From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Momentum continues to outperform as investors remain more concerned by missing the rally than of buying the top.

Reach for yield remains a priority as investors chase higher returns from riskier assets such as equities and corporate bonds as cash returns diminish.

Equities in Australia have outperformed a rallying bond market by +17% since the market low in December and in the United States this outperformance has been even greater at +23%.

This is despite the lack of trade deal and deteriorating global macroeconomic environment.

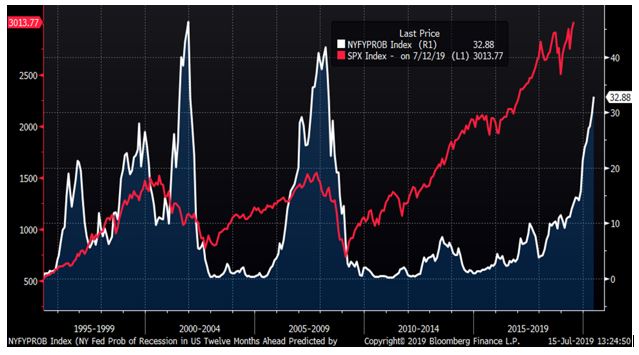

The New York Fed’s indicator on potential for recession in the coming 12-months is at its highest since the GFC at 33% which should be of increasing concern for investors chasing returns at these levels without due consideration for the potential impact of deteriorating corporate cashflows on both equity and corporate bond securities.

See chart below of the NY Fed Probability of Recession in 12-months (white) and the S&P500 overlaid in red.

Economic data released

Australian Consumer Confidence and Business Confidence both eased back in their recent readings, with the NAB Business Confidence giving back some of its post Federal Election spike, and the Westpac Consumer Confidence figure collapsing to its lowest figure in almost 2-years.

This shouldn’t be a surprise since Australia’s economy is still working through a significant construction deceleration and associated job losses are only now impacting the domestic economy.

We think it will be a tricky remainder of 2019, but we do feel more optimistic about the year ahead given the positive impetus from the government’s tax package and the recent interest rate cuts.

Observations from the past week

The Fed gave markets a green light to expect rate cuts as soon as the next meeting on August 1st with the Fed Chairman Jerome Powell suggesting concerns for the global economy as the likely catalyst for lower rates.

Equity investors continue to fear missing out on the rally more than they do about buying at the top, and so markets, in the U.S at least, pushed higher on the week.

With U.S reporting season due to start this week (major bank stocks + Microsoft, Ebay and Netflix) I feel it will be difficult for markets to push significantly higher. The global economy remains soft, as evidenced by the Fed Chairman’s remarks and it feels unlikely corporate commentary on future earnings will be anything but circumspect.

BAS (BAS)

The German chemical and industrial giant lowered its expectations for 2019 profits by as much as -30% citing the impact of global protectionism on business volumes and the unseasonably wet weather across North America for a slower start to planting season within its agrochemicals business (this will have a read through for Nufarm (NUF))

Afterpay Touch Group Ltd (APT)

Goldman Sachs downgraded APT to HOLD last week in a notable research piece.

GS have been strong supporters of the stock in the past few years which is what makes this downgrade more newsworthy.

Importantly, GS seem to acknowledge many of the issues we have become increasingly mindful of in recent weeks, such as the potential for competition in offshore markets and the dilution from recent stock issuance.

Perhaps more than that, we simply feel that the APT story is now becoming increasingly well known. The company themselves have outlined their ‘blue-sky’ targets for 2022 which is $20bn in gross transactions – a commendable target, but one that looks far less optimistic than some of the more bullish estimates of analysts.

In a speculative stock such as APT, you always want the potential for optimists to speculate.

When the news becomes ‘known’ a core part of the valuation begins to erode, and so it has with APT, albeit the underlying performance of the business remains as sound as ever.

We still like the APT story but remain of the view it is worth $28 – 30, hence we trimmed our holdings and will remain patient for levels under $20 to begin buying again.

Oil Search (OSH)

OSH had a neat bounce on Friday after The Australian reported that SANTOS (STO) could be interested in seeking a takeover of OSH.

Though we see merit in the idea STO could be interested in OSH, in reality, any number of local and global oil producers could be interested in the company given its excellent breadth of long-life, low-cost assets.

Whilst there are a few near term hoops for OSH to jump through in terms of final investment decision on the Papua LNG project with Total (likely mid 2020) and on the terms for the P’nyang gas agreement with the newly formed PNG Government, in the medium-term we think the OSH asset base and associated growth potential looks very undervalued.

OSH and STO each hold stakes in the low-cost PNG LNG project (29% and 13.5%).

BWX (BWX)

BWX has bounced nicely on Monday morning after announcing it had extended and improved the terms of its existing debt facility.

Though we haven’t been overly fearful of BWX’s rising net debt, believing a good portion of the uptick relates to inventories, some in the market have been. Hence, this is seen as good news in some quarters.

We still feel like BWX has significant upside potential and we remain encouraged by indications on underlying sales trends for its key products.

What’s interesting?

Short interest in Australia’s major banks has fallen significantly since the Australian Federal Election – most banks have seen their short interest halve in the last 2 months, and in the case of ANZ (ANZ) and Commonwealth Bank (CBA), short interest is at or nearing multi-year lows.

Short interest in some of the tech high-flyers such as Wisetech (WTC), Afterpay (APT) and Nanosonics (NAN) just to name a few, has also fallen significantly.

This broader capitulation on shorting of the banks and technology in particular is noteworthy since it removes a significant support from the market for these stocks, and in the case of technology, it is often noteworthy that short-sellers capitulate at the top when valuations are stretched (as they most definitely are now).

Looking ahead

- Monday – US Empire Manufacturing (July), CH GDP (Q2), CH Fixed Asset (Jun), CH Industrial Production (Jun), Citigroup earnings

- Tuesday – AU RBA Meeting minutes, US Retail Sales (Jun), US NAHB Housing Confidence (July), JP Morgan, Wells Fargo & Goldman Sachs earnings

- Wednesday – AU Westpac Leading Economic Indicator (Jun), Bank of America, EBAY earnings

- Thursday – AU Employment Report (Jun), US Beige Book, Netflix & Morgan Stanley earnings

- Friday – US Michigan Consumer Confidence, Microsoft earnings

The Australian employment report due to be released on Thursday is the local focus, but offshore, the U.S reporting season will be the key driver for market sentiment near term.

This week the focus will be on U.S banking majors, but the following 10-days sees technology giants Alphabet (GOOG), Facebook (FB), Amazon (AMZN) and Apple (APPL) all report numbers.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 6789 | -43 | -0.6% |

| S&P / ASX 200 | 6697 | -54 | -0.8% |

| Property Trust Index | 1668 | -44 | -2.6% |

| Utilities Index | 8333 | -191 | -2.2% |

| Financials Index | 6342 | -74 | -1.2% |

| Materials Index | 13999 | -161 | -1.1% |

| Energy Index | 11042 | +34 | +0.3% |

Friday Closing Values

| Index | Change | % | |

| U.S. S&P 500 | 3014 | +24 | +0.8% |

| London’s FTSE | 7506 | -47 | -0.6% |

| Japan’s Nikkei | 21686 | -60 | -0.3% |

| Hang Seng | 28472 | -303 | -1.1% |

| China’s Shanghai | 2930 | -81 | -2.7% |

–

Monday 15 July 2019, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information