International equity markets had another tough week with the US market falling for a seventh straight week. The US S&P500 index sold off over 3% with disappointing earnings releases from major retailers Walmart and Target stoking fears of peak margins and an earnings slowdown as higher costs bite. European markets also slipped, while Chinese stocks rose with the central bank cutting key interest rates.

The Australian stock market continued its relative outperformance, with the ASX200 posting a 1% gain for the week. Technology was the best performing sector rising by 5%, and Consumers Staples was the worst falling by 3.5%. Aristocrat Leisure’s (ALL) 1H22 result beat across the board and management provided strong guidance. James Hardie (JHX) reported a solid set of results with margins improving in Asia Pacific and the key US market, with the uptake of premium products helping to offset rising input costs. Management maintained FY23 guidance and commentary was positive regarding the US renovations market. Goodman Group (GMG) increased FY22 EPS guidance however management noted supply chain pressures are inflating costs which we believe increases execution risk.

Bond yields fell over the week, with the US 10-year yield falling 15bps at 2.79%. Fed Chair Powell indicated the Fed will not hesitate to keep raising rates until there are clear signs inflation is tamed. Some market commentators are concerned that this will impact growth rates and risk sending the economy into recession. The Australian 10-year bond yield fell 19bps to 3.31%.

In economic news, Australian employment figures disappointed with just 4,000 jobs added compared to the 30,000 expected. The headline unemployment rate fell to 3.9% with the participation rate falling slightly. Wages rose less than expected through the March quarter. However, the RBA expects the tight job market will lead to a pickup in wage growth in the coming quarters.

US retail sales (+1% MoM) and industrial production (+1.1% MoM) were better than expected. However, key retailers Walmart and Target both noted that there has been a shift away from discretionary items and a shift towards cheaper brands, suggesting that inflationary pressures are starting to bite and impact spending decisions. Inflation accelerated in the UK, hitting 9% YoY on the back of surging electricity and gas prices.

The impact of lockdowns was clear to see in China’s April data with industrial production, retail sales, and unemployment all worse than consensus estimates. In response to weak sentiment, the People’s Bank of China cut the five-year loan prime rate, a reference for home mortgages, by 15 basis points to 4.45% to support the country’s ailing property sector. Further support will be required if China is to achieve its 5.5% economic growth target.

Looking ahead, it is a light week for economic data, with the market likely to focus on preliminary results from global Purchasing Manager Index surveys.

Staying the course

The US S&P500 Index has now fallen nearly 19% from the highs in January, leaving the market teetering on the edge of a bear market, commonly defined as a fall of over 20%. How much further there is to go is anyone’s guess. While it is naturally difficult seeing the value of your portfolio go down, we do not believe it is a prudent strategy to exit the market completely and wait for clear signs of a rebound.

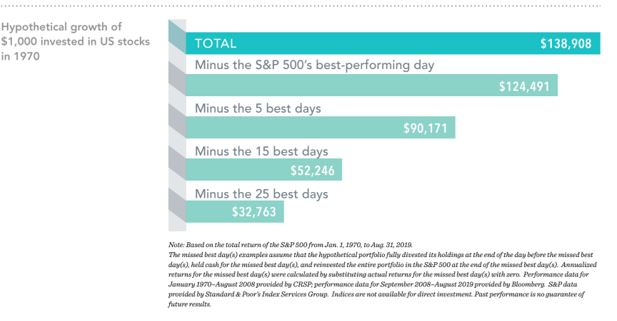

The below graphic from Dimensional Fund Advisors, shows the growth of $1,000 invested in the S&P500 index between 1970 and 2019. It demonstrates that missing just a few of the index’s best performing days over this period had a huge impact on the investor’s compounded investment return over the nearly 50-year period. Missing just the 5 best days over the 49 years resulted in a portfolio 35% lower than staying fully invested. While missing the very worst days may also have a similarly impressive effect, this analysis highlights the difficulty in timing the market.

Given the difficulty in timing a market bottom, and the risk that comes from missing these best performing days, we think that our clients will be best served staying the course during this difficult period. We have made the tactical decision to underweight riskier assets which should help provide downside protection while we await clarity on the path forward for inflation and interest rates.

–

Tuesday 24 May 2022, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.