From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Busy, busy, busy

A busy week with the US central bank meeting on Wednesday night and then major technology companies Facebook (FB), Amazon (AMZN), Apple (AAPL) and Alphabet (GOOG) all reporting over Thursday and Friday nights respectively.

It feels like the coming week will shape market direction for the coming months since investors will be more informed on underlying corporate earnings and on the position of the Federal Reserve and future stimulus, both of which should be major market drivers.

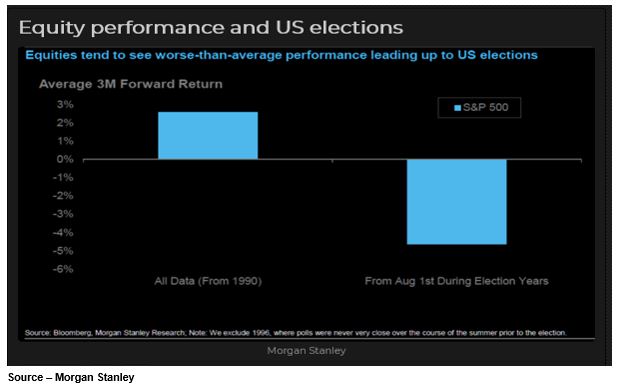

As the chart from Morgan Stanley below shows, US equity markets tend to underperform in the lead-up to Presidential elections, falling around -5% on average through August – November periods in election years.

Australian corporate reporting season kicks off in a big way in the week of August 10th – a fortnight from today – with heavyweight companies such as Commonwealth Bank (CBA) and CSL (CSL) early to report.

Sadly, the local economy saw precious little in the form of additional stimulatory efforts from the Federal Government at last week’s Mid-Year Economic and Financial Outlook statement.

Whilst it was encouraging that the Jobkeeper support packages were extended to the end of the March 2021, it was disappointing to see the packages cut by 20% or more and similarly the Jobseeker supplement cut for those facing unemployment.

The pending US$1tln second stimulus package to be agreed in the coming weeks in the US looks likely to take a similar path, reducing benefits to a proportion of an individuals pre-COVID 19 salary (likely 70%).

With diminishing government support, but economies still operating on restricted mobility, its understandable that our focus turns to the promise of vaccines and last week saw some optimism emerge around the prospect for vaccine success before the onset of the northern winter.

The leading COVID-19 vaccine trial being conducted by Vaccitech in Oxford England has shown early promise in terms of efficacy and safety markers, but its unlikely we will get proper trial news on this potential vaccine ahead of mid-September.

Similarly, the United States government committed significant funds to another leading vaccine candidate being developed by a consortium of Pfizer and German bioech group BioNtech in which they would receive 100m doses of the vaccine upon proven success and approval.

For now we remain hopeful and expectant of vaccine success for mass consumption early in Q1 and perhaps for prophylactic use for front line workers slightly sooner.

Looking ahead

| Monday | US Durable Goods (JUNE), US Dallas Fed Manufacturing Activity (JULY), |

| Tuesday | AU ANZ Weekly Confidence, US Consumer Confidence (JULY), Richmond Fed Manufacturing Outlook (JULY) |

| Wednesday | AU CPI (Q2), US Federal Reserve meeting |

| Thursday | AU Building Approvals (JUNE), US GDP (Q2), US Weekly Jobless Claims, US Weekly Consumer Confidence |

| Friday | AU Private Sector Credit (JUNE), AU PPI (Q2), US Personal Income/Spending (JUNE), US Employment Cost Index (Q2), US Chicago PMI (July), US Michigan Consumer Confidence (JULY) |

It’s a very important week ahead, particularly after we saw some negative investor reaction to major corporate results from favourites such as Tesla (TSLA), Netflix (NFLX) and Microsoft (MSFT)

Whilst many companies are reporting, the market will be squarely focused on results from each of Facebook (FB, Thursday night pre-market) and then Alphabet (GOOG), Amazon (AMZN) and Apple (AAPL) all Friday night pre-market.

On top of the major technology reports, the U.S Federal Reserve meeting on Wednesday night will be closely watched, albeit I expect little new actions to be undertaken by the Fed given the successful early actions taken and the resulting market improvements.

In Australia we will get June funds under management numbers from IOOF (IFL) on Thursday, but in a fortnight’s time Australian results season kicks into full swing (week of August 10th).

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 6148 | +4 | +0.1% |

| S&P / ASX 200 | 6023 | -10 | -0.2% |

| Property Trust Index | 1227 | +7 | +0.5% |

| Utilities Index | 7721 | -46 | -0.7% |

| Financials Index | 4872 | -6 | -0.1% |

| Materials Index | 14172 | +2 | – |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 3215 | -9 | -0.3% |

| London’s FTSE | 6123 | -167 | -2.7% |

| Japan’s Nikkei | 22751 | +55 | +0.2% |

| Hang Seng | 24705 | -384 | -1.6% |

| China’s Shanghai | 3196 | -18 | -0.6% |

Key dividends

| Date | |

| Mon 27 July | n/a |

| Tue 28 July | Div Pay-Date – Magellan ETF/EQMF’s (MGE, MGG, MHG, MHH) |

| Wed 29 July | n/a |

| Thu 30 July | n/a |

| Fri 31 July | n/a |

–

Tuesday 28 July 2020, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.