Despite a disappointing week for economic data, equities continued to make new highs whilst bond yields edged up. The S&P/ASX 200 rose 1%, led by energy and materials continuing their rebound. U.S. stocks continue to hit new highs with growth stocks driving a 0.6% gain for the S&P 500 last week. Australian 10-year government bond yields rose slightly above 1.2% and the U.S. 10-year treasury yield rose slightly above 1.3%.

Australia posted a stronger second quarter GDP reading than expected, with the economy growing 0.7% from the first quarter of 2021, or 9.6% over the previous year. However, markets are forward looking, with disappointing manufacturing and services surveys indicating a difficult time ahead as lockdowns look likely to remain in place for much of the east coast for an extended period, with restrictions likely to ease only gradually as hopes fade for COVID zero in both New South Wales and Victoria.

The rest of the world is also in a tougher period than it was a couple of months ago. The Chinese economy now looks to be on the verge of contraction in the near term which has spawned hopes for the government to start turning the liquidity taps on once again.

Meanwhile, U.S. and European economies are still poised to grow above long-term trends, but the growth rates continue to slow from their earlier highs. This is starting to have an impact on hard data, with U.S. consumer confidence falling sharply from previous months and employment data came in significantly weaker than expected, with just 235,000 jobs added compared to consensus expectations for 750,000. The employment picture remains mixed as many indicators continue to point to a shortage of labour.

In the week ahead, the Reserve Bank of Australia’s (RBA) policy meeting will be on watch as markets are starting to speculate a reversal of the recent tapering in response to the weakening economy. ANZ will also post its monthly job advertisement data and NAB will post its monthly business confidence survey results, both of which are likely to continue to weaken significantly. On the global side, Chinese import and export data may provide some insight on the depth of the global slowdown.

Lockdowns hurt the economy, but will they hurt the ASX?

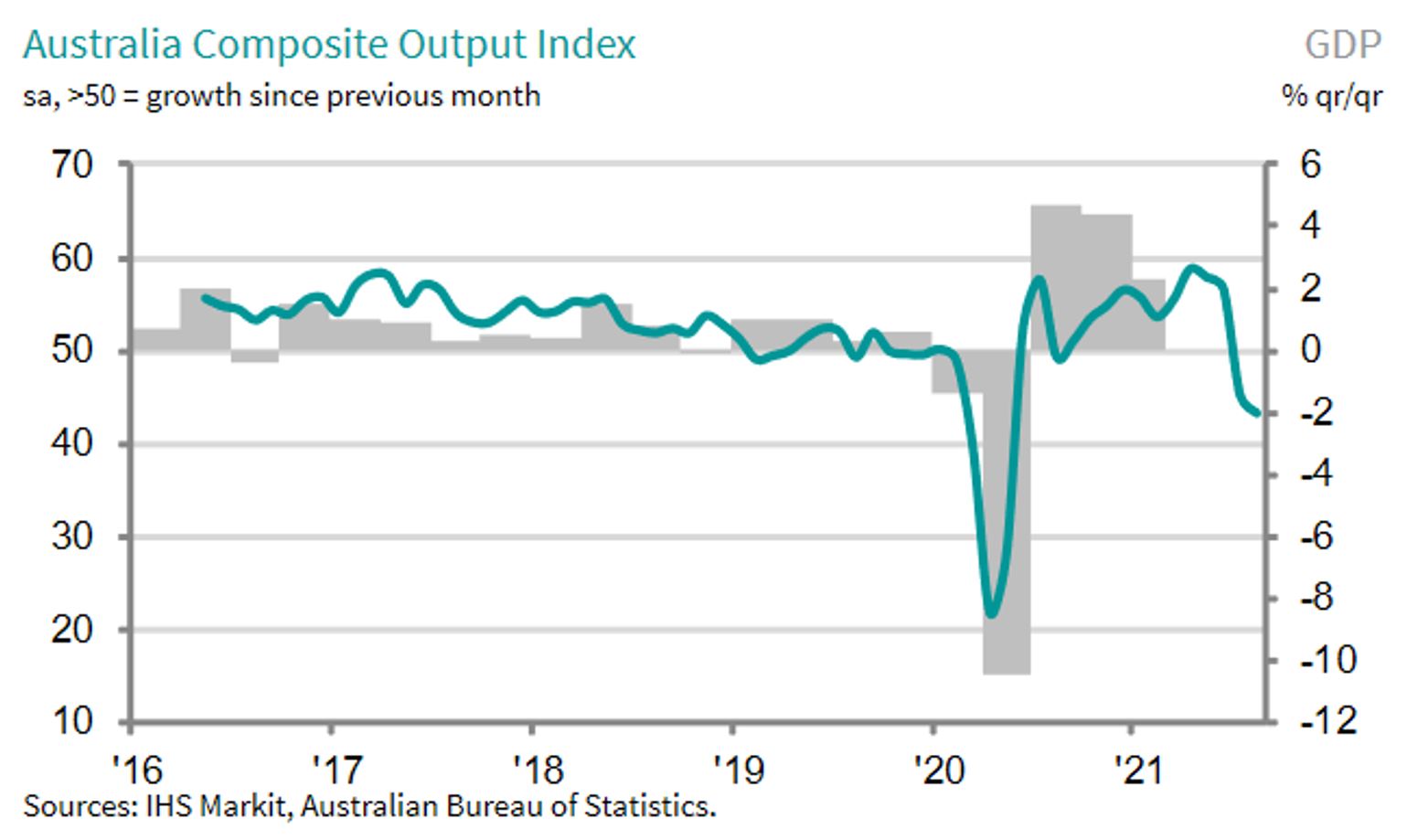

With the current lockdowns in New South Wales and Victoria likely to go on for much longer than any since the 111 days served by Melbourne residents last year, it is no surprise that the Australian economy is likely to contract. Based on the chart below, the contraction this time is unlikely to be as sharp as the initial lockdown in 2020 as policy makers and businesses have a better understanding of how to mitigate the impact, with working from home now normalised for many industries.

