From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Earnings season has begun in the U.S. Thus far it has been a mixed bag with general industrials seeing a clouded outlook and those exposed to technology and the future of 5G deployment more optimistic. Google and Facebook earnings last week were solid, Amazon was mixed and this week we have Apple’s earnings on Wednesday night.

Reach for yield remains a priority with investors chasing higher returns from riskier assets such as equities and corporate bonds as cash returns diminish.

Economic data released

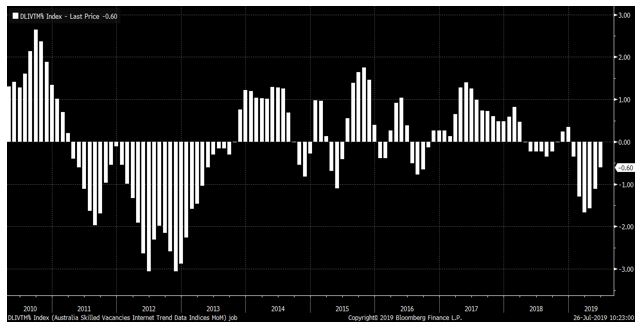

Australian skilled vacancies fell further in June and are now down over -6% annually.

As the chart below shows, June was the 6th month on the trot of falling demand for skilled workers and points to a worsening in Australia’s employment conditions for at least the remainder of 2019, as have mentioned on multiple times in recent months.

Observations from the past week

Alphabet (GOOG), Facebook (FB), & Amazon (AMZN) all reported quarterly profit figures last week with the former two stocks delivering strong figures, and AMZN showing a little disappointment once again with rising costs.

Investors loved the rebound in GOOG operating margins and the confidence of management in authorizing a US$25bn buyback given the significant cash pile accumulated.

The stock ended up +10% on the week and just shy of an all-time high.

AMZN on the other hand were a little disappointing to investors as operating costs associated with one-day delivery to Amazon PRIME customers exceeded initial expectations and the company noted that this was likely to continue for a period of time.

Investors were left wondering if this is the start of another heavy investment cycle by AMZN and are also concerned by the slowing rate of growth in the group’s cash-cow, Amazon Web Services, which generates the vast majority of cashflows with which AMZN is able to utilize for growth in their wider retail franchises.

FB was also well supported after demonstrating solid earnings and providing excellent commentary around future advertising revenue market share gains.

Latrobe Financial Group

Latrobe Financial Group notified advisors and investors alike that in response to the 0.50% cuts to Australian domestic interest rates, it had lowered the variable rates paid on its suite of products to investors.

Notably, the 12-month term account had seen its rate fall from 5.20% (5.70% for platform investors) to 5.05% (5.55% for platform) after fees.

This shouldn’t be a surprise, and in light of the 0.50% official interest rate cut, it is actually not too bad an outcome for investors.

I would expect to see more rate reductions on variable income products associated with mortgage lending in the months ahead.

Offers from Metrics and Qualitas both have the potential for minor adjustments lower given the nature of their lending.

Macquarie Bank (MQG)

Macquarie Bank reaffirmed guidance last week that profits would be slightly down for the current financial year relative to 2019.

MQG is not overly cheap in absolute terms on 14.5x P/E, but interestingly it has underperformed a rising market and in particular it has underperformed the big-4 by around -10% since giving guidance back in early May.

The big-4 retail banks have all rallied hard on relief that Labor’s policies to ban excess franking have been abolished, but now look fully valued and arguably staring down the barrel of more earnings risk as interest rate cuts bite on interest margins.

Whilst it’s not obvious to say MQG looks like a BUY yet, its period of underperformance relative to a rising and arguably expensive set of comparable stocks is worth watching.

IOOF (IFL)

IFL was the best performing stock in the ASX200 last week rising +12% after it released its quarterly fund flow statement.

Whilst the rate of fund flow growth to its advice and administration business was well below last year, the fact was it continued to grow on a quarterly basis and was nowhere near as bad as the current stock price implies.

