Weekly Market Update

More vaccine news as the AstraZeneca/University of Oxford candidate released interim results for two studies showing varying efficacy rates. The lower dosage trial where candidates received half a dose followed by a full dose one month after had a 90% rate, whilst the larger study showed a 62% rate when participants took two full doses, a month apart. Whilst there has been some concerns and criticism around the data sets, this remains positive news given that the viral vector technology for this vaccine is more widespread meaning that established manufacturing capacity is much higher, whilst the distribution requirements are less onerous as this candidate can be kept at standard refrigeration temperatures.

As a result, equities had another good week, with value and cyclical stocks continuing to lead. The ASX 200 was up 1% for the week, and last Wednesday, the price index (not including dividends) closed just 0.1% from erasing losses for the year before turning lower.

Over in the U.S., the Dow Jones Industrial closed above 30,000 points for the first time, though it ended the week slightly under that mark. The S&P 500 was up 2.3% for the week.

U.S. may not be giving thanks for Thanksgiving

New cases in the U.S. continue to rise strongly, and with Thanksgiving seeing strong activity and movement across states for gatherings, there is potential for a sharp spike higher to an already troubling trend… just in time for Christmas and New Year’s. Right now, investors are looking out six months ahead to a time when vaccines are expected to be widespread, but there is certainly the risk of a sharp shift in sentiment over the next few months if hospital capacity starts to get overrun.

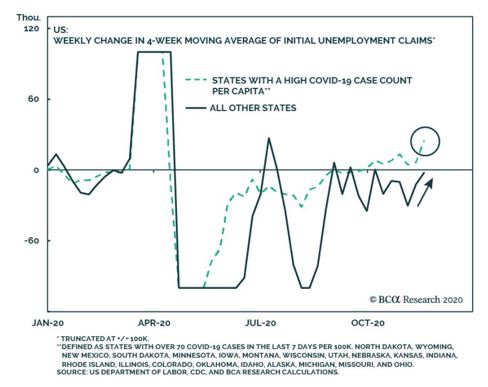

The risk to rising cases also flows on to business activity and employment. We have already seen a return to contraction for the Eurozone following their recent spike in cases. The U.S. has held up well thus far, but we have certainly seen high frequency data such as mobility and weekly unemployment claims weakening.

Consumer confidence also came in lower than expected last week, along with news of further restrictions in various areas such as California.

Further exacerbating the issue is the expiry of various government stimulus programs to assist both businesses and people. Some have already expired since September, but more are due by the end of the year. Despite the urgent need, the Democrats and Republicans remain far apart on a new stimulus package, though the need to approve a U.S. funding bill by 11 December 2020 to avert a government shutdown may allow for some interim relief to be included.

With fiscal policy absent again, it is up to the Federal Reserve to step up to the plate. Despite already pumping in record amounts of liquidity this year, the recent meeting minutes noted that there could be more accommodation coming through increasing the pace or size of purchases, or shifting to longer maturity purchases. With traditional monetary policy already exhausted with rates at 0%, there is little doubt that the central bank will be expanding the balance sheet further which should continue to provide some short term support for markets.

Optimism for Australia

On a lighter note, domestically, the recovery looks to be gaining momentum as PMIs push higher for both manufacturing and services, indicating improving growth momentum. Retail sales out this week for October is also expected to rebound and are expected to recover further over November with Victoria ending the lockdown.

Despite the consternation over trade with China and the deteriorating relationship there, there is some optimism that the domestic economic recovery will gain steam in the following months as interstate boundary restrictions are expected to ease further.

This week, U.S. employment figures are out, with conditions expected to have deteriorated as indicated by the weekly unemployment claims. U.S. ISM PMIs which measure broader activity are expected to remain in growth territory but at a slower pace. China PMIs are also expected to continue to indicate strong growth momentum as the economy maintains its V-shaped recovery.

For oil watchers, there is also an OPEC+ meeting to discuss the extension of oil production cuts. Given that demand for oil remains severely impacted by travel restrictions, the consensus is that an extension is a given.

Looking ahead

| Monday | CN Manufacturing PMI, CN Non-Manufacturing PMI |

| Tuesday | AU RBA Interest Rate Decision, EU Manufacturing PMI |

| Wednesday | US ISM Manufacturing PMI, AU AIG Manufacturing Index, AU ANZ Job Ads, AU GDP, CN Caixin Manufacturing PMI, EU Unemployment Rate |

| Thursday | US ADP Nonfarm Employment Change, AU Trade Balance, CN Caixin Services PMI, EU Services PMI, EU Retail Sales (MoM) |

| Friday | US Initial Jobless Claims, US Services PMI, US ISM Non-Manufacturing PMI, AU Retail Sales, US Unemployment, US Factory Orders |

–

Tuesday 1 December 2020, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.