Equities took a breather while bond yields largely headed higher again as the closely watched U.S. inflation figures came in much hotter than expected, prompting further concerns that price pressures may not be ‘transitory’ as central banks have forecast.

The MSCI World was flat as strength in European equities offset a 0.3% fall in the U.S. S&P 500. Emerging markets outperformed with a 1.7% gain as China Evergrande avoided default once again. The S&P/ASX 200 was flat overall as a rebound in materials (+4.7%) offset losses in every other sector. Healthcare was the worst performer, tumbling 3.4%.

Global bond yields rose as the U.S. inflation came in at 0.9% for the month, far higher than the 0.6% expected with more ‘sticky’ factors such as rent pushed higher while ‘transitory’ factors such as vehicle costs remained high. The U.S. 10-year yield bounced back 0.13% to 1.58%. Australia’s 10-year yield was largely flat at a higher level, closing the week at 1.8%, as weak employment figures tempered optimism.

Australian employment fell by 46,300, a huge disappointment compared to consensus expectations for a 50,000 gain. The underlying detail was not encouraging either, with 40,400 full time jobs lost, the participation rate rising less than expected, and the underemployment rate rising 0.3% to 9.5%. As outlined last week, October data may be too early to see the effects of the easing restrictions in NSW and VIC. We still expect a sharp improvement in the coming months, with the underemployment rate remaining our preferred gauge of the strength of the jobs market. The business confidence and consumer sentiment survey results released last week continue to show improvement, supporting our view of a sharp post-delta rebound.

In corporate news, M&A still features heavily, with Sydney Airport’s (SYD) board recommending the takeover offer of $8.75 per share subject to regulatory approval, Australian Pharmaceutical Industries’ (API) board recommending Wesfarmers’ (WES) takeover offer of $1.55 per share, BHP agreeing to sell some of its coal assets, and Newcrest (NCM) announcing a deal for a Canadian gold miner. Xero (XRO) also announced the acquisition of inventory management software, LOCATE, alongside first half results that disappointed the market.

NAB reported full year figures ahead of consensus expectations. It was a strong operational result, and the bank now deservedly trades at a premium to peers ANZ and Westpac (WBC).

Elsewhere, James Hardie (JHX) and Ramsay Healthcare (RHC) provided trading updates. JHX had another strong quarter, leading to upgraded guidance for its full financial year. The company has been able to pass through rising costs and we remain confident in its growth trajectory as it continues to benefit from strong demand, a shift to higher margin products, and as the LEAN strategy to improve operational efficiency progresses. RHC, on the other hand, was impacted by surging costs because of COVID-related issues. We remain positive on the company in the medium term as results showed strong underlying demand and restrictions continue to ease across its major operating regions.

For the week ahead, markets will be watching U.S. retail sales alongside a swathe of retail companies’ quarterly earnings. Europe will be releasing their third quarter GDP figures and October inflation, with the latter likely to be closely watched following the blowout in U.S. readings. Chinese retail sales, industrial production and fixed asset investment growth could also drive markets, with policymakers continuing to prioritise deleveraging and regulation over growth.

The state of inflation

The U.S. inflation reading last week was well above expectations, adding fuel to the fiery debate of ‘transitory’ or not and perhaps more importantly for markets, whether central banks will be forced to tighten monetary policy faster and harder than expected.

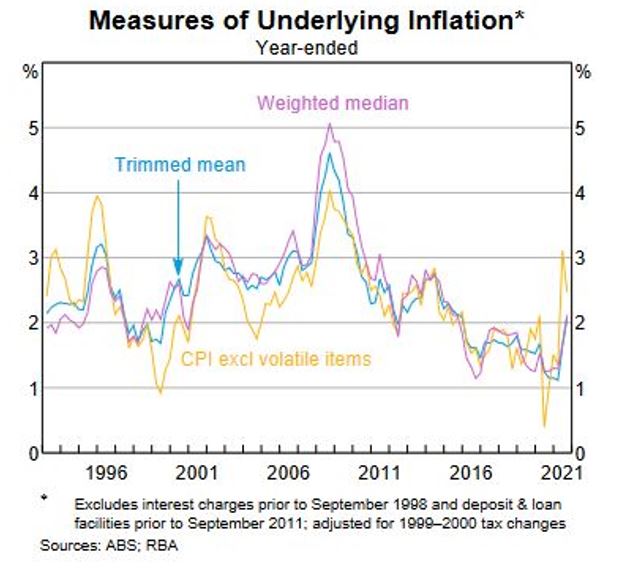

On the domestic front, despite the recent volatility in the Australian bond market, inflation has come back within the Reserve Bank of Australia’s (RBA) target range. It is likely that we will see some upward pressure as restrictions ease in NSW and VIC, but in a relative sense, domestic inflation is not posing a major concern at this stage.

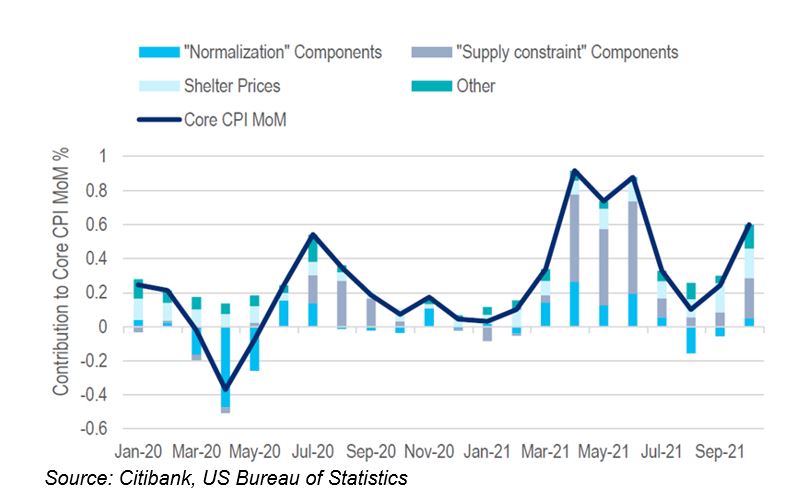

Back to the U.S., inflation is running hot and cannot be attributed to base effects. On a month-on-month basis, core inflation, which strips out more volatile food and energy components, rose 0.6%, or 4.6% year-on-year. Supply constraints and reopening factors continue to contribute to inflation, but more sticky factors such as shelter have been on the rise over the past few months.

Alongside an imbalanced labour market, the worry is that we could be on the cusp of a more structural inflation cycle rather than one that recedes over the coming months. On the business side, rising costs are leading to companies raising prices on their own products. Meanwhile, the population is facing higher rents and prices, leading to demand for higher wages which leads to higher costs for companies again. This leads to a spiral that pushes inflation structurally higher even if supply chain issues are resolved. Whilst not our base case, the likelihood of such a scenario occurring is rising and we remain acutely aware of the risks that it would pose to markets.

Even if domestic inflation remains under control, U.S. inflation will likely remain the key driver for global markets as the U.S. government bond yield remains the standard risk-free rate proxy for global investors. While consensus expectations are for supply chain issues to ease over the next year, resulting in easing inflation and an uptick in global economic growth, upward inflationary pressures that result in either the U.S. Federal Reserve tightening quicker than expected or a loss in market confidence that the Fed can tame inflation could lead to chaos in the bond markets. This would drive a broader sell-off in other investment assets, so we remain keen watchers of leading inflationary data such as producer price indices, shipping costs and wage growth over the next few months.

–

Tuesday 16 November 2021, 11.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.