Equities had a great week with the S&P/ASX 200 rising 2.4% to end the week close to the 7,000 mark. A rebound in the technology sector led gains, with defensives such as consumer staples and utilities lagging the market. Both global economic data and bond yields were supportive of the risk rally, as strong PMI data and U.S. employment figures boosted cyclicals whilst central bank comments drove yields off their recent highs and boosted growth names.

The S&P 500 rose another 2.8%, driving the MSCI World 2.3% higher, though emerging markets were dragged lower by China again as Chinese tech giants remain weak on the back of regulatory concerns and a tightening of the liquidity tap with regulators concerned about the risk of potential asset price bubbles.

Looking ahead, the quarterly earnings season kicks off this week for international equities. There is also a whole raft of economic data including domestic employment, business confidence and consumer sentiment readings. US inflation figures will also be watched closely after strong producer price inflation readings came out last week, whilst major Chinese data including trade, industrial production, retail sales and GDP are due.

Best earnings growth in more than 10 years?

Analysts are expecting a big quarter for earnings growth as the US earnings season kicks off. Following the run-up in global equities since the November elections, valuations look stretched but history shows that strong earnings growth tends to follow recessions, with equities still able to push higher whilst valuations fall to a more reasonable level on the back of strong earnings growth as laid out in our most recent Monthly Perspective newsletter.

Prior to the first results rolling in later this week, analysts currently expect over 24% year-on-year growth versus last year’s pandemic hit earnings. Relative to the first quarter of 2019, this would represent 5.4% earnings growth, partly explaining why the market has been able to power through pre-pandemic levels to set new highs.

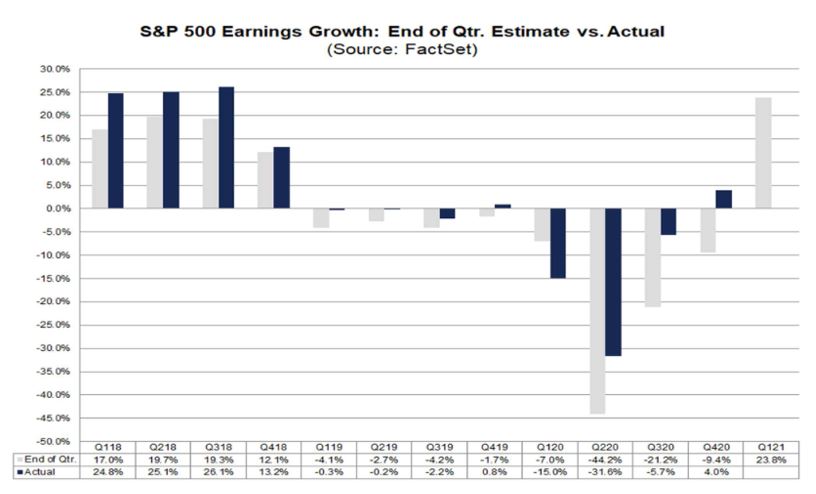

When we include the fact that estimates have consistently been understated, with results coming in worse than expected for only one quarter in the last three years as shown below. That quarter is of course Q1 of 2020 when the impacts of the pandemic and lockdowns were just being felt.

We could expect to see headlines of the best single quarter earnings growth since the initial recovery stages of the financial crisis in 2010 if earnings come in better than expected again and it beats the 26.1% recorded in the third quarter of 2018 on the back of Trump’s corporate tax cuts, though the second quarter will likely beat this one due to the base effect given the huge fall last year.

These headlines may not mean much to most investors given the base effect but another stronger than expected earnings season can help reduce forward multiples and bring valuations to more palatable levels whilst a weaker than expected earnings season could trigger a correction as expectations adjust.

–

Monday 12 April 2021, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.