Risk sentiment rebounded despite a lack of de-escalation in Ukraine, the U.S. Federal Reserve hiking rates while signalling six more this year, and inflationary readings continuing to surprise to the upside. The MSCI World bounced 6% last week, paring the year-to-date falls to 5.8%, led by the S&P 500’s 6.2% return as growth names rebounded strongly despite rising yields. The S&P/ASX 200 rose 3.3% for the week and is a clear outperformer on a year-to-date basis, currently sitting just 0.6% lower than the end of 2021.

The Technology sector led gains domestically, rising 7.8% for the week. Financials (+6.1%), Healthcare (+5.5%) and Telecoms (+5.4%) also had strong gains while Energy (0%) and Materials (-1.1%) took a breather.

Bond yields largely rose on the back of rate hikes from the U.S. Federal Reserve (Fed) and the Bank of England. The U.S. 10-year Treasury yield rose 0.15% to 2.15% while the Australian 10-year government bond rose 0.18% to 2.56%. The Fed hiked rates by 0.25% as the market expected and signalled six more hikes for the rest of the year whilst it expects balance sheet reduction to begin soon. Inflation readings in the form of U.S. purchasing price indices and European consumer price indices continue to remain elevated, heaping further pressure on central banks to tighten monetary policy.

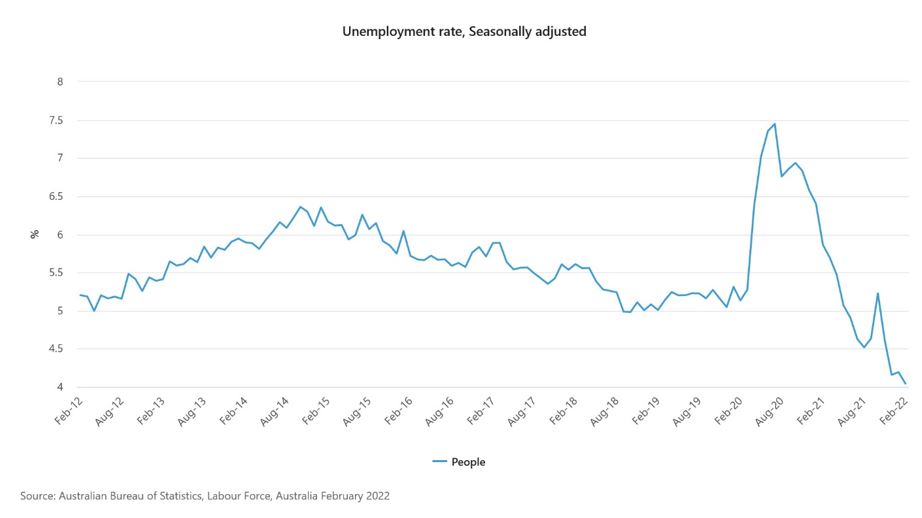

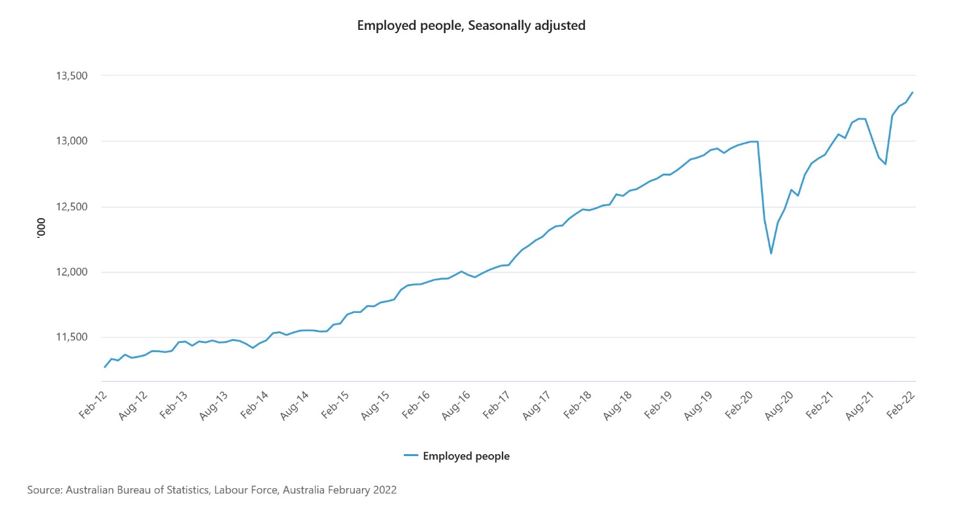

In other economic news, domestic employment data remains strong, with 77,400 jobs added in February relative to expectations of 37,000 jobs. The unemployment rate fell 0.2% to 4% despite the participation rate rising 0.2% to 66.4%. The strength of domestic employment led several prominent economists to bring forward their expectations for when the Reserve Bank of Australia will start hiking rates.

Meanwhile, China released key economic data that were stronger than expected. Fixed asset investments grew 12.2%, retail sales rose 6.7% and industrial production grew 7.5%, all beating expectations for 5%, 3% and 3.9% respectively. While the figures were much better than expected, markets were wary on the one-off reading given the likely significant impact of Chinese New Year. It will likely take another two or three months of strong data for the market to gain confidence that the Chinese economy has turned a corner, especially as the government continues to focus on its COVID-zero strategy, with several key economic areas, including the tech hub of Shenzhen, in lockdown.

Looking ahead, it is a light week for economic data, with the market likely to focus on preliminary results from global Purchasing Manager Index surveys. The situation in Ukraine will continue to be a focus as Russia and Ukraine continue talks with little progress thus far.

Jobs

Last week’s employment data was strong across the board. At 4%, the last time the unemployment rate was this low was in March 2008 following several years of significantly strong economic growth.

Meanwhile, the number of employed people in Australia has surged to new highs despite the spike in COVID cases due to the Omicron strain. In the absence of lockdowns, employment rose steadily as the economy remains on strong footing and sectors most impacted by COVID such as travel and hospitality have driven the recent surge in hiring.

Given the strength of economic data, we remain positive on companies exposed to the domestic economy. Australia should also be relatively resilient to current risks to global economic growth. As a significant commodity exporter, rising commodity prices stemming from a further escalation or prolonged conflict in Ukraine would have a positive impact on the Australian economy. Meanwhile, though continued employment strength will likely lead to the RBA moving faster to raise interest rates, domestic inflationary pressures are currently less of an issue relative to the U.S. or Europe. Overall, we continue to prefer domestic equities relative to global equities in the current environment.

–

Tuesday 22 March 2022, 2pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.