Key economic releases last week

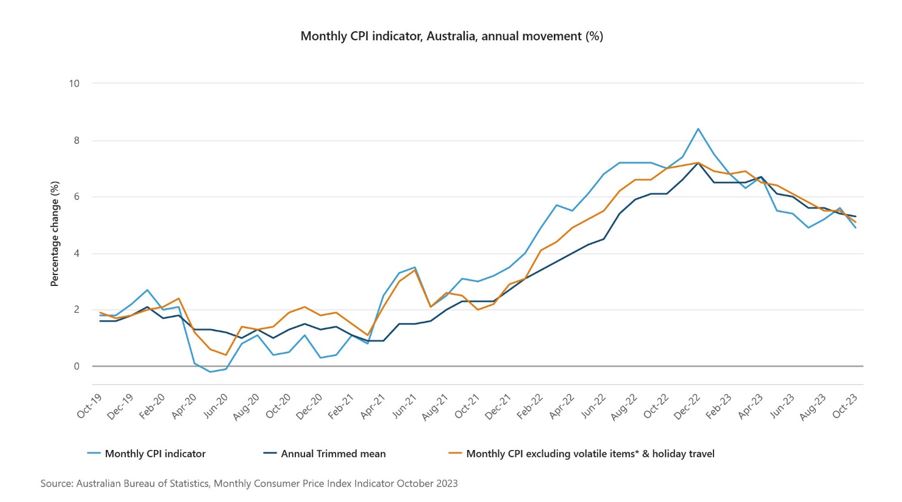

- Australian weighted mean CPI rose 4.9% in October, below consensus for 5.2%, alleviating concerns for the RBA to keep hiking.

- US consumer confidence was better than expected as consumers remained slightly optimistic

- US personal consumption expenditure was flat MoM and rose 3% YoY while the core reading rose 0.2% MoM and 3.5% YoY.

- US personal spending rose 0.2% MoM, in-line with consensus.

- EU preliminary CPI was lower than consensus as the headline reading fell to 2.4% YoY compared to expectations for 2.7% as CPI fell 0.5% for the month. The core reading fell 0.6% for the month, with the YoY reading rising 3.6% compared to expectations for 3.9%.

- China PMIs disappointed as Manufacturing deteriorated further into contraction territory while Non-Manufacturing also deteriorated to 50.2, barely in expansionary territory.

Key releases for the week ahead

- Australian ANZ job ads

- Australian retail sales

- RBA Policy Meeting

- Australian Q3 GDP

- US employment data

- China trade data

- EU Q3 GDP

Chart of the week

The readings across the US and Europe also indicate that inflation is continuing to moderate and supports the view that we are near the end of the interest rate cycle. Though the monthly release of the year-on-year weighted mean CPI reading for Australia indicates that inflation remains above the Reserve Bank’s target, it moderated more than consensus expectations, reducing the risk of another hike. The market has already moved to price out further hikes in Australia after this latest inflation reading.

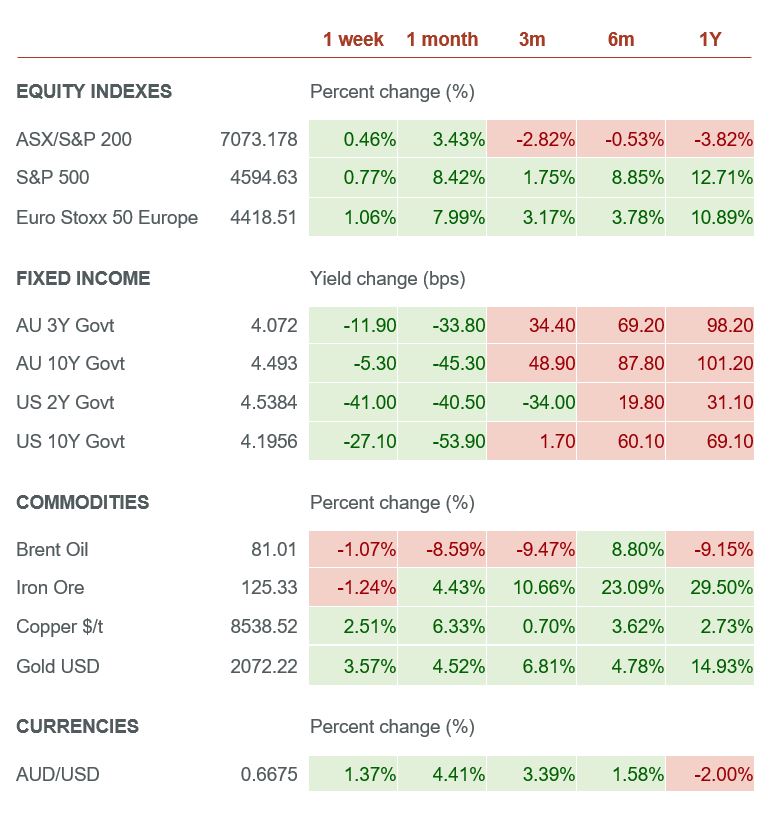

The end of a rate hiking cycle is historically supportive of bond returns, particularly high-grade exposures. Government bond yields usually tend to peak with the rate hiking cycle so high-grade bond investors tend to see capital gains on top of distributions as bond prices rise when yields fall. Returns for more risky areas such as junk bonds and equities will be dependent on whether a recession can be avoided.

Despite the recent rally in bonds over the past month, we continue to see the potential for bond market returns as attractive relative to recent history.

–

Monday 04 December 2023, 3.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.