The rotation from growth to value continued in equities even as yields stabilised, with the Australian 10-year ending the week at 1.83% and the U.S. 10-year flat at 1.77%. The MSCI World fell 0.4% for the week while the MSCI Emerging Markets index rose 2.1%, helped by some weakness in the U.S. Dollar and a bounce in Chinese tech.

Despite the rotation to value, the S&P/ASX 200 underperformed with a 0.8% fall relative to a 0.3% fall in the U.S. S&P 500. Locally, Materials (+4.7%) and Energy (+4.1%) were the best performers for the week as commodity prices enjoyed a rally, led by oil, with Brent crude prices rising 4.9% to USD86.29 per barrel. Utilities also bounced, up 3.6%, with Origin (ORG) participating in the energy rally, while AGL enjoyed a strong rebound despite the absence of any notable news. The worst performers were Consumer Staples (-5.5%), with Tech (-4.6%) and Consumer Discretionary (-4.5%) not far behind.

In company news, Afterpay (APT) announced that it received regulatory approval for Block (formerly Square) to proceed with the acquisition. The deal is expected to close this Friday, with Block shares trading under the ticker SQ2 starting 2 February. M&A activity remains high, with Crown (CWN) receiving an improved offer from Blackstone of $13.10 per share.

Ramsay Healthcare (RHC) provided an update noting the potential impact of elective surgery restrictions in NSW and VIC, with January being the quietest month seasonally but the impact of restrictions from the first quarter was $55 million in EBIT. RHC also announced the renewal of its volume-based agreement with NHS England until 31 March. Whilst RHC has been negatively impacted by the omicron variant in the near-term, we remain comfortable with the position on a longer-term view as we expect that demand for elective surgeries are only delayed.

Asset-manager Pendal (PDL) tumbled on Friday as it provided an update of funds under management, showing a fall of $3.5 billion to $135.7 billion as at the end of December. Net flows were more disappointing, with $6.2 billion in withdrawals, though management had already flagged two large institutional outflows at its AGM last month. While net flows were disappointing for the quarter, the large sell-off over the past few months looks overdone, with PDL trading under 10 times of earnings and a dividend yield of 9%. PDL’s investor base and product suite is well diversified with good medium-term performance, and it is a leader in the ESG space which continues to see significant interest. Therefore, we see current valuations as significantly attractive for PDL.

On the economic front, Australian retail sales had a strong November, rising 7.3% for the month relative to consensus expectations for a 3.9% bounce. A re-opening bounce and early Christmas shopping were likely key contributors to the beat, but the reading offers little as we are already seeing the omicron variant significantly impacting inventory and foot traffic over the past few weeks.

The headliner for last week was U.S. inflation. While the 7% reading was in-line with consensus, it is a 40-year high and will continue to be closely watched as markets remain dependent on extraordinarily loose monetary policy. With the U.S. Federal Reserve (Fed) showing a greater willingness in recent times to tighten in the effort to rein in inflationary pressures, inflation and central bank commentary will remain key drivers for markets.

Looking to the week ahead, Chinese economic data and Australian employment figures will be released. Both are likely to remain sluggish as the Chinese property sector continues to struggle and the initial surge in COVID cases may have impacted domestic employment in December. Investors will also have their eye on corporate earnings, with the quarterly U.S. earnings season kicking off last week.

Taking away the punchbowl

In many respects, the relative performance of the so-called “innovation” stocks has very closely followed that of the tech stocks during the tech bubble that popped in the early 2000s. While there are undoubtedly several companies that will likely fulfill their huge promise in years to come, there is also likely to be many others that will never recover to the heights seen in late 2020 or early 2021. The NASDAQ fell 78% by the time it bottomed in 2002. Many of the current “innovation” stocks are down over 50% from their peak.

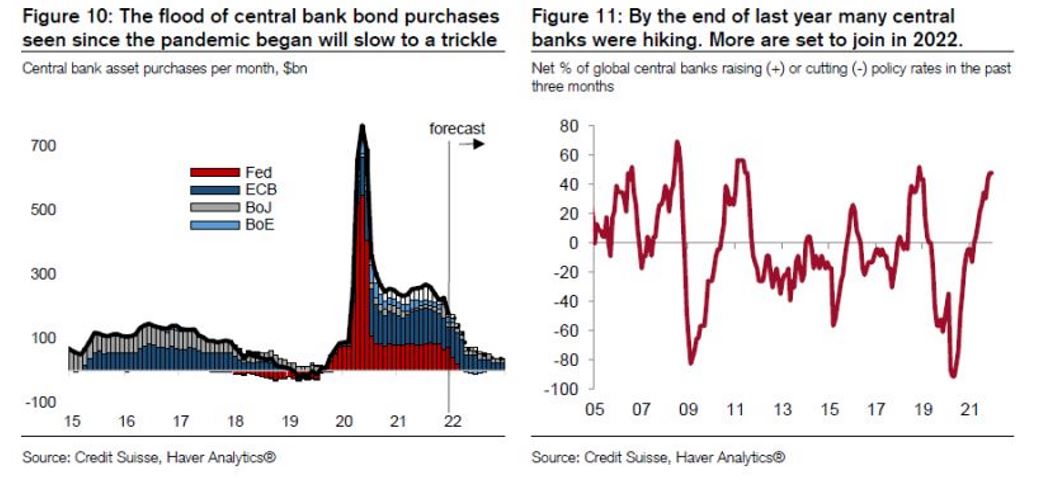

While it is hard to pinpoint a specific catalyst for this significant shift in market leadership, the end of free money may have been a major driver. Since Fed Chairman Jerome Powell held a press conference announcing that it was “time to retire” the word “transitory” when describing inflation, there has been significant moves in markets as yields rose and, despite relatively muted reaction from equities at the index levels, richly valued growth stocks have taken a dive. Subsequently, the Fed has moved to accelerate the tapering of its quantitative easing program, signalled more rate hikes at a faster pace, and, more recently, the Fed minutes showed that a reduction of its balance sheet is on the cards.

As seen above, the Fed is not the only central bank tightening policy, and it is likely that more will join the fight against inflation in the first half of 2022. While this will likely remain a headwind for both fixed income and equities in the near term, it does not necessarily mean negative returns for investors. For fixed income investors, income distributions can cushion the impact of rising yields, U.S. treasury yields rose between 2004 and 2007 but returns were still positive in each of those years. The pace of monetary policy tightening will be key, with the market currently largely pricing in the Fed’s December 2021 forecasted scenario.

For equities, the most impacted segment of the market is not a huge part of the indices. Whilst growth equities are a large proportion of the index, large technology stock valuations do not look extremely stretched. This could mean more of what we have seen over the past few months where there is significant volatility at the stock level, but indices remain resilient.

Overall, it is likely to be a bumpier ride moving forward. Supply chain issues and the ongoing impact of COVID will remain key drivers as the impact on inflation and economic growth remain difficult to forecast. Supply chain issues will need to be worked through for inflation to moderate and economic growth to rebound as orders finally get filled and inventory re-stocking boosts near-term growth. Such a scenario should be positive for investors, but one where supply chain issues continue to stoke inflation while limiting economic growth would likely result in a poor outcome for investors.

–

Tuesday 18 January 2022, 9am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.