Bond yields remain the headline story for markets. Australia’s 10-year yield is hovering around 1.8% whilst the U.S. 10-year yield surged to new recent highs of 1.76% before paring to 1.72% at the end of the week despite some disappointing U.S. economic data and a Federal Reserve (Fed) that reiterated its commitment to low rates. This continues to drive the rotation to cyclical companies at the expense of growth as markets ended higher for the week. The S&P/ASX 200 was up 0.9%, lagging the S&P 500 and MSCI World that had 2.7% and 2.8% returns respectively.

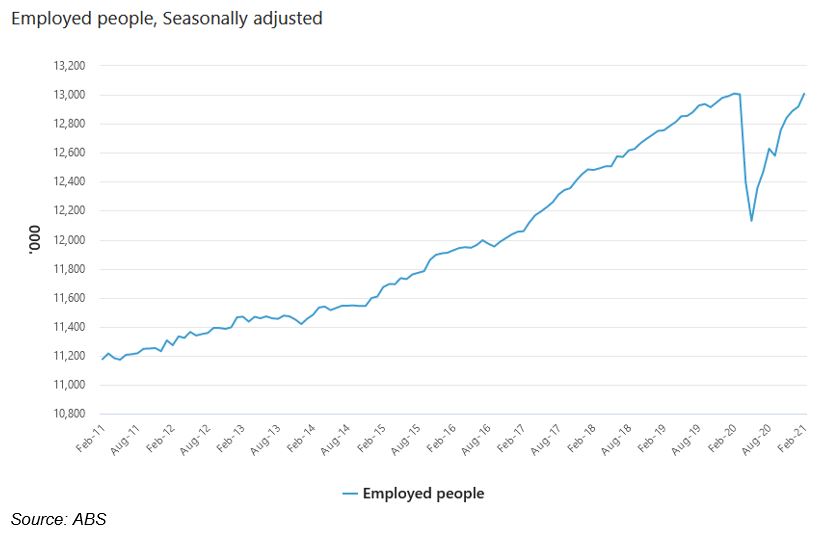

On the economic front, domestic employment figures showed an extremely strong recovery. There were 88,700 jobs added over the month, (a 0.7% increase of full and part-time employment to 13,006,900) well above expectations. Of this, 89,100 jobs added were full-time positions (a national total of 8,895,000), indicative of strong business confidence as part-time workers are converted to full-time, supporting the strong NAB Business Survey results of recent months. The unemployment rate of 5.8% is now well ahead of the Reserve Bank’s and consensus forecasts, whilst the number of employed people is at similar levels to the pre-COVID peak.

As mentioned above, U.S. data disappointed with weaker than expected retail sales and industrial production, both impacted by the harsh winter weather last month. Despite the weather issues, the Fed upgraded their economic projections after considering the U.S. $1.9 trillion stimulus bill. The Fed now expects the U.S. to grow by 6.5% in 2021, with unemployment falling to 4.5%. Previous estimates were for 4.2% and 5% respectively, and whilst this looks to be a big upgrade, these estimates remain below consensus of many major Wall Street banks. As expected, the Fed continued to hold its policies and reiterated that no hikes were expected until 2023, though the move in yields for the week suggests that markets are not exactly buying this rhetoric.

Last week, we also saw Chinese industrial production and retail sales figures beating expectations by a decent margin as the figures lapped the post-lockdown plunge to post year-over-year growth figures of 35.1% and 33.8% respectively.

Looking towards the banking sector, Westpac (WBC) announced that it will merge its consumer and business banking arms as it looks to cut costs and simplify operations. Meanwhile, Commonwealth Bank (CBA) launched its own buy-now pay-later product to compete with the likes of Afterpay (APT) and Zip (Z1P) as competition continues to grow.

Elsewhere, Fortescue (FMG) moves up its plans to be carbon neutral with a new 2030 target, with green electricity, green hydrogen and green ammonia projects flagged under the FFI subsidiary. This will likely mean materially higher capital expenditure in the coming years, but with iron ore prices still high, FMG should have no issues funding both the projects and meeting investors’ dividend expectations.

Recovery remains uneven

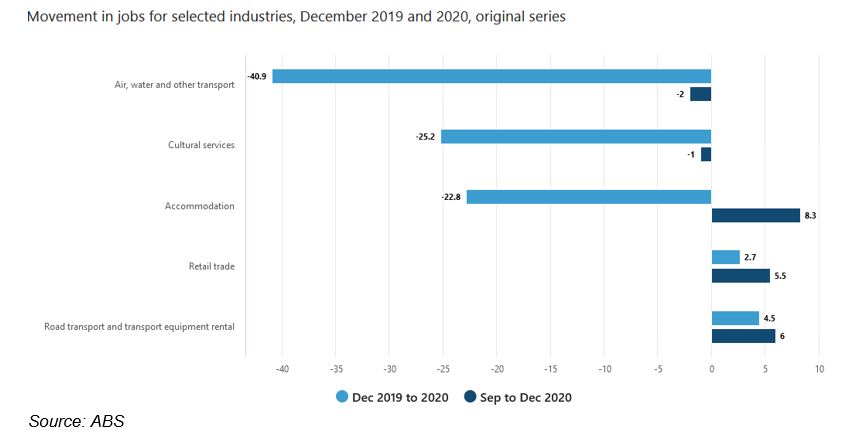

This probably comes as no surprise, but despite the recovery in employment, certain segments remain heavily impacted by COVID-19 restrictions.

Whilst many industrial and corporate jobs have recovered, and indeed, grown from pre-COVID levels, tourism remains deeply impacted.

Recent policy moves from governments continue to target the tourism industry, and likely more will need to be done as international travel restrictions remain in place, and even domestic interstate travel remains highly uncertain.

As per the chart above, there are still massive job losses in transport, cultural services and accommodation, with job losses for the first two continuing in the final quarter of 2020. With JobKeeper incentives rolling off, more job losses for these sectors may be forthcoming, especially with the easing of restrictions still six months away at best.

In the market, stocks like Webjet (WEB), Corporate Travel (CTD) and Flight Centre (FLT) have been surging as optimism around vaccines and domestic travel incentives boost prices. However, much of this looks to be baked in. For example, after accounting for the doubling of the equity on issue following the big capital raise last year, WEB now sits above pre-COVID levels whilst it continues to burn cash each month and the outlook for travel and, by extension, WEB’s revenue and profits, remains highly uncertain.

–

Monday 22 March 2021, 3pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.