So what has happened in the markets recently?

Well, they have had cheery news on several fronts but the outlook for economic growth has weakened. The Fed had further dovish comments, with one speaker indicating that Quantitative Tightening may cease in late 2019. Meanwhile, Donald Trump tweeted that discussions with China were going well and raised the possibility of an extension to the March 1 deadline for the tariff freeze.

On the economic data front, the domestic picture was not pretty. Australia’s unemployment rate fell to 5% as employment figures surprised to the upside but the underlying picture was mixed, with full time employment falling. Inflation remains low at 1.8% and the housing market remains weak, with building approvals down 8.4% and home loans down 6.1% from December. Retail sales also fell 0.4%.

The U.S. economy remains robust as employment recorded another strong month, with 296,000 jobs added in January and the participation rate ticking up, meaning that despite the large number of jobs added, the unemployment rate rose to 4%. This continues a trend of strong jobs growth but rising unemployment rate as more people are tempted back to look for work with wages rising 3.2% over the past year. Activity indicators were also strong, showing that the U.S. economy continues to show robustness, though a very weak December retail sales print reined in optimism. A key point to watch is the inflation rate in the U.S. which picked up to 2.2%. This could push the Fed to turn more hawkish again if it continues to push higher.

Elsewhere, European and Japanese data remain weak. China showed a pickup in non-manufacturing activity despite the ongoing slowdown in the manufacturing sector, providing some hope.

Chinese trade data was also much better than expected and a big boost in new loans showed that earlier stimulus measures could be starting to work through the economy. However, data around this time of year can be volatile due to the Lunar New Year celebrations.

On the earnings front, we are coming to the tail-end of what has been a good U.S. earnings season so far, and we are just about to get into the busy period for domestic earnings.

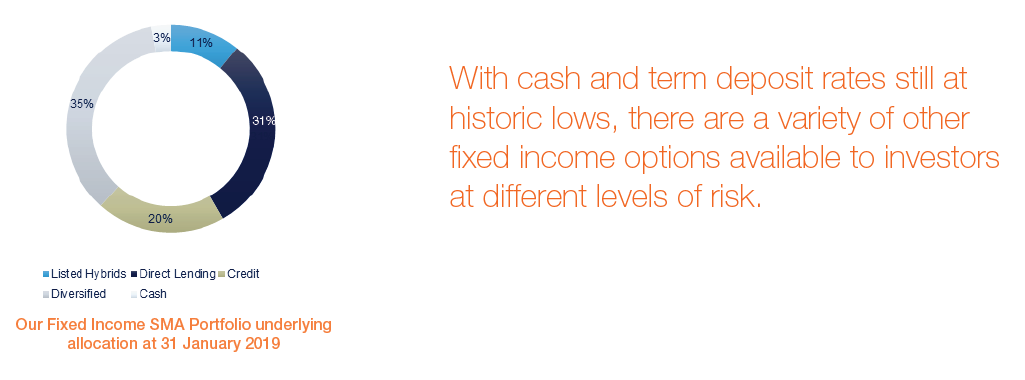

So what does this all mean in the context of cash and fixed interest?

Yields in Australia are likely to stay low and the spread or difference with US yields is likely to widen. We expect global yields to continue to push higher in the longer term, though political risks and sentiment have recently combined to push yields back down. In this environment, total returns will be lower than previous years because capital gains will be constrained given that yields are likely to move upwards.

What low risk exposures do we like that are not cash?

Direct senior loans which will pay between 2.5-4% for investment grade companies. These are traditionally very difficult to access, except through wholesale funds. We have several of these opportunities in our portfolio, or on our radar, and we look to minimise risk by only considering funds where loans are generally securitised and high on the corporate capital structure.

We also like absolute return funds, especially those with more alternative levers, like pair trading or a derivatives overlay. For this, the returns will depend on the risk you are willing to take. There are generally two big buckets here; the lower risk ones are good at providing cash plus returns, but the higher risk ones are more like equities – big returns in some years, but losses in others. At this stage, we prefer the lower risk opportunities of this segment and we currently hold the Ardea Real Outcome Fund in our models.

Other low risk alternatives that we have researched include the likes of the Kapstream Absolute Return and Franklin Australian Absolute Bond. However, we view these as being more traditional fixed interest funds and our preference in this space is for a slightly more flexible approach at this stage.

What about the higher risk exposures in the fixed income space?

Our preferred approach in this space is well diversified asset backed funds like the La Trobe Australian Credit Fund 12 Month Term or the Qualitas Real Estate Income Fund (QRI).

Overall, we think property defaults will remain low for higher quality borrowers (both in the residential and commercial space) and, in terms of returns, we believe the La Trobe Credit Fund can pay 5.2%+, with higher risk exposures like QRI targeting 8%+. Qualitas have historically returned much higher than this, with their higher mezzanine funding exposures returning 20%+ per annum since inception of the business.

Mezzanine finance is much higher risk and can pay double digits, although we generally prefer higher quality and diversified exposures to reduce risk.

What we don’t like?

Fixed interest defensive global bonds as we think yields will still move higher globally and this will constrain returns via capital losses.

We also do not like higher risk credit as spreads have come back below long-term averages following the recent rebound over the past few weeks. We are also wary that credit spreads tend to flare up in the latter stages of an economic cycle (and most economists do now believe that we are coming to the end of a cycle). Having said that, there are still good returns in this space and there is not much interest rate risk because the exposures are generally on floating yields. For this reason, we do still like to hold a position in investment grade credit but overall, we are underweight in this sector.

Do you have any concerns or questions?

There is a lot of noise in the media and our message to you is to try and cut through as much of this as possible.

We are here to help by offering support and guidance to navigate the complex landscape of superannuation, investments and retirement planning and we would love to hear from you if the above has raised any questions or concerns.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.

(PRPIA Pty Ltd (ABN 61 144 888 433) trading as Bentleys Wealth Advisors, authorised representatives of Charter Financial Planning, Australian Financial Services Licensee).