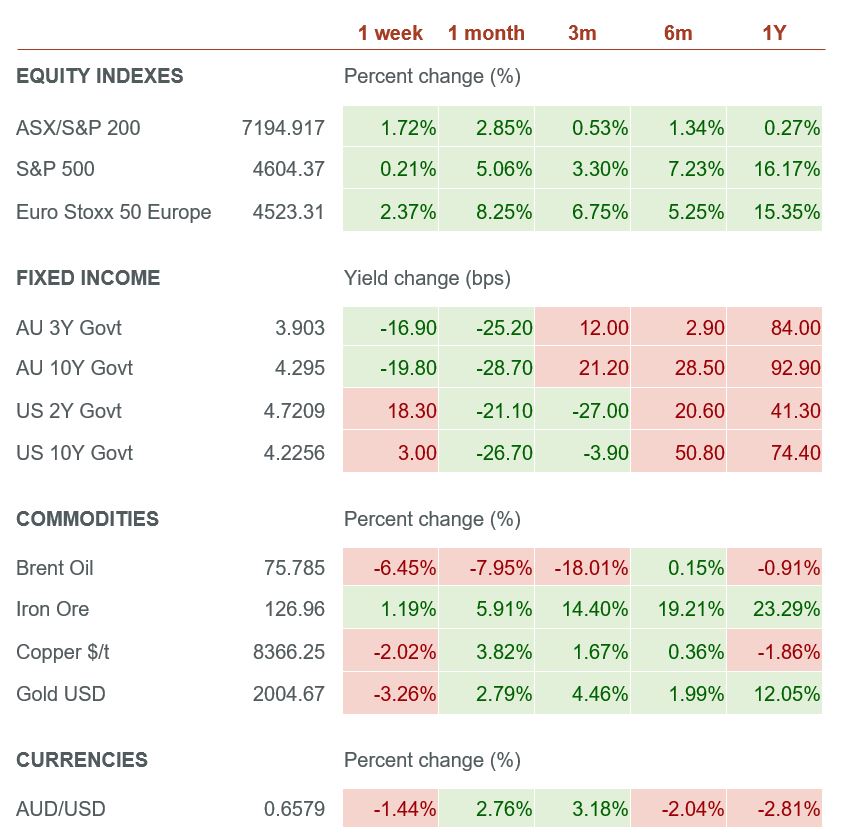

Key economic releases last week

- Australian ANZ job ads fell 4.6%, accelerating recent declines.

- Australian retail sales fell 0.2%, in-line with expectations.

- RBA Policy Meeting kept rates steady as expected, with the market no longer pricing in further hikes.

- Australian Q3 GDP rose 0.2% QoQ, below consensus estimates for 0.4% growth.

- US added 199,000 jobs, above consensus for 180,000. The unemployment rate fell to 3.7% compared to consensus expectations for it to remain flat at 3.9%. Average hourly earnings grew 4% YoY, in-line with consensus.

- US job openings fell more than expected to 8.7m compared to consensus 9.3m.

- China exports grew 0.5% YoY compared to expectations for a 1.1% fall, but imports fell 0.6% YoY compared to expectations for a 3.3% rise. The import weakness is consistent with weaker China growth.

- EU Q3 GDP fell 0.1% QoQ and was flat YoY.

Key releases for the week ahead

- Westpac Consumer Sentiment and NAB Business Confidence

- Australian employment data

- Australian, US, EU preliminary PMI readings

- US inflation data

- US Federal Reserve policy meeting and interest rate projections

- US retail sales

- China fixed asset investment, industrial production, retail sales and unemployment rate

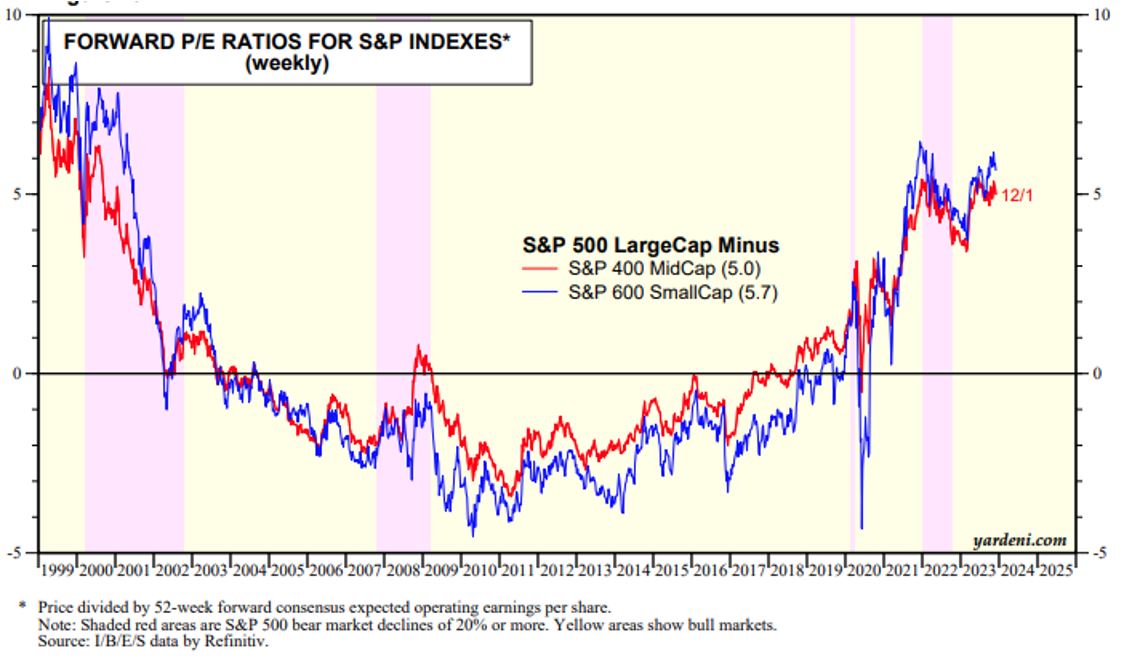

Chart of the week

US large cap stocks as measured by the S&P500 have had a particularly strong year rising 20% year-to-date, powered by the returns of the mega cap technology stocks. In comparison the S&P MidCap400 Index has risen 8.3% and the S&P SmallCap600 Index just 5.4%.

The chart above illustrates that the valuation gap between large-cap companies (S&P500) and small-cap (S&P 600 SmallCap) and mid-cap (S&P 400 MidCap) companies is currently near a multi-decade high, as indicated by forward PE ratios.

There are some solid reasons for smaller companies trading at a discount to their long-term average at present such as lower interest coverage ratios (operating income/interest expense), making them more susceptible to default in a high-interest rate environment. They also have lower access to capital and are perceived as less resilient to economic shocks, including recessions.

However, it is these parts of the market that tend to outperform in the early stages of an economic recovery as they tend to be more sensitive to changes in the business cycle and they also benefit from “risk-on” market sentiment.

Our portfolio of international fund managers tend to have a natural overweight to mid-cap companies with active investment managers seeking investment outperformance in the less-efficient parts of the market. As a team we continue to monitor economic developments as we assess potential opportunities to gain from the eventual normalisation of the large cap and mid/small cap valuation gap.

–

Tuesday 12 December 2023, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.