Global equity markets rebounded strongly over the last week. Investors calmed on the threat of the Omicron variant upending the economic recovery, with early indications suggesting that the variant is causing predominantly mild cases. Markets were also boosted by US inflation figures that matched consensus estimates when some had predicted they would prove to be worse.

The Australian S&P/ASX 200 rose 1.6% last week. The Consumer Staples sector was the best performer, which rose 3%, aided by a strong report from Metcash Limited (MTS). The Utilities sector also performed strongly. The worst performer was the Information Technology sector which finished the week flat.

Overseas equity markets outperformed the ASX, with the US S&P500 rising an impressive 3.8% for the week, recovering all losses from the recent sell-off and finishing the week at an all-time high. The US 10-year bond yield reflected the risk-on mood rising to 1.49%.

In economic news, US consumer prices climbed at the fastest annual rate since 1982, rising 6.8% (headline) and 4.9% (core). Markets responded favourably to the report. The figure was broadly in line with consensus estimates, and some economists had predicted that the inflation figure would exceed 7%. However, the high reading increases pressure on the Federal Reserve to tighten monetary policy to fight inflation.

Australian job ads rose strongly over the prior month, indicating a strong job market that has recovered strongly from lockdowns. The Reserve Bank of Australia (RBA) kept policies unchanged. It reiterated that they would not increase the cash rate until wage growth is materially higher than it currently is. Chinese trade data was strong, with imports surging, indicating that domestic consumption may be picking up. China’s central bank also announced that they would reduce the cash banks must hold in reserve which will release US$180 billion in long-term liquidity to help support slowing economic growth.

In company news, Boral (BLD) announced the sale of its fly-ash business for $USD755m/$AUD1billion. The transaction is expected to complete in the 2022 financial year, subject to customary conditions precedent and allowing for the regulatory approval process. The price received was largely in-line with consensus broker estimates. We view this sale as a positive for Seven Group Holdings (SVW) as it continues to have a high debt load from buying a 70% stake in Boral earlier this year. The return of capital will allow Seven Group to repay debt and bring its balance sheet back into a healthy position.

Ramsay Healthcare (RHC) held their Investor Briefing. It was pleasing to see that private health insurance (PHI) coverage has increased in Australia for the last five consecutive quarters. It reverses a downward trajectory in the previous six years, particularly for those under 64. The increase in coverage has coincided with increasing pressure on public sector waitlists. And increasing PHI coverage will help boost the private hospital players in the future, giving them a stronger negotiating position with insurance providers. Ramsay Healthcare will play a crucial role in assisting Australia’s broader healthcare system cope with COVID-related backlogs. This helps explain why we are bullish on the company.

In other corporate news, the Australian Competition & Consumer Commission (ACCC) will not oppose the takeover of Sydney Airport (SYD) by the Sydney Aviation Alliance. Woodside Petroleum (WPL) aim to invest USD$5 billion by 2030 in new energy opportunities, mostly hydrogen, if the merger with BHP Petroleum completes, which we believe is positive as it will enhance their resilience to the energy transition to renewables. Magellan Financial Group (MFG) reported growth of funds under management, however, this growth lagged the returns of the underlying MSCI World Index, showing that the firms poor recent investment performance is leading to net outflows.

For the week ahead, investors will focus on the outcome of the US Federal Reserve, European Central Bank and Bank of England policy meetings. The market expects the Fed to announce an accelerated taper considering strong inflation readings and improving economic data. Economists are divided about whether the Bank of England will hike interest rates at this meeting or wait until the new year. We receive consumer and business confidence data for Australia on top of the November jobs figure.

US Household savings

It appears confounding how the US S&P500 index closed last week at all-time highs when annual CPI inflation readings were at 39 years highs and uncertainty regarding the Omicron variant remains. As discussed in previous updates, a crucial part of the explanation is that the market currently believes that the Fed’s actions will effectively control inflation. Another part of the equation is how the unwinding of record household savings could support US equity valuations.

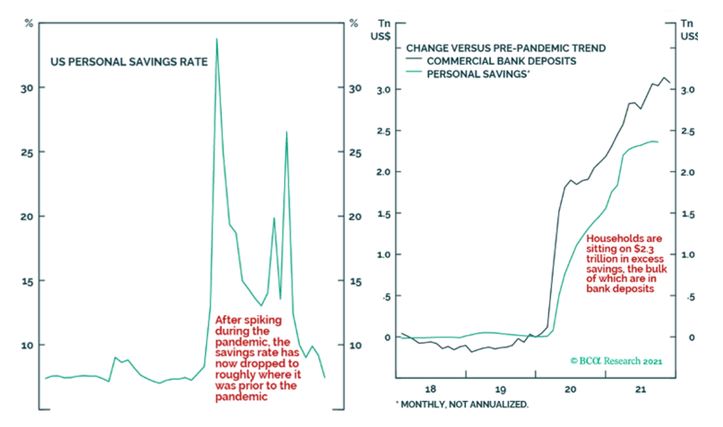

US personal savings rates have now returned to their pre-pandemic trend. They were boosted during the pandemic by large stimulus payments and households tightening their purse strings in an uncertain environment. However, even with savings rates returning to long term trends, households are sitting on over $2.3 trillion in excess savings, the bulk of which is bank deposits. These figures suggest that households have vast amounts of savings in aggregate that will continue to unwind and support consumer spending, the economy, and company earnings. This helps to explain our current neutral stance on international equities. A strong US economy and the unwinding of excess savings should continue to benefit our holdings with exposure to the US consumer including James Hardie and Breville.

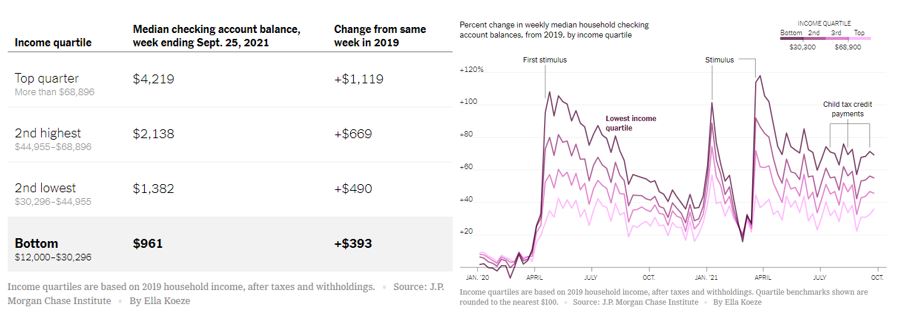

Delving into the data, the distribution of savings is far from equal amongst households. The lowest quartile of households by income has had the most significant increase in savings compared to pre-pandemic. However, the total amount of savings is less than USD$1000 on average. Further, there are signs that these savings quickly diminish with the removal of stimulus. The low-income quartile is the most impacted by the rising cost of living. Rents have been surging, and this cohort is less likely to own their own home. And the recent inflation figures also show that grocery prices have surged 6.4% over the last 12 months. Low-income households lack the savings to deal with these rising costs. Though on a positive note, they may succeed in securing pay rises in a tight labour market where vacant jobs are at a historic high.

The above data helps to explain why the US Federal Reserve is facing increasing pressure to fight inflation as many households find themselves struggling to keep up with advancing prices. And why the market expects them to announce an accelerated tapering of bond purchases this week.

–

Tuesday 14 December 2021, 10.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.