The continued invasion of Ukraine drove a risk-off week as equities continued to fall while bonds rose on the back of safe-haven demand. European equities were, unsurprisingly, the worst performers as the STOXX 600 fell 7% while the MSCI World fell 2.5%. The S&P 500 fell 1.2% while the S&P/ASX 200 benefitted from the rally in commodities, rising 1.9%. The domestic Energy sector led gains, rising 9.1%, followed closely by Materials, up 8.5%. Other domestic sectors were well supported as the worst performer, Healthcare, fell just 0.9% for the week.

The escalating situation in Ukraine continues to worry investors as a nuclear power plant was attacked and captured by Russia late last week, raising alarms of another potential nuclear fallout similar to Chernobyl. This drove another rally in safe-havens despite rising inflationary pressures from surging commodity prices. Europe again led the way, with German 10-year bund yields falling 0.32% and ended the week back in negative territory. The Australian 10-year government bond yield fell 0.08% to 2.14% while the U.S. 10-year treasury yield fell 0.25% to 1.73%.

Gold benefitted as a safe-haven asset, rising 3.2% for the week in a broader commodity rally as Russia and Ukraine are both major commodity assets, especially in agricultural and energy products. Brent crude prices surged above $118, rising by almost 20% for the week.

Largely positive economic news went under the radar as the Ukraine conflict dominated headlines. The Australian economy remains resilient as GDP beat expectations by a wide margin, growing in the fourth quarter by 3.4%, defying expectations for a 2.7% drop. For the full 2021 year, GDP grew by 4.2% versus expectations for 3% growth. January retail sales data indicated continued domestic strength as sales grew 1.8% over the previous month, shaking off concerns around the impact of Omicron. Meanwhile, the Reserve Bank of Australia (RBA) continues to remain cautious over rate hikes, acknowledging higher inflation and the risk of surging energy prices, but continues to expect only a gradual pick up in wage growth which seems to be the main swing factor in the RBA’s decision making at this point in time.

Elsewhere, U.S. and European services indicators, rebounded as the Omicron wave subsides, but were weaker than expected. In China, manufacturing indicators were hovering in expansionary territory but monetary policy easing has yet to produce a firm rebound. China also announced its growth target for 2022, coming in at 5.5%, in-line with consensus expectations, while reiterating its commitment to the COVID-zero policy, though acknowledging that restrictions may be fine-tuned. This remains a concern as rolling lockdowns in the global manufacturing hub continues to impact supply chains.

Russia’s moves will continue to dominate attention for the coming week as the situation continues to escalate. The European Central Bank has a policy meeting this week but little is expected as the central bank weighs the risk of stagflation. Chinese and U.S. inflation readings are also unlikely to yield much relief as energy prices are likely to drive further increases.

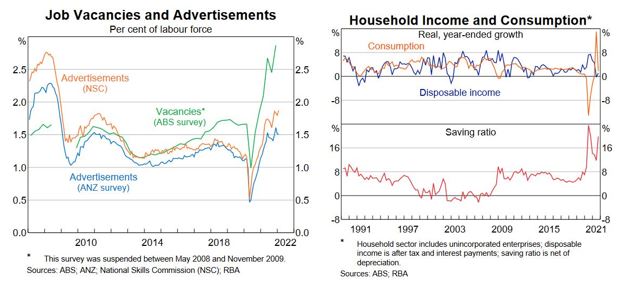

Domestically, the ANZ job ads, NAB business confidence and Westpac consumer sentiment surveys will help provide a read of how quickly the economy is rebounding from the Omicron impact as restrictions are eased further while borders are reopening.

Reasons to be less pessimistic

The start to the year has been a poor one as geopolitics has erupted into war in Ukraine, supply chain issues and high inflation is plaguing consumers, while investors have seen dismal returns from stocks and bonds. Indeed, there are significant reasons to be cautious now, with runaway inflation and slowing growth the major threat to, not just investors, but also global stability given that periods of high inflation have often resulted in unrest and further geopolitical confrontations. Emerging countries where food and energy make up a bigger portion of spending are more vulnerable to the recent surge in prices for both. As outlined in our recent note from our CIO a couple of weeks ago (click here for video), we think these are all valid reasons to be cautiously positioned. However, we think the media has the negatives well covered, given that doomsaying sells papers and attracts eyeballs, so we thought it would be good to cover some reasons to be less pessimistic and remain invested, albeit with a cautious tilt.

The domestic economy is strong for now

Recent economic data has been positive despite the wave of cases from the Omicron variant. The job market is strong with low unemployment rates and soaring job vacancies. Meanwhile, borrowing rates remain significantly low relative to history and Australians still have significant amount of room to drive consumption growth, with savings still high.

A booming commodity market, while negative for most countries, is yet another positive for the lucky country as a net exporter of all types of commodities. These are some of the reasons for having an overweight position in domestic equities relative to international equities.

U.S. economy remains strong, China easing and could rebound

Elsewhere, the U.S. economy is in a similar position to Australia with a strong jobs market and robust economic growth as it continues to benefit from a post-Omicron wave rebound. Meanwhile, China has started to ease monetary policy, which should lead to an economic growth recovery in the coming months. Europe is also in the midst of a reopening driven economic growth spurt, though it is most at risk of the Russia-Ukraine war given its reliance on commodity imports from both countries as well as the risk of spill over of the war itself.

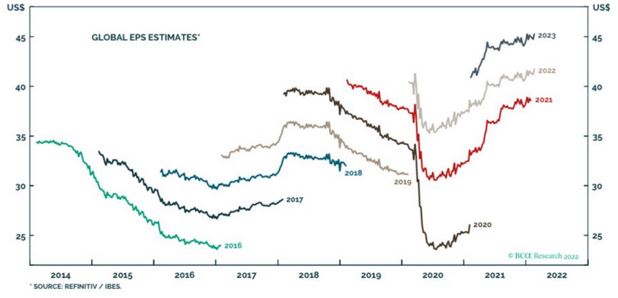

As a result, expectations for earnings growth remains robust and valuations are now closer to historical five-year averages while yields remain at the lower end.

As unlikely as it currently seems, if there is some de-escalation or even stabilisation of the Ukraine situation resulting in a retracement of commodity prices, there could be a strong rebound for risk assets over a short period. Therefore, we reiterate our stance on the importance of remaining invested over the long-term, albeit with a tactical tilt to a more defensive position in the near term as risks are elevated.

–

Tuesday 08 March 2022, 9.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.