Following several strong weeks, equities took a breather despite strong earnings and further economic data underlining the strength of the recovery, notably in Australia and the U.S., as investors considered the potential implications of President Biden’s proposed doubling of the capital gains tax to 39.6% for individuals earning over $1 million per year.

The S&P/ASX 200 was flat for the week whilst global markets ended slightly lower, with the MSCI World down 0.3% and the S&P 500 down 0.1%. Locally, healthcare and materials led gains whilst energy and tech drove losses.

On the economic front, preliminary Australian retail sales for March came in stronger than expected, growing 1.4% over the previous month. Preliminary readings for activity indicators across U.S., Europe and Australia also had beats across the board as the global economic recovery continues to outpace expectations despite the pandemic still raging across many countries, with India of particular concern.

In corporate news, companies have been issuing trading updates for the quarter, with solid results from Afterpay (APT), Brambles (BXB) and BHP. RIO saw export volumes slightly underwhelm due to disruptions from Tropical Cyclone Seroja.

In the mid-cap space, OZ Minerals (OZL) reported in-line copper and gold production but flagged higher costs due to the stronger AUD and warned that COVID issues in Brazil could potentially impact production there, though not materially enough to impact full year guidance. We remain positive on OZL as stronger than expected copper prices offset higher costs.

Bapcor (BAP) provided another strong trading update, reiterating continued strong sales growth trends across both its retail and wholesale business as the number and average age of vehicles continues to rise. We continue to be optimistic about BAP’s prospects and expect strong sales trends to continue.

Investors ignored strong sales and assets under management growth of 8% to over $100 billion and sold down Challenger (CGF) as it updated that it expects profits to come in at the lower end of guidance as profit margins have been hurt by lower credit spreads and still-elevated cash levels. Whilst the disappointing profit guidance surprised us, we think the reaction was overdone given the strength of net inflows. We expect profit margins to improve as CGF continues to deploy cash and reprice its annuity products. Whilst we had recently trimmed the position in January in the high $6s, CGF is starting to look attractive again at these prices.

Record high PMI

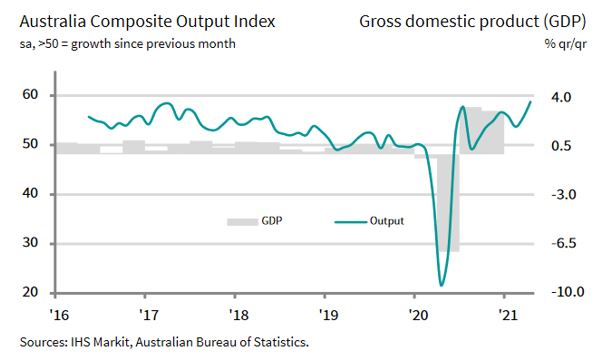

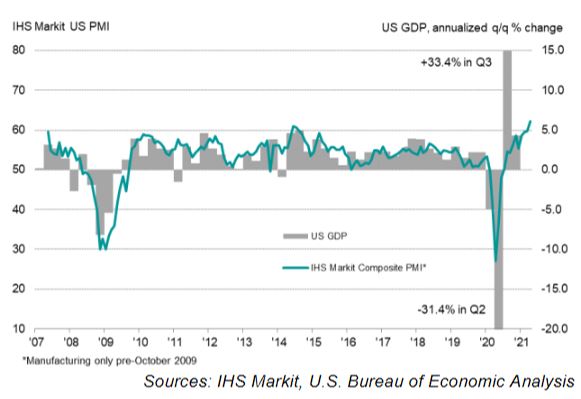

Economic activity is really booming thanks to both fiscal and monetary stimulus. The Purchasing Manager Indices (PMIs) are wide-ranging surveys of businesses to gauge the near-term outlook and is a commonly used indicator for economic growth. These PMIs have been hitting record highs lately as shown below.

Whilst it is no surprise that Australia is booming given the control of the pandemic, it is interesting to see the U.S. economy so strong given the much tougher time they have had with the pandemic. Even more surprising is Eurozone manufacturing hitting an all-time high, though services continue to languish as harsh mobility restrictions remain in place.

The record high composite PMIs made up of two separate readings for the services and manufacturing sectors for both Australia and the U.S. highlight the strength of the recovery in two key markets for Australian investors. As a result, we continue to prefer cyclicals that will be more leveraged to earnings upgrades from a stronger than expected economic recovery.

–

Wednesday 28 April 2021, 9am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.