This will be our final update for 2023 and we will resume on 15 January 2024. Thanks for reading and best wishes for the holiday season, see you next year!

Key economic releases last week

- Westpac Consumer Sentiment rose 2.7% but remains at depressed levels near historical lows. NAB Business Confidence fell sharply to -9, well below historical average, while Conditions remained above historical average but fell to 9.

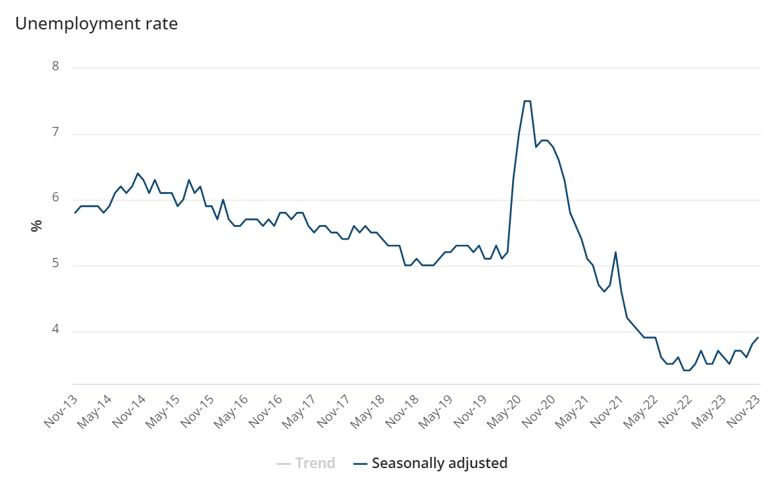

- Australian employment data was better than expected again as 61,500 jobs were added compared to consensus estimates for 11,000. 57,000 of those were full time, indicating high quality of job adds. The unemployment rate ticked higher to 3.9% as the participation rate rose 0.2% to 67.2%.

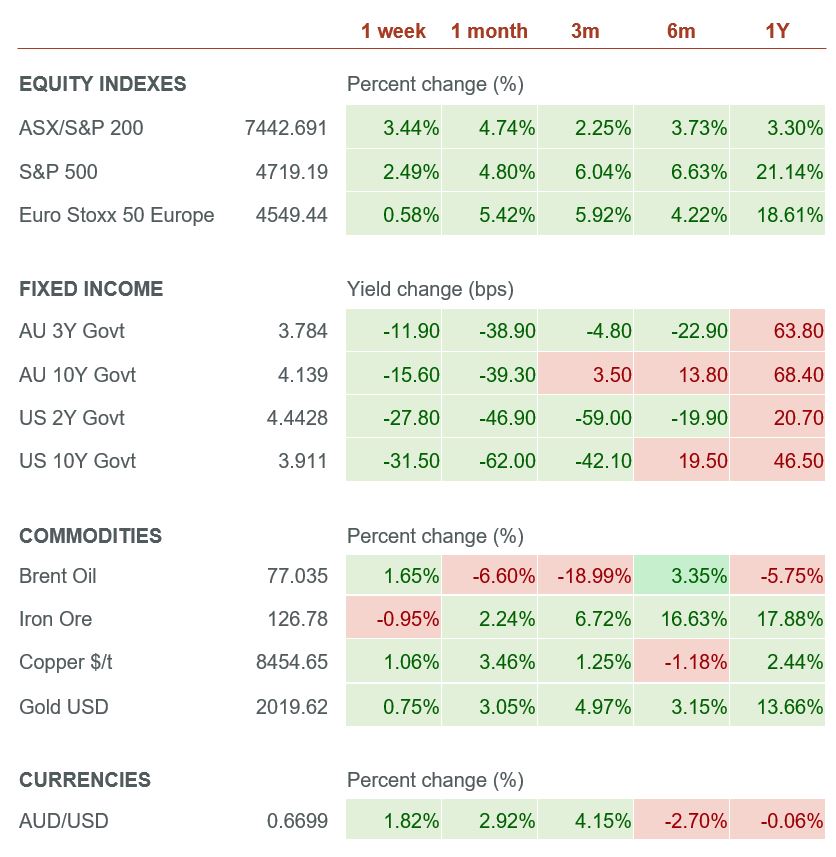

- US CPI rose 0.1% MoM and 3.1% YoY, slightly above consensus. The core reading was in-line with consensus, rising 0.3% MoM and 4% YoY.

- US Federal Reserve held rates as expected and projections for interest rates in 2024 showed a wide range of estimates while the median showed 0.75% worth of cuts, with five of the 13 members expecting deeper cuts.

- US retail sales rose 0.3% MoM, well above consensus estimates for a 0.1% fall.

- ECB held rates as expected.

- China lending data disappointed as new loans and total social financing growth came in below consensus.

- China fixed asset investment rose 2.9% YoY, industrial production rose 6.6% and retail sales rose 10.1%.

Key releases for the week ahead

- RBA meeting minutes

- Bank of Japan interest rate decision

- US PCE Inflation

Chart of the week

The latest job data for November demonstrates that while Australia’s labour market remains strong it is starting to soften around the edges. Employment increased by a stronger than expected 61,500 compared to expectations of 10,500 gains. However, unemployment still rose to 3.9% due to an improved participation rate and high immigration levels leading to population growth. It is a positive sign that the uptick in the unemployment rate is due to the supply side rather than an abrupt drop in demand for labour. Factors like increasing underemployment, rising youth unemployment and stagnant total hours worked demonstrate that the RBA has succeeded in taking some heat out of the economy. The ongoing gradual cooling of the labour market is exactly what the RBA would want to see in their ongoing battle to return inflation to target levels and reduces the odds of further rate hikes. Overall, the signs are starting to look positive that the RBA may be able to engineer a ‘soft-landing’ for the Australian economy, which provides hope that Santa will be able to deliver strong equity market returns in 2024!

–

Monday 18 December 2023, 5pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.