Weekly Market Update

Global equities posted positive gains for the weak as markets stabilised with the U.S. S&P 500 up 1.3% but the S&P/ASX 200 ended the week 0.5% lower. The domestic earnings season is just starting to kick into gear, whilst the U.S. earnings season is getting ready to wind down, with about three-quarters of the S&P 500 having reported by the end of last week.

In the U.S., earnings season has been very positive, with 80% of reporting companies beating earnings estimates, whilst 78% are beating revenue estimates. Should this trend continue, the year-on-year growth for 2020 would end with a 2.9% growth in earnings and a 2.8% growth in revenues. This lends further weights to early market bulls that were buying near the start of the rally under the notion that the economy is not the market, with the economy still expected to see a sizeable contraction for the full year. However, judging by price reactions to beats, this has followed the trend of the last quarter where earnings beats have not necessarily been rewarded by rising prices, with a very low correlation of same day earnings beats and market outperformance relative to historical averages.

Domestic earnings have also been promising so far. Insurance majors Suncorp (SUN) and Insurance Australia Group (IAG) both posting strong underlying growth. Building materials suppliers Boral (BLD) and James Hardie (JHX) saw some dispersion as BLD disappointed with a 9% drop in revenue whilst JHX posted strong results across all business lines and upgraded guidance for the year. Transurban (TCL) had a lacklustre result with a 21.9% fall in revenue and a 50% cut to the dividend as its toll roads, primarily in the U.S., remain impacted by pandemic restrictions. Magellan Financial (MFG) also posted a mixed result as a rise in funds under management was offset by a fall in performance fees, with net profit up just 3% for the first half.

Commonwealth Bank (CBA) saw net cash profits slumping 10.8%, though revenue was down just 1%. Loan deferrals for both home and business lending continued to recover, with CBA noting that the outlook is positive though the pace of recovery remains uncertain. CBA continues to take market share and outperform the broader banking system across the board as business lending, home lending and deposit growth all grew above the average system growth. The Tier 1 capital ratio continued to rise to 12.6% and remains well above regulated requirements of 10.5%. This would likely see CBA start to consider capital return initiatives once the economy normalises, which could mean a buyback program or special dividend.

Telstra (TLS) soothed investors’ fears over the dividend as it maintained its 8 cent payout for the first half despite income falling 10.4% as revenue fell 9.7% due to ongoing NBN and COVID headwinds. The firm achieved $201 million in cost cuts and upgraded its target for further cost-outs by the end of the 2022 financial year by $200 million to total $2.7 billion, with management noting that there could be further cost savings as they continue to improve business efficiency. Management sounded increasingly upbeat about the future as Andrew Penn remains confident of achieving the underlying EBITDA target of $7.5-8.5 billion and ROIC target of 8% by the end of the 2023 financial year, underpinned by an expected return to mid-high single digit growth by next financial year. Penn also noted that binding offers for its InfraCo Towers business is expected before the end of next financial year, representing progress in a key initiative to bring focus to underappreciated assets. The firm also announced that it will look to take full ownership of physical stores, with 270 of its 337 physical stores owned by Vita Group and independent licenses. There is still a lot of road to cover but it finally looks like TLS is turning the corner and we remain positive that the pending infrastructure divestment, roll-off of headwinds and normalising competitive environment will benefit shareholders in the medium term.

Challenger Group (CGF) maintained full year guidance, though profits came under expectations due to lower returns as CGF continued to maintain an outsized cash balance. This cash balance continues to be deployed gradually which should drive a rebound in profitability, though CGF intends to maintain its capital buffer at the upper end of the long-term target range, meaning that it will likely still fall short of the 14% through-the-cycle ROE target. On the sales side, growth was more positive, with group assets under management growing 11% to $96 billion. The funds management business continued to grow impressively, whilst there were positive signs of a recovery in annuity sales as the financial planner channel stabilised. We remain positive on the long-term growth prospects for CGF.

Downer EDI (DOW) reported a fall in both proforma profits and sales of 14.4% and 10.5% respectively. However, cash flows were a bright spot as conversion improved markedly to 84.1%. This helped DOW pay off some debt, with net debt now sitting at $1.18 billion or 28.2%. The company continued to withhold guidance, however, DOW had work-in-hand worth $36.2 billion and noted that it expected demand to remain strong due to continued strong government and private sector investment. With a further $430 million coming in from sales of parts of its mining services business, with potentially more as the Otraco tyre management and Open Cut Mining East segments remain up for sale, DOW is considering capital return initiatives via a buyback or special dividend as its balance sheet is now in good shape. DOW remains positively exposed to government stimulus spending on infrastructure and the post-pandemic recovery.

Newcrest Mining (NCM) showed stronger than expected profit as realised gold price came in higher than expected. Shares rallied as NCM raised its payout ratio from 10-30% to 30-60% and doubled the dividend to U.S.15c for the first half of the year. We continue to see NCM benefitting from higher gold prices in the shorter term and are also looking forward to its promising expansion projects to drive longer-term growth, though this remains about 2-3 years away.

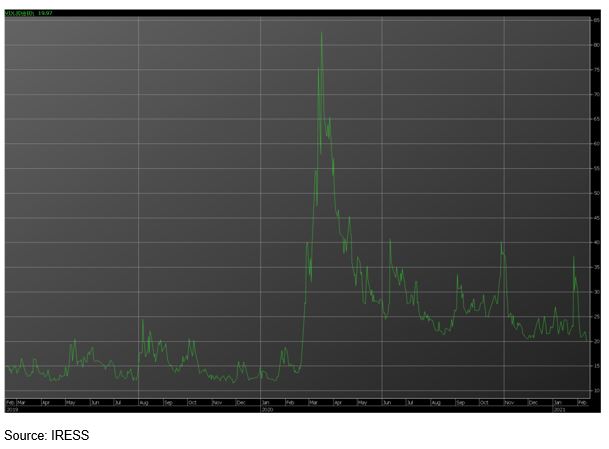

The fear-gauge finally drops below 20

With the market marching higher in an almost unilateral fashion since the March lows, one could have thought that fear had been well and truly driven out. However, the CBOE Volatility Index, commonly called the VIX and also known as the fear-gauge, has been consistently above 20 since the middle of February last year. On Friday, this finally fell to 19.97 for the first time since 24 February 2020.

Whilst 20 is just an arbitrary number, the equity rally has previously paused or saw a mini-correction of several percentage points after the VIX hit around 21. A break lower could mean a return to more normal bull-market VIX levels around the mid-teens, thus, for some investors, confirming the new bull-market.

To us, the break lower would mean that the outlook for a return to normalised travel and economic conditions is becoming clearer and is consistent with the vaccine roll-out.

Looking to the week ahead, the domestic earnings season heats up, with BHP, Coles (COL), CSL and Wesfarmers (WES) among the bevy of companies slated to post reports this week. On the economic front, domestic employment figures will be closely watched, whilst U.S. retail sales and global flash PMIs are also on the menu.

–

Tuesday 16 February 2021, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.