Key economic releases last week

- Westpac Consumer Sentiment fell 2.6%, remaining near historic lows. The NAB Business Confidence fell further below the long-term average to -2 while conditions remained above the long-term average.

- Australian employment data was stronger than expected with 55,000 jobs added compared to consensus estimates for 20,000. Full time employment rose 17,000 while the participation rate rose to 67%, helping the unemployment rate rise to 3.7%.The data was robust and supports economic resilience as job gains remain solid while easing labour market tightness was driven by supply.

- US inflation data was better than expected coming in 0.1% lower than consensus across the key readings. CPI rose 3.2% YoY and was flat MoM, while core CPI rose 4% YoY and 0.2% MoM.

This is positive as the recent monthly trend was on the rise and was sparking some concerns. We continue to monitor the core MoM readings closely. - US retail sales fell 0.1% MoM compared to consensus for -0.3%.

- China fixed asset investment rose 2.9%, industrial production rose 4.6%, retail sales rose 7.6% and unemployment stayed at 5%. The data was broadly solid, with industrial production and retail sales slightly better than estimates, partly offset by weakness in fixed asset investment.

- China loans data was mixed as new loan volumes beat consensus, but total social financing was slightly under expectations.

Key releases for the week ahead

- RBA minutes + Governor Bullock’s speech

- Japanese inflation

- Aus, US, EU PMIs

Chart of the week

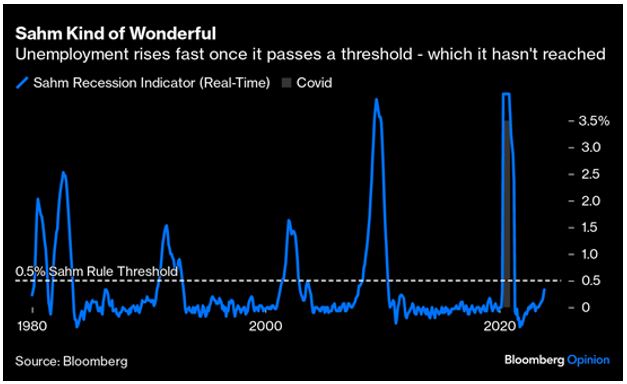

The chart above from Bloomberg Opinion tracks the Sahm rule over the last 4 decades. The Sahm rule posits that if the three-month average of the US unemployment rate is a half a percentage point or more above its low in the prior 12 months, the economy is in a recession. The current level of 0.33 is still below the 0.5 threshold, but it is worth monitoring in the coming months.

Perhaps the most interesting thing about this chart is that it shows when the Sahm 0.5 threshold is breached, unemployment tends to rise fast, as rising unemployment creates a negative feedback loop where job losses beget further job losses (as the unemployed cut back on spending, and the employed become more cautious for fear of losing their job).

We are not suggesting that this will be the case on this occasion, as the data from the US jobs market remains resilient but weakening. However, history shows that given the long and unpredictable lags of policy tightening we are not necessarily out of the woods yet even with inflation data surprising to the downside last week. If the unemployment rate continues to tick up (it rose to 3.9% in October from 3.4% earlier this year) job losses may start to gain momentum, and risk assets would need to be repriced lower. As a result we are waiting to see more data before buying into the soft-landing narrative, and this is reflected in our current portfolio positioning.

–

Monday 20 November 2023, 4.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.