From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Market update

I have been too cautious.

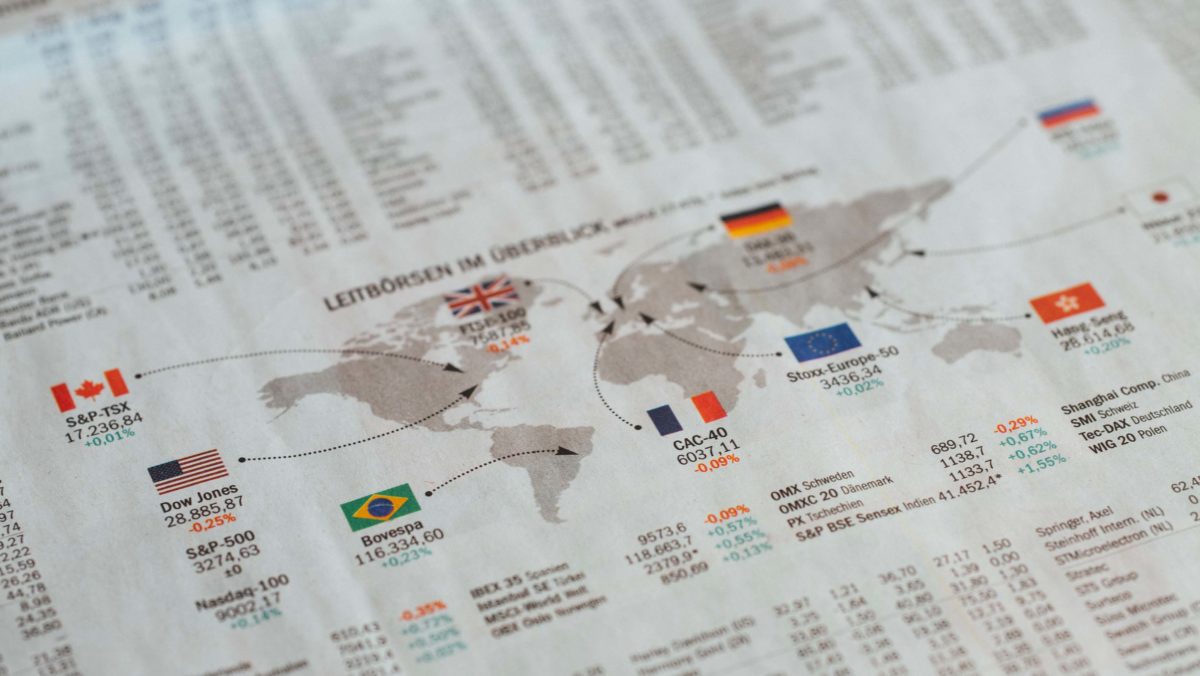

Monday night saw the S&P 500 close at 3232 which makes it flat on the year, which is an incredible effort given the events of recent months.

In fact, the rally has been the biggest 50-day rally in history.

The NASDAQ Composite is +10.6% YTD, fuelled by ‘big-tech’ and seems assured to trade above the key 10,000 level in the coming week.

Whilst the ASX200 remains down around -9% YTD including dividends, it is pleasing to see that in USD terms, the Australian share-market has recovered 80% of its losses and has in fact outperformed the S&P by around 12-13% in USD’s off the lows with much of this driven by the rebounding Australian Dollar.

We highlighted a fortnight ago that we felt asset markets were in an eerie twilight where there was unlikely any incrementally negative news-flow on economic conditions or COVID-19 until late June/early July and that, coupled with cautious investor positioning such as our own, we could see asset prices grind higher.

And they did, though we certainly did not expect the 10%+ gains in major indices or we would obviously have been more actively positioned.

Whilst central bank liquidity provision is surely the fuel for the gains, the market narrative has been one of optimism around re-opening and a growing belief, particularly in the United States, that the economic impacts of the virus will be short-lived and overcome by the extraordinary ~20% growth in money supplied by the Federal Reserve.

Equities have in fact led most other asset classes, which is unusual, but even high yield credit and levered loans are rapidly approaching levels traded pre the onset of COVID-19 which is astounding given swathes of the global economy remain shuttered indefinitely.

One interesting statistic from May was that approximately 7.5% of all U.S commercial real estate mortgages were 30-days delinquent, a tripling from the previous month.

The knock-on effects of lost business cashflows to landlords and corporations with unmoveable debt burdens will cause issues for months and years to come.

Within the economic data for May, beyond the headline US employment report Friday which I will address shortly, there was little cause for genuine optimism.

Within the Australian Industry Group surveys, the service and construction sector saw a ratio of 2 or 3 to 1 in favour of businesses still seeing falling month on month activity.

Manufacturing was only marginally better with a ratio of 1.5 to 1 in favour of companies with falling levels of May activity.

The two bright spots locally are weekly consumer confidence (see chart below of the ANZ Weekly Confidence figures) which is working hard to re-claim levels seen pre-COVID 19, and the export sector.

Last week saw the April figure as the second largest Australian Trade surplus in history, with the largest being the March result.

