Equities were mixed as bond yields fell close to 2021 lows last week before a bit of a rebound on Friday night with both the U.S. and Australian 10-year government bonds sitting at 1.35%. Equity traders took that as a signal for economic concerns, with the S&P/ASX 200 falling 0.5% and the MSCI Emerging Markets falling 2.1%. Bond yields and the U.S. market staged a rebound on Friday though, with the U.S. reversing losses for the week to finish at a new record high after notching a 0.4% gain for the week, helping the MSCI World rise 0.2%.

Despite lower bond yields, the ASX tech sector fell alongside healthcare, whilst cyclical sectors like materials and energy rose. The industrials sector was the best performer, largely driven by the big bounce in Sydney Airport (SYD) after a conditional, non-binding takeover offer of $8.25 per share from a consortium led by IFM. Demand for infrastructure assets is proving to be strong, following Telstra’s (TLS) 49% sale of InfraCo Towers announced last week and the recent takeover of Vocus by Macquarie Infrastructure and Real Assets.

Elsewhere, global fund manager Apollo Global Management acquired a 15% stake in Challenger Financial (CGF) via its insurance affiliate, Athene, from long-time investor, Caledonia. The transaction was priced at $6 per share, a 10% premium to CGF’s prior price, but included a potentially higher sale price for Caledonia under certain scenarios including any takeover offer. Athene is seeking approval from APRA to acquire a more than 20% stake and disclosed a previously held 3% stake meaning that it currently sits at 18% ownership. We continue to see value in CGF in the longer term with continued strong sales growth though the market remains concerned on lower margins as CGF continues to hold higher than anticipated cash levels.

The main headline last week was the Reserve Bank of Australia’s (RBA) policy meeting, with the RBA tapering bond purchases from $5 billion a week to $4 billion. As highlighted in last week’s update, a taper was expected and largely priced in by the market. The three-year yield target of 0.1% via the April 2024 bond remains in place. RBA Governor Dr. Lowe also highlighted that decisions would continue to be data-dependent with a rate hike likely to require an unemployment rate close to 4% to drive a sustainable long-term wage growth of 3% and inflation in the 2-3% range.

Central banks were back in the spotlight last week as the People’s Bank of China announced a 0.5% cut to the reserve requirement ratio, unleashing about 1 trillion yuan (over $200 billion) worth of liquidity into the economy. This marks a reversal of monetary tightening over the past few months as China continues to try to balance between reining in excess debt and maintaining strong economic growth.

This week, investors will be watching U.S. inflation figures closely. We will also get Australian employment figures that are expected to remain strong in June despite lockdowns, though the Sydney lockdown may be more impactful on next month’s release of July employment data.

U.S. earnings season also kicks off with the big banks the standard highlight for the first week.

Earnings season preview

Although the U.S. earnings season kicks off this week with expectations of over 60% year-on-year earnings growth as we cycle the worst pandemic quarter for earnings, we are still a few weeks away before the Australian earnings season starts in earnest.