IFL continues to have almost $150bn in funds under advice, management and administration, making it one of the industry’s biggest and still a franchise of considerable value in a sector facing short term issues, but still with excellent long-term growth potential.

Whilst we have several key events pending in the coming month or two, such as results and the company’s estimate of compensation due for ‘no advice’, we expect the stock to end the year higher as investors fears subside.

Further, the ANZ Wealth deal should be resolved in the coming months, with it quite possible that IFL seek to renegotiate terms for a better deal in light of industry changes post Royal Commission, potentially offering investors a positive, not negative surprise on this front.

RESMED (RMD)

RMD reported sound quarterly profit figures with excellent revenue progress in American mask/accessories following product launch and encouraging margin expansion on account of the strong sales growth.

That said, RMD now trades 34x current earnings and must surely pose some risk to any or all of the following a) a strengthening Australian Dollar, b) risks in relation to competitive bidding for 2021 and falling reimbursements or c) wider investors concerns in relation to the need for reduction in US healthcare industry costs as we head into the 2020 Presidential Election.

Mineral Resources (MIN)

Mineral Resources bounced +8% last week after confirming it had received Chinese anti-trust approvals for its agreement to sell down half of its Wodgina lithium prospect to US specialty chemical giant Albemarle (ALB).

This is good news for MIN as the future expansion of Wodgina to include significant downstream lithium processing should yield a significant and ongoing cash earnings stream for the group from 2023-2024 that has the potential to double the share price.

We have had our eyes on MIN and would love to have it in the portfolio, however the option on lithium expansion is long-dated and we would prefer to see a bottom in the lithium price emerge before committing funds to a position.

What’s interesting?

Chinese steel inventories (in blue in the figure below) are creeping higher. Consequentially, a couple of broking firms have begun to temper their optimism on Australian iron ore miners, with Credit Suisse in particular, downgrading Rio Tinto (RIO) to underperform last week.

CS noted in their research that the drawdown in Chinese port inventory of iron ore seemed to be ending with Chinese finished goods steel inventories rising (see chart below) and supply of iron ore from both Australia and Brazil recovering after months of significant shortfall.

RIO will make 75% of its operating income from iron ore in 2019.

Looking ahead

- Monday – n/a

- Tuesday – US Consumer Confidence (Jun), AU Building Approvals (Jun)

- Wednesday – US ADP Employment (July), US Chicago Purchasing Manager Report (July), CH Purchasing Manager Report (July), AU CPI (Q2), AU Private Sector Credit (Jun), APPLE earnings

- Thursday – US Federal Reserve interest rate decision, AU AIG Manufacturing survey (July), Rio Tinto earnings

- Friday – US ISM Manufacturing survey (July), US Employment report (July), AU Retail Sales (June)

On top of the data, this is a key week as US and Chinese trade representatives will sit down for the latest session on current disputed trade terms.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 6879 | +93 | +1.4% |

| S&P / ASX 200 | 6793 | +93 | +1.4% |

| Property Trust Index | 1658 | – | – |

| Utilities Index | 8340 | +14 | +0.2% |

| Financials Index | 6460 | +116 | +1.8% |

| Materials Index | 14148 | -50 | -0.4% |

| Energy Index | 11007 | +421 | +4.0% |

Friday Closing Values

| Index | Change | % | |

| U.S. S&P 500 | 3026 | +49 | +1.6% |

| London’s FTSE | 7549 | +40 | +0.5% |

| Japan’s Nikkei | 21658 | +191 | +0.9% |

| Hang Seng | 28398 | -367 | -1.3% |

| China’s Shanghai | 2945 | +21 | +0.7% |

Key Dividends

| Mon 29th July 2019 | Div Pay Date – Magellan Global EQMF’s (MGG, MGE) |

| Tue 30th July 2019 | Div Ex-Date – NABHA |

| Wed 31st July 2019 | Div Ex-Date – Metrics Master Income (MXT)

|

| Thu 1st Aug 2019 | Earnings – Rio Tinto (RIO) |

| Fri 2nd Aug 2019 | Div Pay Date – James Hardie (JHX) |

Monday 29th July 2019, 1pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.