A rebound took hold last week as equities broke a 7-week losing streak. Tech stocks ended the week with a strong rally in the U.S., with most Asian markets missing out but looking to catch up on Monday. The MSCI World rose 5.2%, led by the U.S., with the S&P 500 gaining 6.6% for the week. The S&P/ASX 200 lagged with a meagre 0.5% gain but remains one of the better performing indices.

Energy (+2.1%) and Materials (+1.9%) led the way for the ASX, while Tech (-3.4%) continued to suffer. Consumer Staples (-2.2%) was a laggard but not surprising given the relative strength of the sector and spill over weakness from several big retailers issuing poor reports in the U.S. last week. ALS Ltd (ALQ) reported a solid set of figures for its 2022 fiscal year while noting a ‘positive start’ to its 2023 fiscal year, leading to a series of upgrades and strong performance for the week. On the other hand, Fisher and Paykel Healthcare (FPH) saw some selling pressure after it reported a big drop in earnings as it is cycling a pandemic-driven boost while noting that margins continue to be impacted by higher freight costs. We continue to see supply chain issues as a major headwind for many businesses in the near-term as restrictions remain in China while adherence to the zero-COVID policy means elevated risk of further disruptions.

Bond yields eased again as the U.S. 10-year ended the week at 2.74% while the Australian 10-year fell to 3.24%. The U.S. Federal Reserve (Fed) minutes and a speech by Fed governor Raphael Bostic helped ease expectations for an aggressive hiking cycle as they maintained guidance for several further 0.5% rate hikes over the next few meetings but signalled a potential pause later in the year to assess the impact of rate hikes. Easing Personal Consumption Expenditure (PCE) readings, a favoured inflation indicator for the Fed, also helped sentiment as they supported the view that inflation may have peaked and is slowing.

In commodities, oil saw a rebound back close to USD120 per barrel for Brent crude driven by a drawdown in U.S. stockpiles and supported by the easing of restrictions in Shanghai. China remains the biggest importer of commodities globally, and recent moves to support growth such as tax reliefs and providing larger loan quotas for small-to-medium enterprises have helped to support broader commodity prices, however, more needs to be done for China to re-stimulate its economy.

There is a busy week ahead on the economic front, with Australia reporting its first quarter GDP while most countries are reporting on Purchasing Manager Indices (PMIs), a commonly followed survey that is considered a leading indicator for economic growth. However, the headlines are likely to come from the U.S., with employment data due to be released at the end of the week.

Finally a good week for investors, should we chase the rally?

Our investment philosophy remains that of long-term investors intending to remain invested but making tactical tilts to adjust to different points of the business cycle and the prevailing market environment. We moved to a more defensive stance within days after the Russian invasion of Ukraine after the event shifted our expectations for inflation and supply chain issues that would put more pressure on global economic growth and earnings. After seven weeks of drawdowns for equities and, until recently, one of the sharpest drawdown for bonds, the recent rebound is a welcome relief for investors. However, does this mean we should be adding back to markets? After all, history has shown that on average, big one week returns tend to be followed by significant gains over the next 12 months. In the U.S., since 1950, the S&P 500 has gained 21.7% on average after a 6%+ weekly gain. However, there are several outliers coinciding with longer term bear markets such as in 1974, 2000 and 2009 where sharp rallies perforated the overall downtrend.

There are many reasons on for both optimism and pessimism, but we remain conservatively positioned as the outlook remains clouded and we think headwinds remain. While inflation looks to now be moderating, it also looks like it will settle at a higher level than the past 10 years. Supply chains remain an issue but this may ease as China eases mobility restrictions. Geopolitical risks remain elevated but we may be in gridlock for some time.

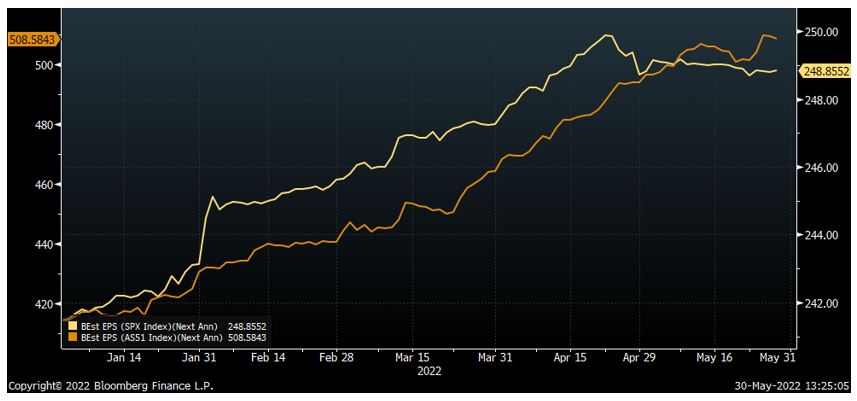

Despite the level of uncertainty we are seeing on the macro front, analysts remain optimistic on earnings. The chart below shows earnings expectations for the next year actually growing for both the S&P/ASX 200 (orange) and S&P 500 (yellow) since the start of the year despite the issues that have surfaced over the past few months.

While the sell-off over the seven weeks prior to the last week, combined with the upgrades to earnings expectations, have left headline valuations (as measured by Price-to-Earnings multiples) for both indices largely in-line with long-term historical averages, we think that it will be difficult for companies to meet lofty expectations in the face of higher costs for raw materials and labour, and an uncertain demand outlook. Therefore, on balance, we think it is prudent to remain cautious and not chase the rally at this stage as earnings expectations may have to come down even if the global economy remains on solid footing. However, as always, we remain vigilant and continue to monitor the situation. If earnings headwinds start to ease and the outlook becomes more positive, we would not hesitate to act quickly to reposition the portfolios.

–

Tuesday 31 May 2022, 9.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.