From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Results season underway

Last week saw reporting season kick off in a meaningful way, with results from Commonwealth Bank (CBA), Telstra (TLS), Woodside (WPL), Challenger (CGF), SEEK (SEK) and Downer (DOW) amongst those of interest, along with a trading statement from National Australia Bank (NAB).

In particular the bank releases were of interest, at least insofar as understanding the delinquency trends and movement in the balance of loans currently under deferral.

At CBA and NAB loan impairments and stressed assets continued to rise, albeit not to the extent most analysts expected.

Within the CBA mortgage book $48bn of loans (8% of the total book) remain on deferred terms.

This is 135,000 individual loans, but down from 154,000 at the peak.

At NAB, mortgages balances deferred are down to $35bn from $38bn at the peak and business loan deferrals are also modestly down from $41bn in balances to $38bn.

In CBA’s business bank, 15% of the total loan book is deferred, which is 59,000 loans, down from 86,000 at the peak of the quarantine measures.

With so much of the economy in temporary stasis still and supported by government payments and banking and property sector forbearance, the situation remains highly uncertain and could easily fall one way or other between now and 2021 depending on the path of the virus.

With much of the security backing these deferred loans in commercial and residential property, it stands to reason that the slower the domestic recovery the greater the potential for rising asset sales in 2021 putting pressure on the local property market.

In fact, this seems entirely likely.

Core earnings drivers such as net interest margin and loan growth remain pressured by the current environment and will do so for much of the coming 12 months making it difficult to mount a strong case for buying the banks at current levels.

Telstra (TLS) were disappointing in the sense that they highlighted an operational impact of -$400m on their 2021 outlook from COVID-19 relating to rising bad debts, slower cost reduction outcomes and lost revenue from mobile roaming charges as social mobility is restricted.

TLS guidance for 2021 hence landed under analyst expectations, coming in at $6.5-7bn and below forecasts of $7-7.2bn.

From an operational standpoint however, the core mobile business continued to perform well in a relative sense, and fascinatingly I am sure to many, the internal measures of both customer perception and of employee satisfaction both surged during the period, suggesting a positive shift in culture and client perception within the sprawling group.

Ultimately however, the stock lost ground last week on concerns that the COVID-19 impact would limit the groups ability to sustain the current 16c dividend.

Despite it all, we think the TLS valuation looks reasonably sound at or around $3.00 and that a looming merger with NBN in 2021-22 will prove a favourable catalyst to re-rate the stock higher, albeit that could be 12mths+ away.

For Downer (DOW), results were encouragingly better than investor forecasts with the impact of COVID-19 on the groups facilities management operations (Spotless) less than feared.

DOW has been and remains ripe for further asset base simplification with the Spotless laundries and hospitality services operations for sale, the engineering and construction business in rundown and mining services still potentially on the block.

The $400m capital raising buys them some leeway in the near term so as not to need to sell assets at fire-sale prices, but when the DOW business is simplified around ‘urban services’ such as road and rail transport and maintenance and facilities management services, DOW shares have a strong opportunity to re-rate back towards the $6 mark given the strength and consistency of those divisions cashflows.

Lastly on Challenger (CGF), the results were modestly under analyst expectations, but the company are facing slowing volumes with the low interest rate environment, continued delay in the governments planned Retirement Income Framework legislation and ongoing disruption within the private financial advisory sector.

CGF remains the dominant annuity provider in the country and a very cheap share, but in need of a boost to volumes that thus far remains a slave to government legislation.

At current levels CGF looks incredibly cheap, with excess capital and a sound dividend outlook, but lacking in a catalyst.

COVID-19 case numbers rising everywhere

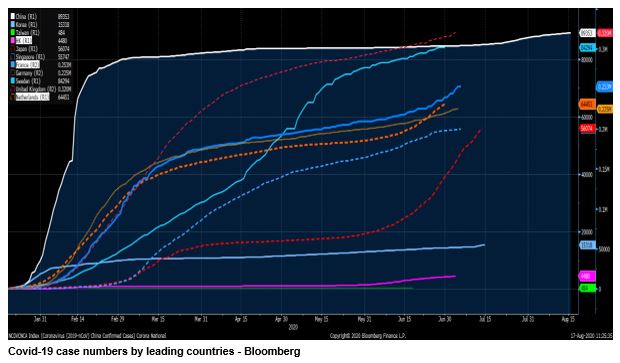

Putting aside the continued COVID-19 scourge in the United States where still more than 40,000 people per day are being diagnosed with the disease, the chart below shows that infection rates are again growing across nearly all major Asian and European countries.

Australia is not alone in the uptick.

The chart below shows the upward bends in most major countries and this is once again a major concern for investors since it is likely to lead to further tightening of social mobility as these countries draw closer to the northern winter.

It is vital to remember that almost 80% of world economic activity takes place above the equator.

Looking ahead

| Monday | Results – JB Hi Fi (JBH), Bendigo Bank (BEN), Lynas (LYC), Altium (ALU), US Empire Manufacturing (AUG), US NAHB Housing Index (AUG) |

| Tuesday | AU ANZ Weekly Confidence, AU RBA Meeting minutes, Results – BHP (BHP), Amcor (AMC), Cochlear (COH), US Building Permits/Housing Starts (JULY) |

| Wednesday | AU Westpac Leading Index (JULY), Results – Sonic Healthcare (SHL), Crown (CWN), Dominos (DMP), Wisetech (WTC), CSL (CSL), Mineral Resources (MIN), Invocare (IVC), Webjet (WEB), Vicinty (VCX), US Fed Meeting minutes |

| Thursday | Results – Blackmores (BKL), Coca Cola (CCL, QANTAS (QAN), Medibank (MPL), Wesfarmers (WES), Domain (DHG) US Philly Fed Business Outlook (AUG), US Weekly Jobless Claims, US Weekly Consumer Confidence |

| Friday | AU CBA Manufacturing/Service Indices (AUG), US Markit Manufacturing/Services Indices (JULY) |

As above, results season continues to dominate investment markets this week, with CSL on Wednesday a notable focus.

Beyond results, all eyes continue to fixate on the US political situation on any number of fronts including Trumps assault on the postal service, an as-yet-unresolved 2nd stimulus package (this remains a huge deal), White House policy on Chinese internet giants (Tik-Tok, We Chat & Alibaba) and any response from the Chinese to creeping US regulatory attacks.

Lastly, as we highlighted above, investors should pay close attention to rising infection rates from COVID-19 across the world and on the potential for tightening restrictions on social mobility in many countries in the lead up to the northern autumn/winter.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 6261 | +117 | +1.9% |

| S&P / ASX 200 | 6126 | +122 | +2.0% |

| Property Trust Index | 1266 | +41 | +3.4% |

| Utilities Index | 7479 | -178 | -2.4% |

| Financials Index | 4881 | +181 | +3.7% |

| Materials Index | 14660 | -40 | -0.3% |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 3372 | +21 | +0.6% |

| London’s FTSE | 6090 | +58 | +1.0% |

| Japan’s Nikkei | 23289 | +960 | +4.3% |

| Hang Seng | 25183 | +652 | +2.6% |

| China’s Shanghai | 3360 | +6 | +0.2% |

Key dividends

| Date | |

| Mon 17 August | Div Ex-Date – Magellan (MFG)

Div Pay-Date – Qualitas Real Income (QRI) |

| Tue 18 August | Div Ex-Date – Computershare (CPU) |

| Wed 19 August | Div Ex-Date – Commonwealth Bank (CBA), RESMED (RMD) |

| Thu 20 August | n/a |

| Fri 21 August | n/a |

–

Tuesday 18 August 2020, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.