Key economic releases last week

- US housing data was better than expected as housing starts and building permits were better than expected

- Australian preliminary PMIs were better than expected while EU readings disappointed and US were mixed. Manufacturing across all three remain in contractionary territory while Services remain in expansionary territory.

- PBoC cuts the loan prime rate by 0.1% to 3.55% for the 1-year and 4.2% for the 5-year rates

- UK inflation data for May surprised to the upside with core inflation rising to 7.1%

Key releases for the week ahead

- Australian May Inflation Indicator

- Australian retail sales and credit data

- US consumer spending and PCE inflation

- EU employment and inflation

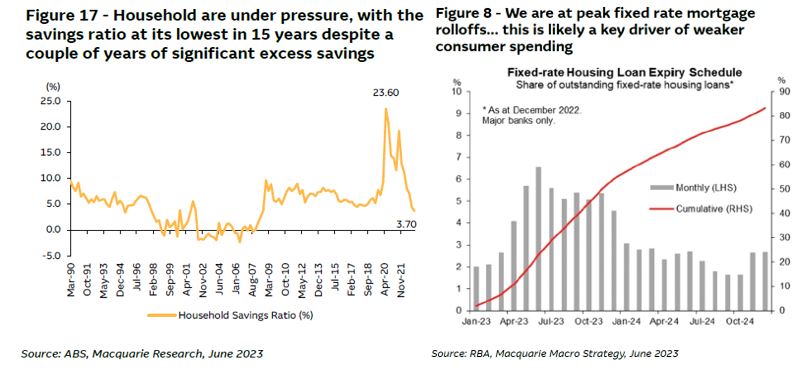

Chart of the week

Recent research conducted by Macquarie highlights the impact of rising living costs and mortgage expenses on people’s ability to spend on non-essential items. The left chart clearly illustrates a significant decline in household savings, reaching a 15-year low of 3.7%. On the right, we can observe that we are currently in the peak months of the phase-out of cheap fixed-rate mortgages. This will negatively affect consumer demand, particularly for those facing higher mortgage repayments.

Additionally, several profit warnings from Australian discretionary consumer stocks indicate a shift towards more cautious spending behaviour. We have refrained from including Australian-focused discretionary stocks in our Australian Equities portfolio, as we had anticipated the weakening consumer environment. However, as our initial concerns appear to be materialising, we will monitor potential opportunities in this sector in the coming months, as the economic reality gets priced in to stock prices.

–

Tuesday 27 June 2023, 1.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.