From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Market update

Market’s remain range-bound with consensus amongst investors still very much on the cautious side, and its perhaps because of this investor caution that share prices have managed to stay afloat.

Investor surveys point to high degrees of uncertainty and caution amongst institutional types, and frustratingly for hedge funds, some of the best-performing stocks have been the most widely short sold.

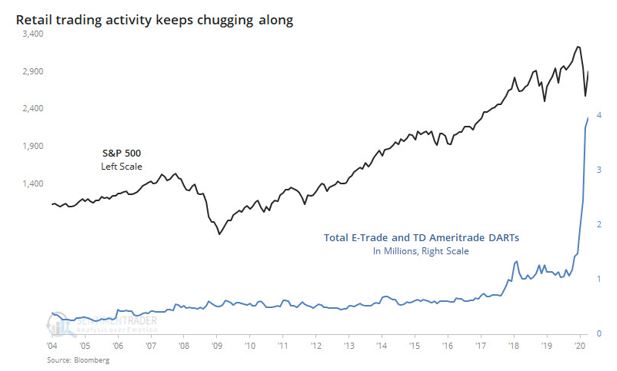

In contrast, across both Australia and the United States there is both hard and anecdotal evidence to suggest that retail investors have aggressively bought this sell-off, with the chart below demonstrating the surge in new account openings at retail brokerages in the U.S since the pandemic began.

The chart below shows ‘Daily Average Revenue Trading’ at two of the largest U.S retail brokerages, E-Trade and TD Ameritrade.

There have been additional reports suggesting a surge in activity at online broker Robin Hood who charge zero brokerage trading.

High growth technology and bio-tech sectors continue to lead the pack for performance in the United States with old economy stocks in banking, commodity and small-cap sectors off the radar, unlike in Australia, where small-caps are the leading gainers as investors chase technology exposures concentrated in the smaller end to the market.

With the U.S Memorial Day holiday next Monday marking the start of summer in the U.S this week will be a quiet one.

Whilst price action remains underpinned given the over-riding investor caution, the underlying corporate and economic fundamentals remain severely challenged and for that reason we believe a focus on certain income streams remains a prudent and winning strategy in the weeks and months ahead.

Observations for the past week

AMCOR (AMC) interim results

- AMC upgraded earnings guidance for the second time this year, raising internal expectations to 11-12% growth on a constant FX basis, up from the previous 7-9% guidance on EPS growth

- AMC remarked that they had seen little net impact from the virus, but that beverage volumes in April were weaker and that this would offset small gains made in the group’s Flexible packaging division

- Whilst much has been made about virus outbreaks at meat-processing plants, as yet AMC has seen no impact on their business, though we should keep an eye on further news as this sector contributes 8-9% of total AMC sales

- AMC benefited from the falling oil price also which saw resin costs coming in better than anticipated

- AMC has been an exceptional performer through the pandemic thus far and we expect it to continue to outperform given its defensive cashflow attributes and undemanding valuation of 14x 2021 earnings

US Federal Reserve commentary

- The Fed Chairman Jerome Powell was quoted over the last week citing his view and that of his colleagues is that they fail to see the merits in NEGATIVE U.S interest rates as a policy tool

- The Fed Chairman said he expected U.S economic growth to resume in the second half, but was not being drawn into whether that would be Q3 or Q4

- His tone was optimistic in the long-term but cautious near-term, commenting that until people felt safe, presumably with administration of a COVID-19 vaccine, it was unlikely that economies would return to ‘normal’

- He suggested it may well take until the end of 2021 before normality was returned

- The Fed Chairman said that a second wave of infections would be quite damaging to the economy

- Lastly, he encouraged the idea of additional fiscal stimulus, noting that it may be ‘costly, but worth it’

Commonwealth Bank (CBA) results

- Like the other 3 major banks before them, CBA surprised on the negative front with its Tier 1 capital being more negatively impacted by credit quality assessment and hence landing under 11% and broadly in line with the peer group

- CBA added $1.5bn in collective provisioning in anticipation of rising bad debts caused by the pandemic and this figure puts them toward the higher level of provision coverage relative to the peer group, which is a positive

- CBA plan to sell a 55% stake in Colonial First State to US private equity giant KKR which will realise them by $1.7bn and will be supportive of their capital position in the medium term

- Unlike its peer group whom are all trading under book value, CBA continues to command a 40-50% premium to its peer group given relative capital resilience and strong deposit funding. Whether it is deserved of such a significant premium given risks to its unsecured personal lending portfolio throughout this crisis remains to be seen

Looking ahead

| Monday | US NAHB Housing Market Index (MAY) |

| Tuesday | AU Weekly ANZ Consumer Confidence, US Housing Starts/Building Permits (APR) |

| Wednesday | AU Westpac Leading Indicator (APR), Skilled Vacancies (APR), US FOMC Meeting minutes |

| Thursday | AU CBA Service/Manufacturing PMI (MAY), US Philly Fed Business Outlook (MAY), US Markit Service/Manufacturing PMI (MAY) |

| Friday | n/a |

The week will likely be a quiet one with results from only James Hardie (JHX) and Aristocrat (ALL) locally.

We will see some early data on May economic activity and the minutes from the last Federal Reserve meeting, however I think there is unlikely to be little information new to investors from these releases.

US Memorial Day long weekend in the United States on Monday will also likely lessen volumes, interest and volatility as the week draws on.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 5492 | +5 | +0.1% |

| S&P / ASX 200 | 5405 | +14 | +0.3% |

| Property Trust Index | 1125 | -23 | -2.1% |

| Utilities Index | 7653 | +30 | +0.4% |

| Financials Index | 4158 | -49 | -1.2% |

| Materials Index | 12037 | +330 | +2.9% |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 2863 | -66 | -2.2% |

| London’s FTSE | 5800 | -135 | -2.3% |

| Japan’s Nikkei | 20037 | -142 | -0.7% |

| Hang Seng | 23797 | -433 | -2.1% |

| China’s Shanghai | 2868 | -27 | -0.9% |

Key dividends

| Date | |

| Mon 18 May | Div Ex-Date – Macquarie (MQG) |

| Tue 19 May | Div Pay-Date – TPG Telecom (TPM) |

| Wed 20 May | Div Ex-Date – Ausnet (AST)

Results – James Hardie (JHX) |

| Thu 21 May | Div Ex-Date – Pendal (PDL)

Results – Aristocrat (ALL) |

| Fri 22 May | n/a |

–

Monday 18 May 2020, 5pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.