Resurgent Chinese demand for Australian commodity exports coupled with subdued import demand has propelled these record numbers and this in turn has been one of several factors assisting in the rise of Australia’s currency through 70c.

As for the U.S May employment figure and the shock surprise of a gain of 2.5m new jobs in May, unfortunately, there is more than meets the eye.

Firstly, the Labor Department who compile the data openly admitted that in compiling the survey their staff had incorrectly classified 4.9m workers as employed over April and May, meaning that the true unemployment rate in May would be 16.3%, not 13.3% – still an improvement on a revised 19.7% in April.

Secondly, much of the surprise ‘re-employment’ in May was driven by employers re-hiring workers so as to claim benefits associated with the Paycheck Protection Program, America’s version of Jobkeeper.

It bores me to be the ‘negative Nancy’ here, but the reality just isn’t the case that ‘America is back to work’. So where do we go from here?

Whilst being the first to acknowledge my caution has been unwarranted during this impressive rise, it is important to try and look at the months to come and to parse the information appropriately for the coming months.

With that in mind, I continue to return to the following points:

- Many economies continue to operate with significantly reduced capacity and with millions unemployed, meaning that medium term consumption will remain depressed

- Policies such as Jobkeeper and the PPP (USA) are doing an excellent job of protecting cashflows for those impacted, but have a finite life (September and July respectively)

- Equity market valuations are back at their highest levels for this century and well within the top decile in history despite the uncertain economic outlook

- COVID-19 infection rates across major southern and south-western states are escalating significantly and cause concern for a second-wave

- Australian bank valuations are now back above book value despite huge uncertainty over potential bad debts and the risk of a deferral of second half dividends

There is a lot of water to flow under this bridge, and encouragingly, we feel confident that there are many increasingly good opportunities for outperformance ahead.

One simple example to highlight our confidence in the opportunity set ahead is to highlight the performance of CSL (CSL), the largest company in the ASX200 and certainly one of the most impressive.

CSL has lagged the market by -25% in the recent rally and in fact has underperformed the banking sector by an incredible -30% in the last 6 weeks also, which I suspect few would have foreseen or expected during the darkest days of March.

We think there will be increasingly more opportunities that unmask themselves in the coming months and we remain alive to taking advantage as and when they present themselves.

Until such time, whilst frustrated we weren’t more optimistic in the rally, we are extremely comfortable and confident in our current positioning and believe opportunities lie ahead for those with cash.

Looking ahead

| Monday | n/a |

| Tuesday | AU NAB Business Confidence (MAY), AU ANZ Job Advertisements (MAY), CH PPI/CPI (MAY), US NFIB Small Business Confidence (MAY), US JOLTS Job Openings (APR) |

| Wednesday | AU Westpac Consumer Confidence (MAY), AU Weekly ANZ Consumer Confidence, US

Weekly Earnings (MAY), US CPI (MAY), US Federal Reserve Decision |

| Thursday | AU Home Loans (APR), US PPI (MAY), US Weekly Jobless Claims, US Weekly

Bloomberg Consumer Confidence |

| Friday | US Michigan Consumer Confidence (JUNE) |

We have a shortened week in Australia and the main focus in the local data will be with both Consumer and Business Confidence reports for May.

The US Federal Reserve meeting on Wednesday night will be the major international event and the language of the Fed will be closely watched to understand their future intentions insofar as support, particularly since asset markets have raced ahead in such a short period following the initial Fed moves announced in the early days of COVID-19.

It feels likely that at some point in the coming months the Fed will likely commence yield-curve targeting, much like the RBA have done in Australia, as a means to curb rising bond yields.

On the COVID-19 front, investors should be keeping a close eye on rolling infection rates across the southern and western regions of the United States as re-opening occurs.

At present there are only minor tremors, but the trend in several states is higher – Arizona is reaching ICU capacity now, and if this situation repeats itself across other states then confidence could rapidly be pulled.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 6116 | +244 | +4.0% |

| S&P / ASX 200 | 5998 | +243 | +4.1% |

| Property Trust Index | 1301 | +58 | +4.7% |

| Utilities Index | 7755 | +30 | +0.4% |

| Financials Index | 4930 | +339 | +6.7% |

| Materials Index | 13423 | +412 | +3.2% |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 3193 | +149 | +5.0% |

| London’s FTSE | 6484 | +408 | +6.7% |

| Japan’s Nikkei | 22863 | +986 | +4.5% |

| Hang Seng | 24770 | +1809 | +7.8% |

| China’s Shanghai | 2930 | +78 | +2.8% |

Key dividends

| Date | |

| Mon 8 June | AUSTRALIA PUBLIC HOLIDAY |

| Tue 9 June | Div Pay-Date Metrics (MXT, MOT) |

| Wed 10 June | Div Pay-Date – MQGPD |

| Thu 11 June | Div Pay-Date – ANZPG, ANZPH, NABPE, WBCPF, WBCPH |

| Fri 12 June | Div Ex-Date – WBCPE |

–

Wednesday 10 June 2020, 12pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.