From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Market update

Price is what you pay, value is what you get.

It’s worth remembering this having seen markets race higher over the last couple of months – I think I mentioned last week that it was the biggest ever 5-day rally in the U.S S&P500 in history.

Even though markets gave up a little bit of ground last week, valuations in Australia remain nudging at their 20-year highs on approximately 19-20x forward earnings, and there has been precious little upgrade momentum as yet for 2021-2022.

Where Australia hasn’t been as overvalued as the United States in recent years, the rally through 6000 on the ASX200 has put us back above the 10-year average Shiller P/E, being the market valuation struck against the average earnings over the past decade.

This measure is designed to smooth the earnings cycle to provide a better sense for market levels.

We continue to believe asset markets are operating in an uneasy twilight right now, but that the outlook is increasingly darker as we draw closer to June quarter results and some insight into corporate performance.

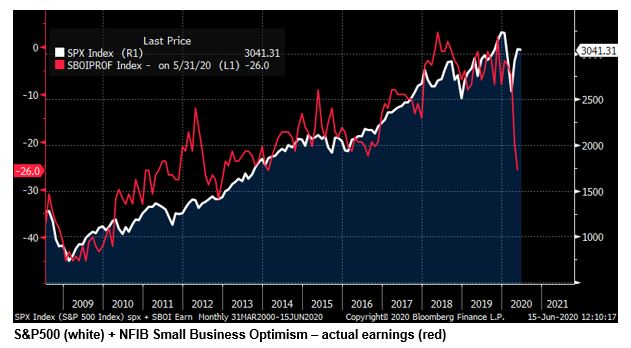

Last week’s May Small Business Confidence figures in the United States pointed to continued subdued profitability with the ‘actual earnings index’ falling to its lowest level since 2014.

This really shouldn’t necessarily be a surprise given many states were still in early re-opening mode during May, but as the chart below shows, earnings are an incredibly relevant driver of share prices.

With the S&P500 back up through 3000 it is imperative that the U.S achieve a speedy and seamless transition back to normality (highly unlikely in my opinion, on which I will discuss below) or the risk remains of more weeks like last week where sellers outnumbered buyers.

Whilst the U.S is in full ‘re-opening mode’ at present, unsurprisingly we are now seeing infection rates rise in those parts of the country less vigilant in their practice of social-distancing and mask-wearing.

I am sure everyone has seen enough charts on infection and hospitalisation rates in the past few months than they would prefer to see, however it is concerning to see the spikes now occurring in states such as Arizona, Texas, Alabama, Arkansas, North & South Carolina, Nevada, Tennessee and Utah.

Many of these states are now seeing intensive care capacity utilisation reaching peak, which runs the risk of authorities being forced to again instruct the population to limit its interaction.

But putting aside whether ‘shelter-in-place’ orders are re-implemented in the U.S, the big negative from rising infection rates is that consumers will naturally shift back to self-preservation mode and will be more reticent in their socialising and interaction in the community.

This is the major problem with the share-market rally since it assumes in large part a return to normalcy in quick time.

If individuals fear catching the virus, whether government tells them it is safe or not, they will simply not return to previous behaviour.

In Australia it is inevitable that we too will see an increasing prevalence of ‘spotfires’ as our economy opens up as well, which isn’t necessarily something to worry ourselves about as we have done an incredible job as a nation, but it is reality and to be expected.

These ‘infection spotfires’ will have the same impact on Australian consumer confidence too.

And for those of you that perhaps have been lulled into thinking it’s all a beat-up and that we are past the worst, look at how quickly Chinese authorities clamped down on the weekend’s outbreak in Beijing’s largest wholesale market – it was swift and is continuing even today as I type.

Anyway, enough about the coronavirus.

In market news last week, the US Federal Reserve met and reiterated their promise to do everything in their powers to support liquidity and the wider economy, although some analysts considered the Fed Chairman’s remarks on the economy somewhat downbeat (or realistic depending on your point of view).

Whilst weekly jobless claim numbers in the United States are falling as the economy re-opens, there are still well over 21m American’s still receiving benefits which is 12-13% of the workforce.

To finish off on one of our more recent single-stock ideas I would like to draw your attention again to funderal-operator Invocare (IVC) since it will be one of the most directly benefited companies from the Federal Governments continued unwinding of social restrictions.

Last week the Prime Minister flagged the intention of raising the 100-person indoor attendance cap as part of the move to stage-3 restrictions in July which should be very positive in allowing IVC operations to very nearly normalise.

In a market in which there are myriad pockets of over-valuation, to be buying a quality growth franchise such as IVC on a 5-year relative low to the ASX200 and at the bottom of its historic valuation range as restrictions on its business ease makes good sense.

We think IVC has upside to $14-15 in the coming year.

Have a good week all.

Looking ahead

| Monday | US Empire Manufacturing (JUN) |

| Tuesday | AU RBA Meeting minutes, AU ANZ Weekly Consumer Confidence, US Retail Sales (MAY), US NAHB Housing Sentiment Index (JUNE) |

| Wednesday | AU Westpac Leading Index (MAY), US Building Permits/Housing Starts (MAY) |

| Thursday | AU Employment (MAY, US Philly Fed Business Outlook (JUNE), US Weekly Jobless Claims, US Weekly Bloomberg Consumer Confidence |

| Friday | n/a |

The main focus locally will be on the May employment report.

Economists are forecasting a fall of 75,000 jobs on top of the 594,000 lost in April, however in truth, given Job-keeper allowance and the fact it is a survey, the likelihood of predictive accuracy feels low.

Markets remain in the twilight period and will remain volatile we think, with downside most likely.

U.S earnings pre-announcements are likely from early July, however it might be more quiet than usual since so many companies have withdrawn earnings guidance and hence might sit tight until their due reporting date.

Either way, activity on the corporate front that gives us an insight into business trends will ramp up from mid-July onwards until the end of August.

The other focus will be on COVID-19 progress and how many of the southern United States are handling the spike in infection rates following late April/early May ‘economic re-openings’.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 5960 | -156 | -2.6% |

| S&P / ASX 200 | 5847 | -149 | -2.5% |

| Property Trust Index | 1253 | -48 | -3.8% |

| Utilities Index | 7713 | -42 | -0.4% |

| Financials Index | 4744 | -186 | -3.7% |

| Materials Index | 13232 | -189 | -1.5% |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 3041 | -152 | -5.0% |

| London’s FTSE | 6105 | -379 | -6.0% |

| Japan’s Nikkei | 22305 | -558 | -2.8% |

| Hang Seng | 24301 | -469 | -1.9% |

| China’s Shanghai | 2919 | -11 | -0.4% |

Key dividends

| Date | |

| Mon 15th June | Div Pay-Date – CBAPD, CBAPE, CBAPF, CBAPG, CBAPH, CBAPI, MQGPC |

| Tue 16th June | Div Pay-Date -Qualitas Real Income (QRI) |

| Wed 17th June | Div Pay-Date – NABPB, NABPF, Amcor (AMC) |

| Thu 18th June | Div Pay-Date – Resmed (RMD), WBCPI |

| Fri 19th June | Div Ex-Date – WBCPG |

–

Tuesday 16 June 2020, 2pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.