Equities had a volatile week with Russia invading Ukraine. The Australian market finished the week down 3.1% as investors assessed the implications of war returning to Europe. The Consumer Staples sector was the best performing (+3.4%) followed by the Utilities sector (+1.7%), as investors preferred defensive exposures. Consumer discretionary (-6.1%) and Materials (-4.6%) were the laggards with several miners going ex-dividend including index heavyweight BHP. The US share market outperformed, finishing the week marginally up. After falling as much as 5% at one point, the S&P500 staged a strong recovery over the last two trading sessions. The 10-year US bond yield rose 5 basis points to 1.98. The Australian 10-year yield also rose slightly, with concerns around energy prices leading to more pervasive inflation. Oil briefly rose to above US$100 per barrel before pulling back.

US Consumer confidence stayed slightly positive and broadly aligned with consensus predictions in economic news. Australian December quarter wage growth accelerated to 0.7% QoQ or 2.3% for 2021. The RBA is looking for annual wage growth of 3% before lifting rates, so the latest reading allows flexibility around tightening decisions. In the US, Europe and Australia, preliminary Purchasing Manager Indices showed a strong rebound for services as Omicron cases and restrictions dissipate. Manufacturing remains strong but was driven by higher output prices, adding to inflationary pressures.

Earnings season in Australia has almost finished, with just a few companies set to report their results early this week. Many big names reported last week. Woolworths (WOW) had a slight miss on earnings due to COVID impacts and supply chain issues; however, Coles (COL) posted strong numbers. Rio Tinto (RIO) had a slight miss on earnings with costs significantly higher than peers. Sonic Healthcare (SHL) and Ramsay Healthcare (RHC) both posted solid results. Brambles (BXB) upgraded guidance; however, rising pallet and lumber costs continue to be an issue. Seven Group (SVW) posted solid numbers across various business lines but flagged supply chain concerns which they are taking active steps to mitigate. For technology names, Appen (APX) disappointed while WiseTech (WTC) and NextDC (NXT) both performed well after upgrading guidance. Overall, we continued to see the trends that we mentioned last week – both supply chain issues and cost pressures continue to impact companies in various industries.

Looking to the week ahead, investors will be closely assessing further developments of the war in Ukraine and the impact of the recently announced sanctions. US jobs data for February will be released towards the end of the week, along with Europe inflation figures. Australian December quarter GDP figures are expected to show a rebound from the Delta impacted September quarter.

Is a correction a cause for concern?

The S&P 500 Index officially entered a correction, defined as a fall of more than 10%, from the recent high achieved on January 3rd, 2022. This was the first 10% tumble for the S&P500, since the early days of the pandemic in 2020. The market continues to be pressured by concerns around inflation and associated rising interest rates. Developments over the last week regarding Russia’s invasion of Ukraine have added to investor concerns.

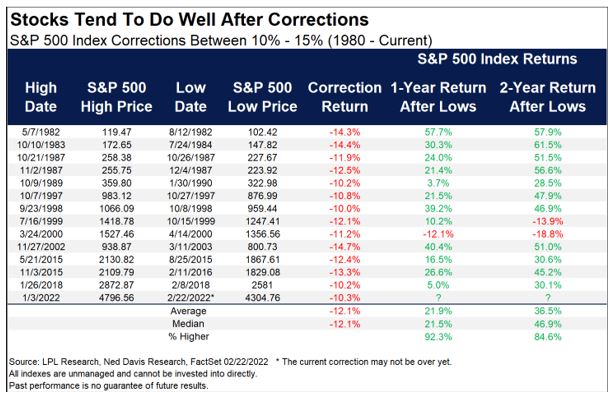

Reiterating our recent message, we will again demonstrate the importance of taking a longer-term perspective during these uncertain market environments. The table below indicates that over the last 40 years, the US stock market has tended to recover strongly from corrections over a one- and two-year period from the lows.

We are not suggesting that the lows are already in for the current pull-back. Nobody can know this, and risks regarding inflation and an associated Central Bank misstep remain. Russia is a major energy supplier, and sanctions placed on the country may add to continued rising pressure on energy prices, exacerbating inflation.

We believe that it does make sense to make tactical adjustments to our asset class allocations to respond to unfolding situations and protect capital. These adjustments will usually be at the margin rather than wide-sweeping changes to our strategic asset allocation. For example, we are slightly reducing exposure to growth assets with our concerns that inflation may be longer-lasting than markets anticipate and that the war in Ukraine will add to upside pressure on inflation. However, we believe that investors must stay the course and stay invested through various shocks and market cycles. Markets have a proven ability to recover from near-term geopolitical shocks. And investors have been rewarded handsomely by holding a well-diversified portfolio over the longer term.

–

Tuesday 01 March 2022, 12.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.