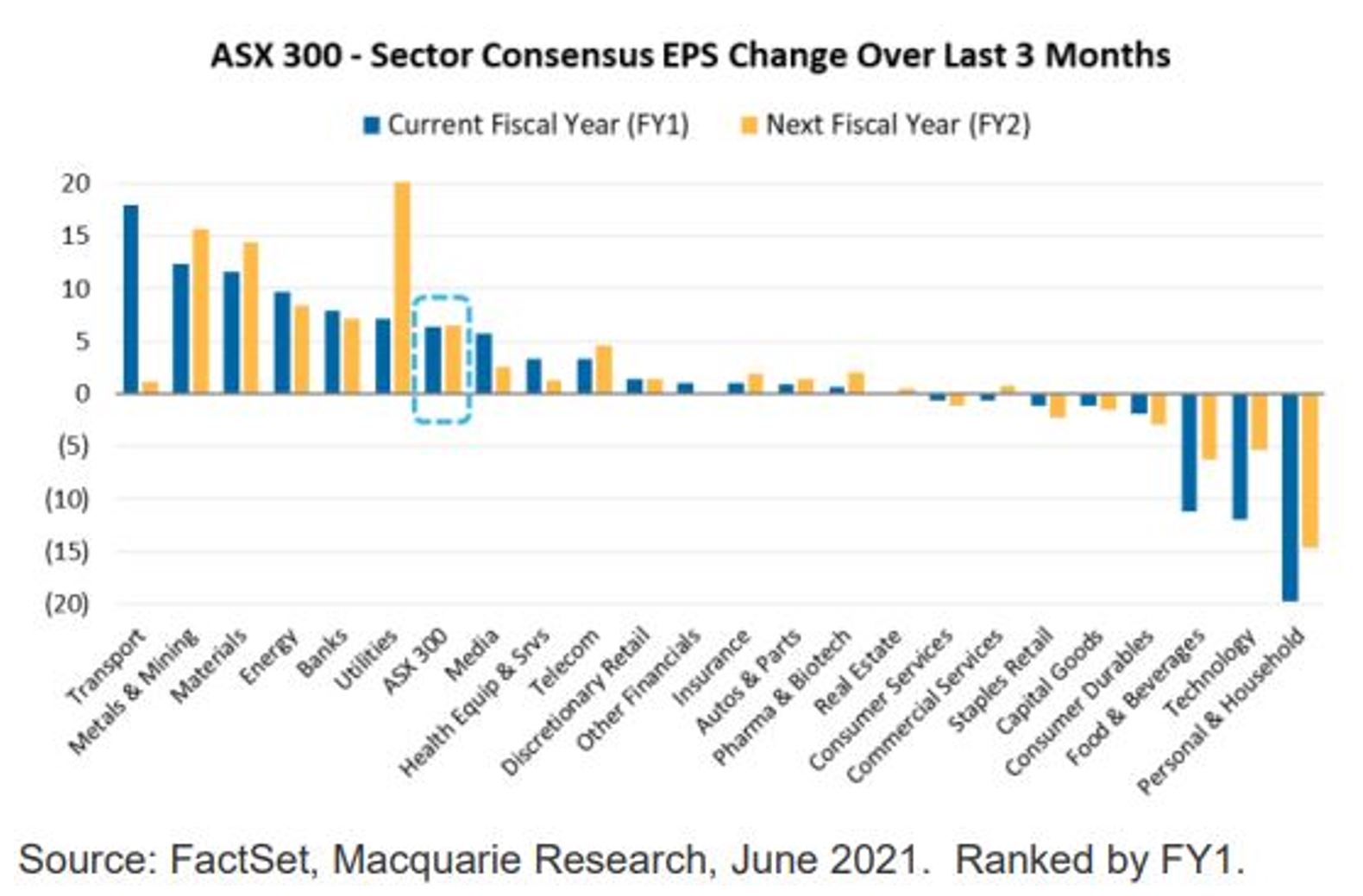

Earnings upgrades continue to flow through, with cyclical sectors like mining, energy and financials continuing to lead the way as pandemic winners such as tech and staples cop the biggest downgrades.

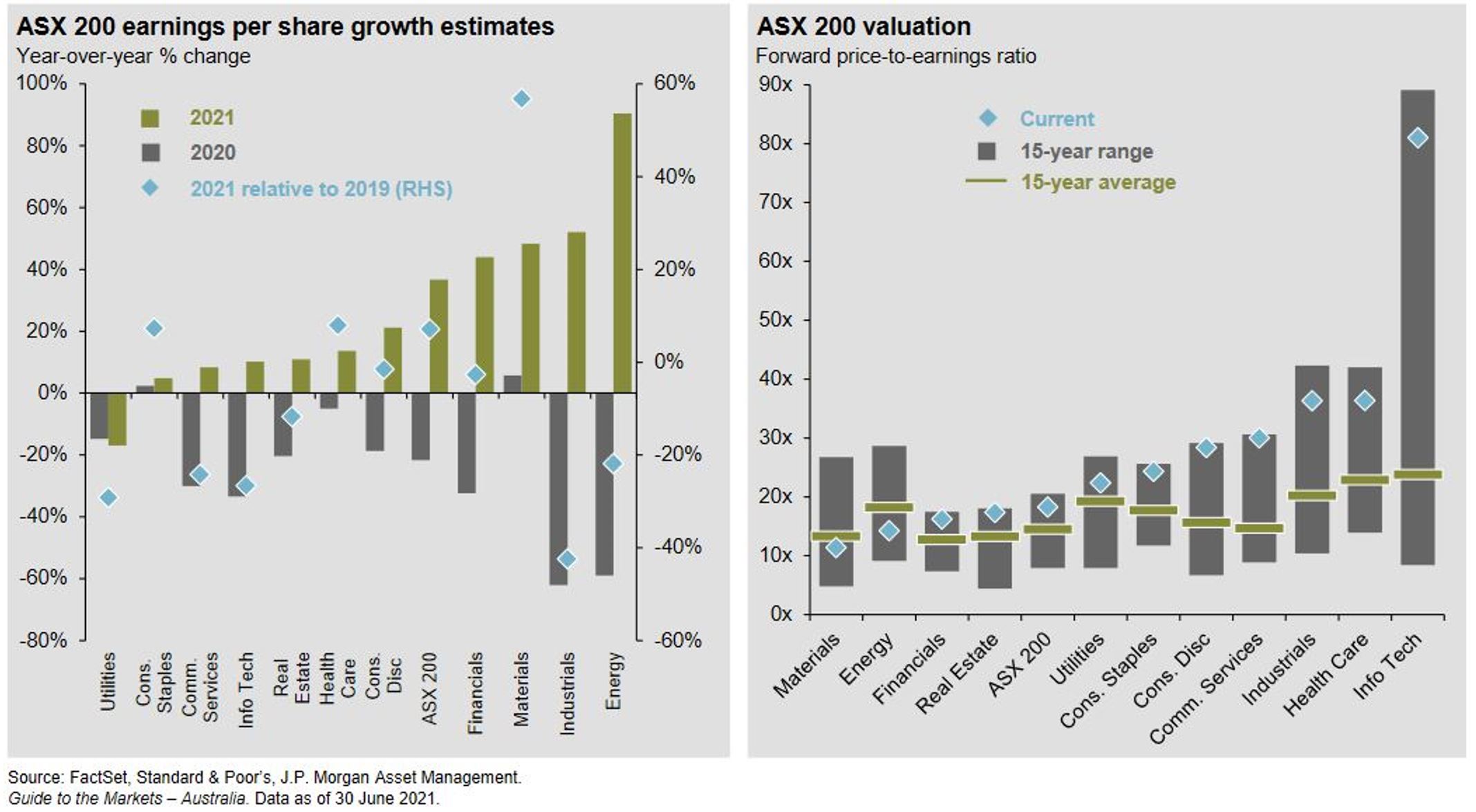

In the domestic market, we continue to prefer cyclicals despite the recent rotation back to tech on the back of lower bond yields. As shown in the chart below, cyclicals are expected to grow earnings versus 2019 pre-pandemic levels, whilst tech, despite strong revenue growth, will actually have lower earnings than 2019 levels. Meanwhile, valuations look a lot more palatable in the cyclical sectors relative to recent history.

This combination means we continue to favour the materials sector whilst we have recently added to energy in our model portfolios.

–

Monday 12 July 2021, 5pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.