A risk-on mood gripped the markets as equities rebounded despite yields pushing higher again. The MSCI World rose 1.5% for the week on the back of a 1.6% rise in the U.S. S&P 500 and a 2.1% rise in the MSCI Emerging Markets index. While gains were decent for the week, there were some wild swings as we saw another busy week for the U.S. earnings season, with Alphabet (Google’s parent name), Meta Platforms (formerly Facebook) and Amazon reporting results. Alphabet and Amazon both surged on strong reports while Meta tanked on very disappointing user data and weak guidance, recording the largest single-day loss in market capitalisation by dollar value in history with its USD 250 billion fall.

Australian equities outperformed, with the S&P/ASX 200 bouncing 1.9% last week. All sectors were in the green with the Energy sector (+4.9%) leading gains alongside Utilities (+4.5%). As both are relatively small sectors, Consumer Discretionary (+3.6%) had a bigger overall impact on the index return. Technology (+1.1%) and Healthcare (+1.2%) were underperformers as growth-style exposures remained weak, though Financials (+1%) and Consumer Staples (+1%) were the overall laggards for the week.

Australian bonds were relative outperformers thanks to a more dovish than expected speech by RBA Chairman Philip Lowe, with 10-year yields only slightly higher, ending the week at 1.95% yield. Although the RBA ended announced an end to its bond buying program this week as expected, the communication that it is “too early to conclude that it (inflation) is sustainably within the target band” tempered expectations for faster rate hikes, though the consensus continues to expect the hiking cycle to start this year. Bonds overseas fared worse, with the U.S. 10-year yield rising 0.15% to 1.92%. Even German 10-year yields rose into positive territory, spurred by the European Central Bank’s decision to drop communication that there would be no hikes this year, despite continuing its bond purchasing program and holding its deposit rate at -0.5%. Meanwhile, the Bank of England surprised markets by hiking rates again to 0.5%.

Bond yields were also likely pressured higher by a strong U.S. employment report, as the 467,000 jobs added blew the consensus estimate (+150,000) out of the water and November’s job gains were revised higher. Wage growth was above expectations too, further fanning inflationary pressures. However, the unemployment rate rose from 3.9% to 4% as the participation rate rose by 0.3% with more people re-joining the workforce.

On the corporate front, domestic earnings season is upon us as Westpac (WBC), Amcor (AMC) and REA Group (REA) reporting. WBC rallied as it showed progress on the cost front, cutting 7% off normalised expenses, driving a 1% increase to cash earnings. We continue to see WBC’s valuation as attractive relative to peers but the banking sector’s profitability remains challenged, as seen by another fall in WBC’s net interest margins to 1.91% from 1.99%.

AMC posted stronger than expected revenues offset by rising costs. Overall, we thought it was a solid result, right in-line with expectations. We continue to see AMC as a quality defensive exposure with undemanding valuations but given the recent sell-off in the broader market, we think that there are more attractive opportunities available.

REA initially rallied on Friday after a strong result, marginally beating consensus expectations on revenue and profits, but gave up gains as management flagged a potential slowdown in listings and higher investment moving forward. We continue to see REA as one of the strongest franchises listed on the ASX, with a significant lead on its nearest competitor so it remains a core holding in our model portfolios despite potential headwinds from rising yields.

Looking to the week ahead, the U.S. earnings season is starting to wind down while the domestic one picks up. Notable reporters this week are James Hardie (JHX), Suncorp Group (SUN), Commonwealth Bank (CBA), Mineral Resources (MIN), ASX, IAG, and Downer EDI (DOW). On the macro front, U.S. inflation remains key for markets, while ANZ job ads, NAB business confidence and Westpac consumer sentiment surveys all feature.

The great inflation debate

In recent months, markets have increasingly been driven by the outlook for inflation. As economies have largely recovered from the impact of COVID despite the virus still impacting our lives, investment markets have increasingly shifted focus from infection numbers to inflation numbers.

U.S. inflation may be the most pronounced amongst developed economies and most closely watched, but many countries are facing the same issue, including Australia, where 2021 inflation came in above the RBA’s target band of 2-3%.

For markets, a key question is how long inflation stays elevated because this impacts long-term yields. Higher yields mean lower bond prices and lower equity valuations as government bond yields are often used as the discount rates for a company’s cash flows. There has been little inflation over the past 15 years so if markets move to price in higher long-term inflation expectations, markets will have a tough time.

