Global equity markets rose last week and recovered most of the prior week’s losses. The US market performed strongly, with the S&P500 rising 1.9% and the Nasdaq up 4.6%. The broad European STOXX 600 finished the week 2.4% higher. The Chinese market took a breather after its recent outperformance falling 1%, likely linked to rising cases leading to fears of further lockdowns.

The Australian ASX200 finished the week up 2.1%, while the Small Ordinaries index outperformed larger peers, rising 3.8%. The hard-hit Technology sector continued its recent strong performance increasing 7.1%, and Consumer Discretionary rose 5.8%. Materials was the worst-performing sector falling 0.9%, with the prices of various commodities falling due to concerns of falling demand in the face of slowing global growth.

In economic news, US employment data was stronger than expected, with 372,000 jobs added versus 268,000 consensus expectation. Job openings fell but remained at elevated levels and were higher than consensus expectations. Wage growth was in-line with expectations at 0.3% MoM, partially easing fears of a wage-price spiral. The strength of the US employment cleared the path for further Federal Reserve aggressive interest rate hikes. This, coupled with hawkish Fed commentary, led to the 10-year Treasury Yield rising by 0.2% to 3.08%. The 2- and 10-year yield curve again inverted, signalling a potential recession. In other news, US President Biden is considering reductions on tariffs on Chinese goods to help curb inflation.

The RBA hiked rates by 0.5% to 1.35% per consensus expectations, noting that spending data and household savings remain strong, so the Board expects to take further steps in normalising monetary conditions. Job ads rose again in June, indicating a still-tight labour market. The latest floods in NSW are likely to see the price of fruit and vegetables increase, contributing to consumer inflation.

China’s Producer Price Index, which measures the average changes in prices received by domestic producers for their output, rose 6.1% YoY. The fall from last month’s 6.4% reading indicates that inflationary pressures continue to ease in the manufacturing hub. China’s Caixin Services Purchasing Manager Index (PMI) reading of 54.5 beat consensus and highlights a significant rebound in the Chinese consumer as lockdowns lift. Further, China is considering bringing forward US$220b in bond sales to accelerate its plans for infrastructure. The plan involves bringing forward 2023 spending, which would help boost near-term commodity demand.

Critical economic releases for the week ahead include US CPI, Chinese June quarter GDP, Australian business and consumer confidence, and June Australian job data. US quarterly earnings releases ramp up this week, and we will get a read on whether earnings estimates have been too bullish.

Supply chain pressures continue to ease

Stretched supply chains have been a pivotal contributor to the high inflation the world has experienced over the last two years. Central Bank monetary policy cannot remedy supply chain issues directly as interest rate hikes can reduce demand for goods but cannot increase supply.

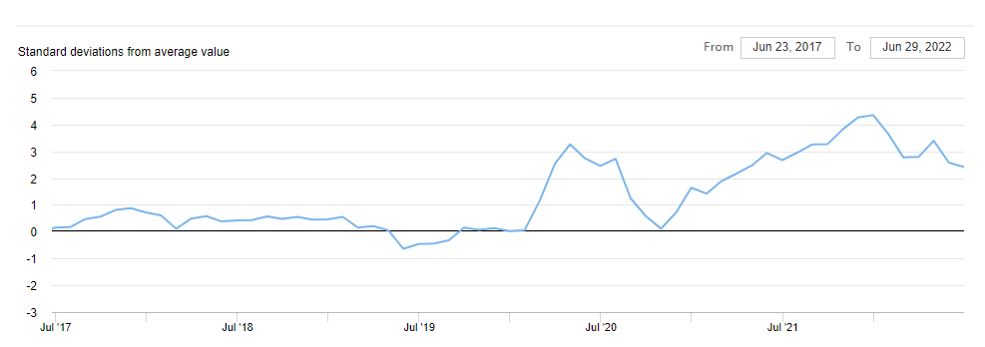

The Federal Reserve Bank of New York created the Global Supply Chain Pressure Index (GSCPI) to gauge global supply chain conditions. It integrates several commonly used metrics to measure transportation cost data and manufacturing indicators.

Pleasingly, global supply chain pressures continued to decline in June. The June decline was primarily due to a significant decrease in Chinese supply delivery times as the key manufacturing hub continued to reopen from widespread lockdowns.

Although supply chain pressures remain at historically high levels, they are on an improving trend. This will help ease inflationary pressures and assist Central Banks in ensuring inflation expectations remain anchored, though the situation remains precarious as China maintains its zero-Covid policy.

Goods inflation is only one part of the inflation equation with services inflation picking up recently. But for now, the improvement in supply chains is positive. It helps to explain investors’ positive view that inflation will trend down in the second half of 2022. The key question for markets now is the pace which inflation falls and at what level it stabilises.

–

Monday 11 July 2022, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.