder requested due diligence access. Woolworths (WOW) withdrew a $1.75 offer for Australian Pharmaceutical Industries (API) after completing due diligence, leaving Wesfarmers (WES) the only suitor for the Priceline Pharmacy owner.

For the week ahead, US earnings season kicks off with the big banks reporting. Investors will focus on the US December consumer price inflation release, which will provide an update on the much-watched inflation figures. We also receive Australian and US retail sales, and Chinese trade figures.

Step aside USA?

The US stock market has outperformed all other major equity markets over the last decade and had another bumper year in 2021 with the S&P 500 rising over 28.7%. Much of this impressive performance can be attributed to high growth technology stocks.

The Fed’s three projected interest rate hike in 2022, a more aggressive path than many investors had expected, will be at the top of investors minds after the release of their December minutes.

Higher rates tend to lead to rising bond yields, which could continue to pressure stretched stock valuations, as projected cash flows will be discounted at higher rates in discounted cashflow valuation models. High growth technology stocks are particularly vulnerable to higher rates, as they are earlier in their lifecycle and much of their cashflow will occur in later years, which compounds the impact of discounting. Technology companies will also be impacted by higher borrowing repayments from any debt they take on to fund growth.

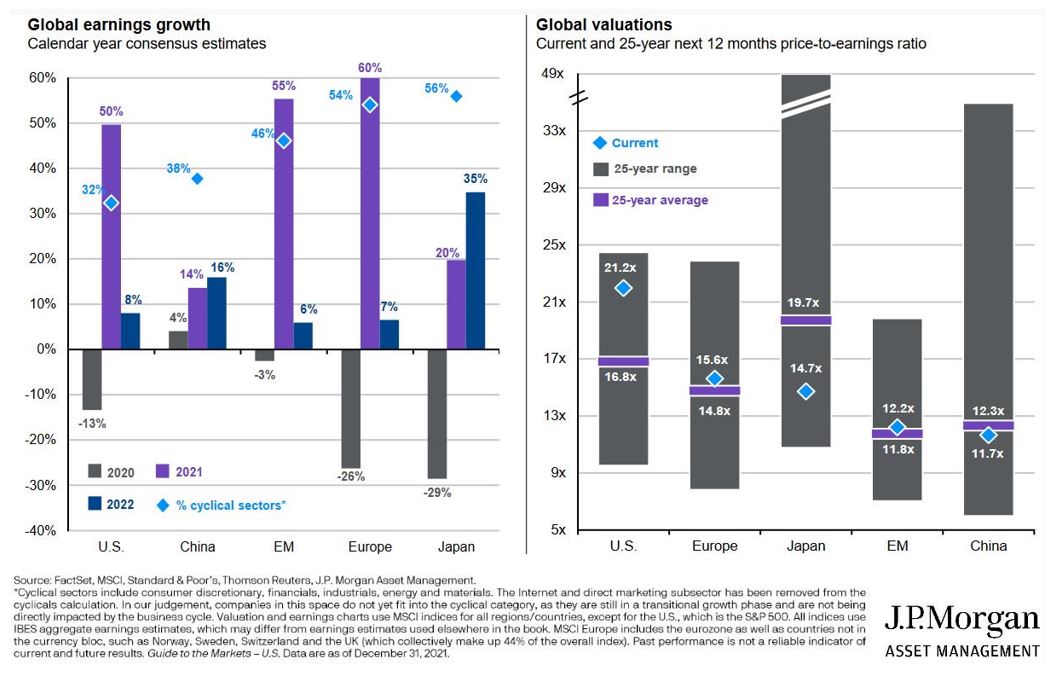

As seen in the below chart, US forward price-to-earnings ratio, a measure of how much investors are willing to pay for a dollar of earnings, is currently sitting well above the 25-year average for the market. This contrasts with in Europe, Japan, China, and other emerging markets, where prevailing valuations are roughly in-line with 25-year trends.

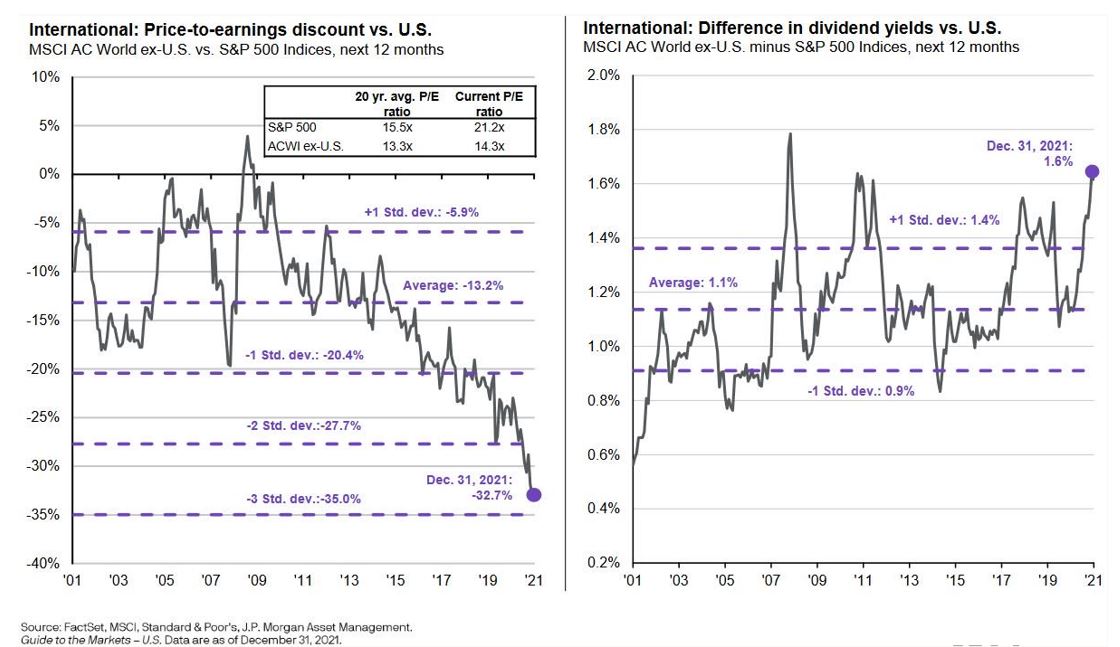

International markets collectively are trading at their largest discount relative to the US S&P500 index over the last 20 years.

Part of this discrepancy is due to the composition of the S&P 500 index where technology shares, led by the mega cap names including Apple and Alphabet (Google), make up a much large proportion of the index. For example, technology makes up 4% of the ASX 200 index compared to 28% of the S&P 500 index. The Australian share market is more heavily weighted towards the materials and financials sectors (combined~50%) vs in the USA (~13%), which will be less directly impacted by rising rates than technology stocks.

While we still think the US market could perform well in 2022 even with some economic support being unwound, it is likely that other markets, including Australia, may begin to catch up some of the last decades relative underperformance.

–

Tuesday 11 January 2022, 3pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.