Key economic releases last week

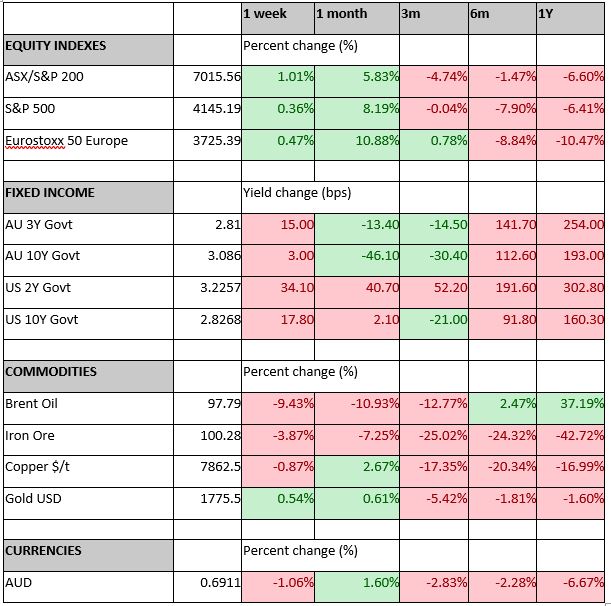

- The RBA raised rates by 0.5% as expected, taking the cash rate to 1.85%.

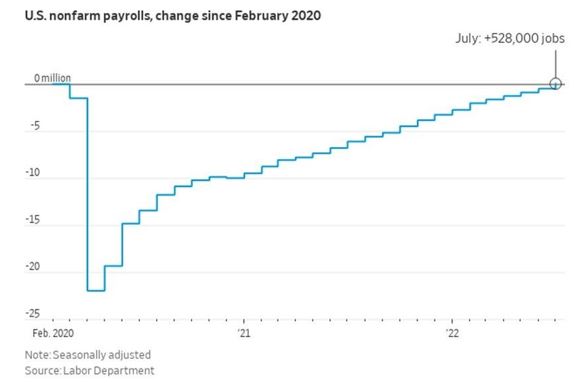

- US employment rose by 528k, much higher than the consensus 250k, driving unemployment down 0.1% to 3.5%. Average hourly earnings rose 0.3% more than consensus at 5.2% YoY.

- China Purchasing Manager Indexes (PMIs) were weaker than expected as the manufacturing reading fell to 49 while non-manufacturing fell to 53.8. The broader Caixin manufacturing was also weaker than consensus at 50.4 for manufacturing, but services rose to 55.5.

- Australian, EU, and US PMIs – manufacturing largely more resilient than expected. Services readings fell across the major regions but remained in expansionary territory for Australia and the EU.

- US Earnings season continued to be stronger than expected.

Key releases for the week ahead

- US July inflation with headline CPI expected to fall from June highs.

- Australian NAB Business Confidence and Westpac Consumer Confidence

- Australian Earnings season ramps up with companies including Commonwealth Bank (CBA), Telstra (TLS), Resmed (RMD), and Suncorp (SUN) all reporting.

Chart of the week

As mentioned above, the US employment market remains strong, with the unemployment rate falling to 3.5%. However, the absolute number of people employed has only now breached pre-COVID levels with the latest jobs report. Forward-looking indicators, including weekly jobless claims and job openings, are deteriorating but at levels that indicate slowdown vs recession. We will watch this closely as the trend remains negative and suggests a slowing US economy.

–

Tuesday 09 August 2022, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.