Historically, equity markets have been better performers relative to bonds during inflationary periods. However, given higher price-to-earnings ratios and the current composition of equity indices, this may be a tougher period for indices. If inflation expectations move higher, we expect the recent trend of value style equities to outperform growth to continue. Therefore, the great inflation debate is key to how investors should be positioned moving forward.

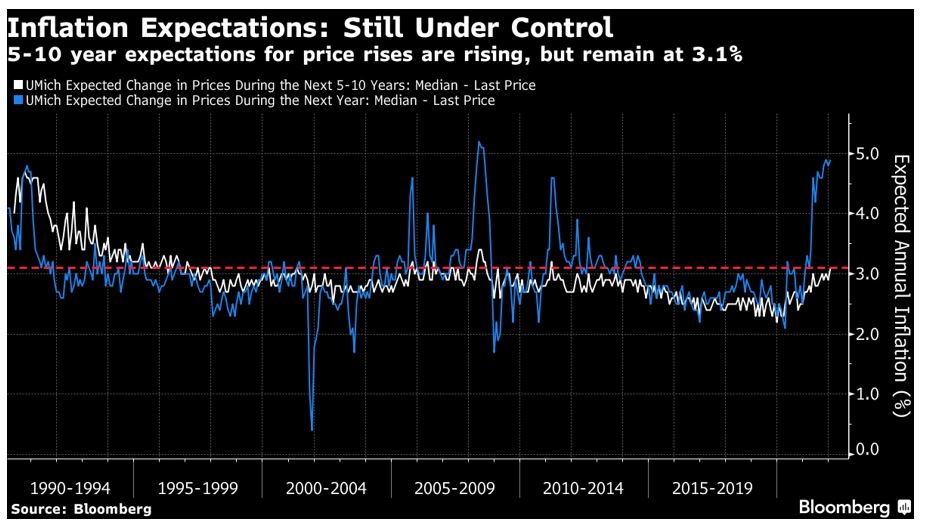

Bond markets still expect long-term inflation to remain low, and the consumer survey by the University of Michigan on long-term inflation expectations in the U.S. has been rising but not at an alarming rate, as seen in the chart below.

There are many structural factors that can keep a lid on longer-term inflationary pressures. This includes an aging global population, artificial intelligence and robotics to name a few. These trends remain in place post-COVID, and if anything, have been accelerated by the pandemic.

On the other hand, the pandemic has led to a reversal in globalisation, which has been a key structural trend in keeping inflation low. This may have started before the pandemic with the Trump presidency, but the recent supply chain issues have accelerated onshoring of production for many developed countries.

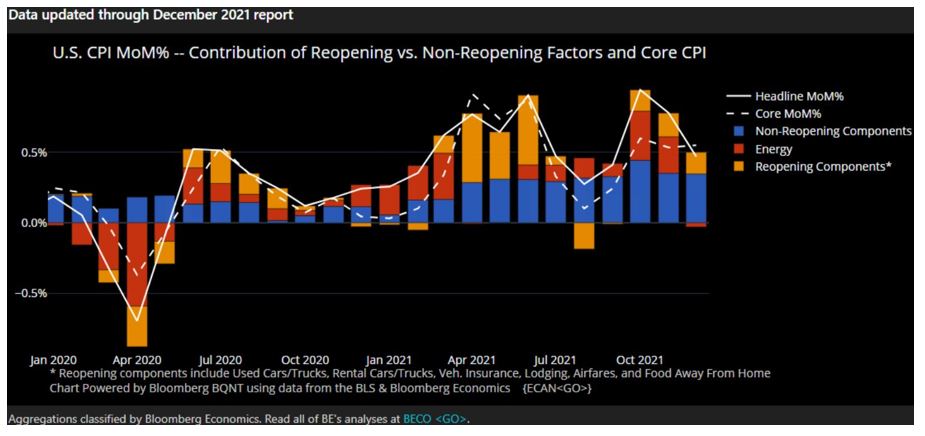

As we can see below for components of U.S. inflation, energy prices and reopening (or COVID impacted) factors are still having a significant impact on inflation figures, while areas of the non-reopening factors are still impacted by supply chain issues driving higher prices as companies pass through costs.

With pandemic-induced issues still causing havoc for inflation in the near-term, we think it is still too early to have a strong view on long-term inflation, so while we have added value exposure to both our domestic and international equity portfolios in late 2021, we continue to retain a largely neutral position relative to the index for now. We expect the recent Omicron surge to have exacerbated supply chain issues and inflationary pressures further in the near-term, but we will be watching monthly changes in inflation figures, energy prices and management commentary on supply chain issues closely to inform any potential changes to our positioning moving forward.

–

Tuesday 08 February 2022, 12pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.