From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Results Season to come

Last week’s market was dominated by the extraordinarily strong results from major technology companies Apple (AAPL) and Amazon (AMZN) in particular, but also to a lesser extent, Facebook (FB).

AAPL and AMZN both eclipsed analyst forecasts for revenues in the quarter by a staggering +10% and AAPL now boasts a staggering US$80bn in net cash on balance sheet.

These results are the culmination of an extraordinary relative operating performance from companies in big-tech who have managed to not only weather the impact from COVID-19 where others haven’t, but benefited from work-from-home orders and from generous stimulus cheques provided by western governments the world over.

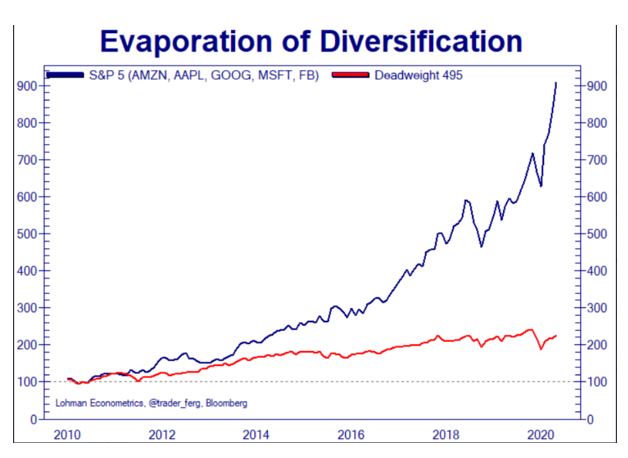

From the chart below, you can see the extraordinary performance of ‘big-tech’ this past decade relative to the remaining 495 members of the S&P500 index, with this outperformance leading to the large 5 technology companies now comprising over 22% of the U.S S&P.

Some notable investor surveys suggest that the market crowding into these 5 tech behemoths is now as crowded a trade as their records have seen and unsurprisingly the valuations of between 25x and 35x forward earnings are broadly their highest since the GFC and well in excess of the wider market.

With the US Presidential Election now only 95 days and the regulatory pressure slowly ratcheting higher, as evidenced not only by Congressional hearings last week, but by national regulatory moves such as that announced by the ACCC last week, one cannot help but feel like we are nearing the back end of this stellar outperformance.

Melbourne lockdown likely the start of more

For those of us in Melbourne, today marks the start of our second round of stay-at-home orders, but we are not alone and nor will we be the last to see these measures enforced for the good of the community.

In the UK last week Greater Manchester saw restrictions tighten and reports suggested UK Prime Minister Boris Johnson could consider locking down London again should a second wave of infections re-emerge.

Authorities across the Eurozone have been on guard in recent days for an uptick in cases and in India too, restrictions were extended in several regions to protect against further spread.

In several of the countries perceived to have handled the initial ‘first wave’ well, including Australia, the past fortnight has seen cases uptick again from recent trend levels.

Each of Denmark, Japan, The Netherlands, Austria and Singapore have all seen their ‘curve’s kink back higher again, highlighting just how difficult it has been and will continue to be to keep the virus in check until a safe and efficacious vaccine arrives.

Here in Australia the additional shutdown will further crimp economic output given Victoria comprises some 24% of national GDP.

Stocks in the travel sector will likely remain pressured, however we believe increasingly that as the year progresses, the opportunity for adding to Webjet (WEB) to recommended portfolios in anticipation of a vaccines could prove attractive.

Funeral operator Invocare (IVC) remains pressured due to social-distancing issues in Victoria and it might take until lockdowns ease for investors to again warm up to the stock, however we feel very excited by the potential upside in IVC as society normalizes towards the end of the year and start of 2021 and see over 50%+ upside on successful containment of COVID-19.

Positively, Coles (COL) should continue to outperform as consumers are restricted in their ability move around the Victorian economy and hence direct consumption dollars to in-home dining and the like.

Looking ahead

| Monday | AU AIG Manufacturing Survey (JULY), AU CBA Manufacturing Survey (JULY), AU ANZ Job Advertisements (JULY), CH Caixin Manufacturing Survey (JULY), US Markit Manufacturing Survey (JULY), US ISM Manufacturing (JULY) |

| Tuesday | AU ANZ Weekly Confidence, AU RBA Meeting, AU Retail Sales (JUNE), AU Trade Balance (JUNE) |

| Wednesday | AU AIG Construction Survey (JULY), AU CBA Services Survey (JULY), CH Caixin Services Survey (JULY), US ADP Employment Survey (JULY), US Markit Services Survey (JULY) |

| Thursday | US Weekly Jobless Claims, US Weekly Consumer Confidence |

| Friday | AU AIG Services Survey (JULY), AU RBA Monetary Policy Statement, US Employment Report (JULY) |

The focus this week will be on political progress towards agreement for the necessary second economic support package in the United States and ultimately its contents.

As of the weekend, Republicans have promised a further US$200/week in additional unemployment benefits, significantly down on the previous US$600/week which expired at the end of last week.

Democrats are holding out for a continuation of current terms until society returns to some semblance of normal post COVID-19.

July economic data will also be in focus, particularly in the United States given gradual quarantine tightening occurred through the month and following the strong response to the inflated employment figures released last month (+4.8m jobs).

In Australia, corporate results start this week, however it is only Resmed (RMD) to report of note, with the likes of Commonwealth Bank (CBA), Magellan (MFG), Transurban (TCL), SEEK (SEK), Woodside (WPL), Telstra (TLS) and Challenger (CGF) all due next week.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 6058 | -90 | -1.5% |

| S&P / ASX 200 | 5927 | -96 | -1.5% |

| Property Trust Index | 1217 | -10 | -0.8% |

| Utilities Index | 7602 | -119 | -1.6% |

| Financials Index | 4740 | -132 | -2.8% |

| Materials Index | 14078 | -94 | -0.7% |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 3271 | +56 | +1.8% |

| London’s FTSE | 5898 | -225 | -3.6% |

| Japan’s Nikkei | 21710 | -1041 | -4.5% |

| Hang Seng | 24595 | -120 | -0.5% |

| China’s Shanghai | 3310 | +114 | +3.4% |

Key dividends

| Date | |

| Mon 3 August | n/a

|

| Tue 4 August | n/a

|

| Wed 5 August | n/a |

| Thu 6 August | Div Ex-Date – Rio Tinto (RIO) |

| Fri 7 August | n/a |

–

Tuesday 4 August 2020, 5pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.