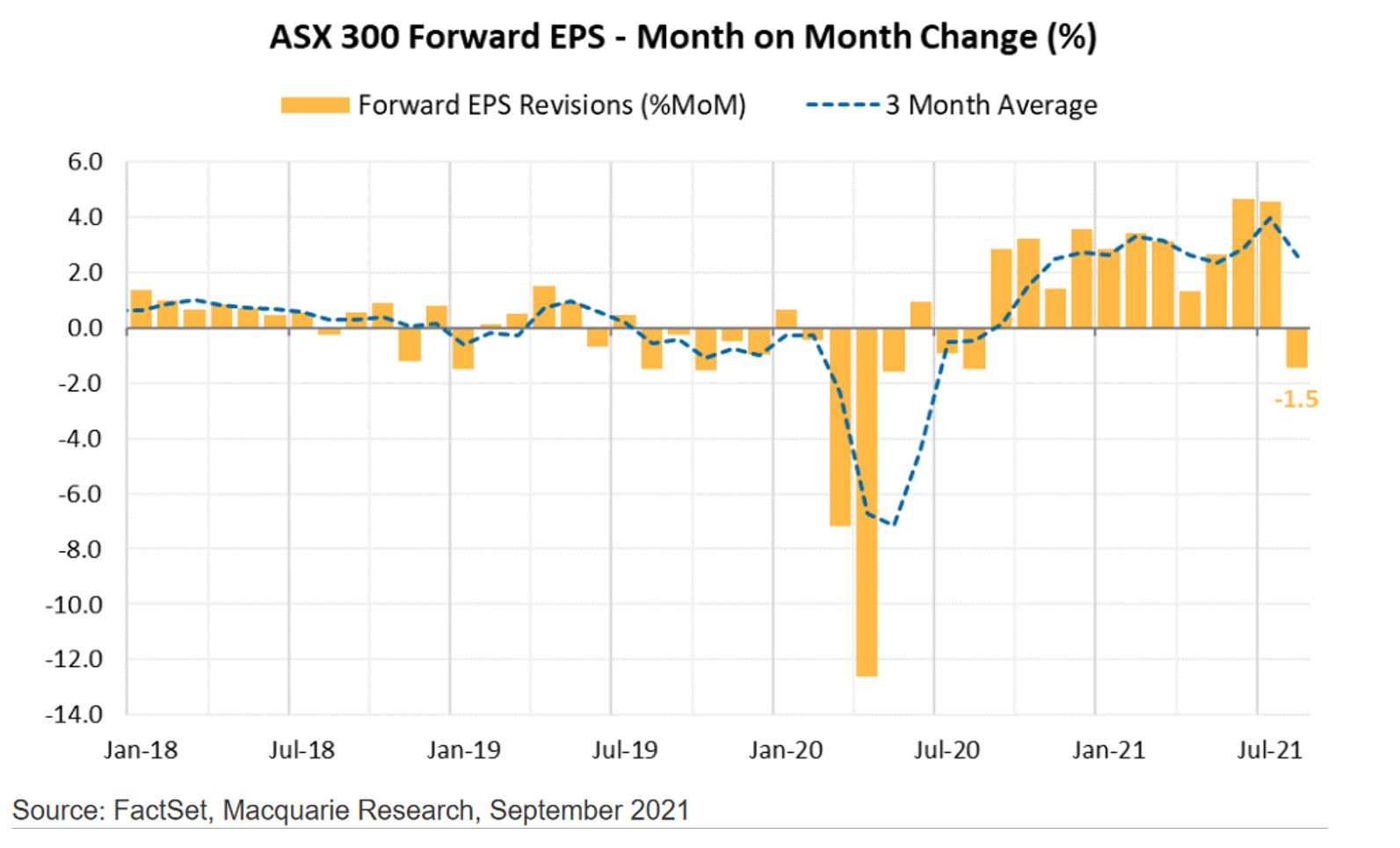

As a result, the equity market has brushed off recent worries, following global markets higher over the past few weeks despite worsening case numbers and extended lockdowns. This is not due to irrationality in the markets. As the saying goes, the market is not the economy. Many of the largest ASX listed companies draw a large part of revenues and earnings from global sources, making them more resilient to isolated downturns. In fact, as the chart below shows, earnings growth for the 2022 financial year has only been marginally reduced and is not at odds with historical norms.

The falls are nowhere near those seen during the initial lockdowns last year as pessimism was rampant with much of the world in lockdown, and costs to shift to a novel working environment also proved another burden to earnings. Furthermore, it comes after a strong run of upgrades that have left earnings well above pre-pandemic levels.

This time around, major sources of revenue and earnings such as the U.S. and Europe are less likely to impose strict mobility restrictions due to higher vaccination rates and lack of political appetite, helping to cushion earnings expectations. Therefore, we see the recent resilience of the market in the face of the recent lockdowns and economic slowdown as justified.

–

Tuesday 7 September 2021, 9.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.