The rotation continues as high growth names in healthcare and tech underperformed whilst cyclical plays such as financials and energy led the market higher despite the surge in bond yields calming down somewhat. The S&P/ASX 200 rose 1.1% for the week whilst the S&P 500 rose 0.8%. Australian 10-year bond yields hovered around the 1.8% mark. Elon Musk had a bad week as Tesla fell below US$600 per share after surging to nearly US$900 at the start of 2021. Other recent headliners such as ARK Investment’s flagship ETF have also tumbled as unprofitable high growth stocks lose their shine.

Oil surged last week as OPEC+ surprised the markets by holding production targets steady, as most expected Saudi Arabia to increase production by 500,000 barrels per day. Early Monday morning, oil spiked further as reports of terrorist missile attacks on Saudi Arabian oil facilities and Brent prices now sit close to the US$70 mark, above pre-pandemic levels.

Australia to completely recover from COVID in 2021

Last week also saw the usual start of the month flood of economic data. Starting domestically, Australia continues to show a promising recovery. GDP for 2020 was down just 1.1% despite the pandemic, with the final quarter’s reading of 3.1% growth smashing expectations for 2.5%. Looking to the future, activity indicators remain strong and signal a continuation of the rebound. For job seekers, the environment continues to look positive, with job ads growing another 7.2% for the month. Many expected the recovery to drag into 2022 but it now looks likely that Australian GDP will rise above pre-COVID levels this year.

Of interest to markets, the Reserve Bank of Australia (RBA) also met last week for its usual start of the month policy meeting. As expected, there was no change to policies with the cash rate held steady and its bond purchase programs continuing as is. The RBA echoed other central banks’ willingness to do more if required and that a hike in the cash rate was at least a few years away. We continue to believe that the central banks can continue to maintain control of yields, with the RBA able to further increase and extend is quantitative easing program or tweak its current purchases to buying more longer-dated bonds.

Elsewhere, the U.S. continues to rebound strongly with another strong round of readings for both manufacturing and services indicators. Employment figures have also looked to resume its rebound with the unemployment rate falling to 6.2%. We expect that the U.S. can continue to recover strongly as they announced that they have secured vaccine supply to cover the entire population by May and Biden’s US$1.9 trillion fiscal stimulus bill expected to be signed into force this week.

Turning to China, growth is looking to be slowing from the furious pace achieved in the second half of last year. The annual policy meeting yielded a restoration of a GDP growth target at above 6% which was lower than market expectations for over 8% in 2021. Whilst this was a disappointment, since the turn of the year, we did notice a shift in tone from Chinese officials to controlling speculative risks and back to deleveraging, with some liquidity being withdrawn from markets. In the long run, we think this is a prudent decision and that the CCP will be able to control this risk in an orderly manner without forcing investors to rush for the exits. As such, we remain overweight in Emerging Markets (where China receives a majority allocation) in our International Equity portfolios.

Domestic businesses and consumers will likely remain optimistic

This week, we expect markets will remain focused on the U.S. stimulus bill that is expected to be passed. However, we also receive important updates on Australian business confidence and consumer sentiment.

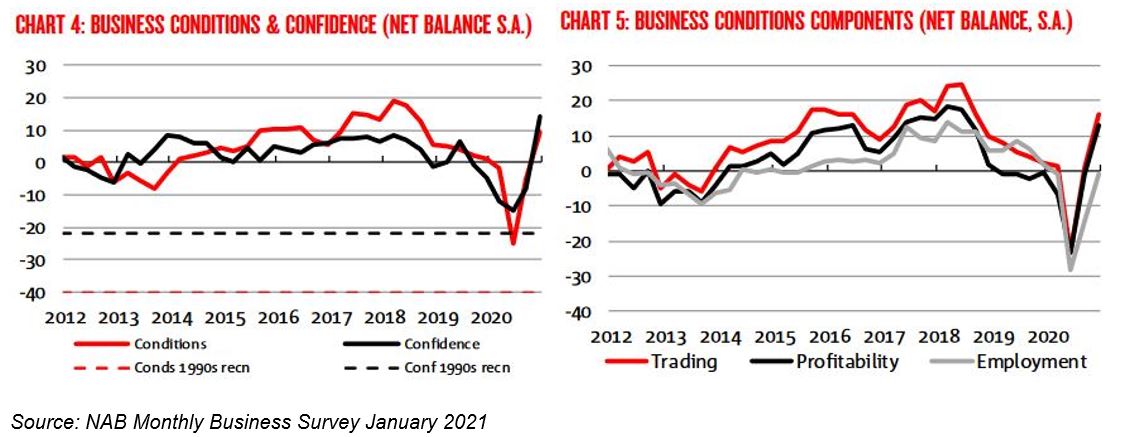

The NAB Business survey has indicated a strong rebound in both business conditions and confidence towards the end of the year.

Whilst we expect some pullback in February due to the snap lockdown in Victoria and Western Australia, we expect both sectors to remain buoyant as the economy continues to strengthen. Businesses are increasingly optimistic on trading and profitability, which should be positive for equities and credit markets as recovering revenues and profit margins should provide strong support for both asset classes. Employment conditions have lagged but are also recovering which supports continued growth in job ads and a continued recovery in employment, with many sectors well above pre-pandemic levels, though this is offset by the worst affected segments such as the tourism and travel industries which remain well below pre-pandemic levels.

–

Tuesday 09 March 2021, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.