From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Fresh from news that the next round of trade talks would kick off early next month, there was also suggestion last week from both sides of pre-empting talks with gestures of goodwill as a means to progress discussions.

President Trump agreed to defer the raising of tariffs on US$250bn of Chinese exports to the US by a fortnight to allow for the chance of success at the talks.

The Chinese government followed suit with a move to allow certain U.S agricultural exports such as soybeans and pork be exempted from pending tariff imposition.

It remains to be seen whether this is the start of a genuine détente or simply a face-saving agreement from both sides, however it does seem assured that both countries are increasingly aware that the longer this goes on the greater likelihood we have of global recession.

Drone attacks on several key Saudi Arabian oil facilities over the weekend has seen oil jump as much as +20% in Monday’s trading – the biggest jump on record.

Oil prices are now +9% but likely to be influenced by the Saudi’s response to the attack and to any confirmation that Iran was involved.

The last thing the world economy needs, and particularly the Chinese economy as a major oil importer, is a supply side shock to oil markets.

It remains to be seen how long it will take for repair, but the immediate damage has been to render around 5m barrels of daily production offline, which is broadly 5% of world supply around half of Saudi Arabia’s daily production.

Economic data released

The August Australian Industry Group data for manufacturing and services both rebounded encouragingly, however the construction index continued to soften month on month albeit at a slower rate.

Australian August Business Conditions fell to their weakest level in 5 years in spite of multiple interest rate cuts.

Forward order figures remained at their low point and employment indicators also remained soft.

Australian September Consumer Confidence remained soft in spite of the multiple stimulus injected into the economy in recent months and the improving domestic housing situation.

Interestingly and perhaps a little surprisingly given the +20% gain in Australia’s ASX200 year-to-date, retiree’s surveyed felt less confident than at any point since 2017.

US August NFIB Small Business Confidence eased modestly, but within the data it does appear that U.S employment trends have peaked.

The index on how difficult employers are finding it to fill roles eased to its lowest point for 2019, and employers also saw less pressure on wages.

This data, alongside job openings, will prove to be an invaluable guide for the economy in the coming 12 months given the huge importance of jobs for consumer confidence and indeed the wider economy for President Trump’s re-election hopes in November 2020.

Observations from the past week

Bellamy’s (BAL)

Bellamy’s was this morning bid for at a +60% premium to last traded price by China dairy behemoth, China Mengniu.

We think this is hugely significant as it demonstrates the willingness of external parties to take advantage of short-term earnings uncertainties, in this instance the largest dairy player in China, and to acquire long term earnings growth that investors in the Australian market seem unwilling to price for.

We think there will be a surge in Australian M&A activity in the coming 12 months, buoyed by a low Australian Dollar and local tax and interest rate cuts, but mostly by lowly valuations placed on stocks facing near term uncertainty.

We think stocks in our portfolio like IOOF (IFL), Oil Search (OSH), Challenger (CGF), Pendal (PDL), Boral (BLD) and BWX (BWX) all have attractions to corporate or financial sponsor suitors, and there are many other companies on the local market with similar attractions.

What’s interesting?

Much has been written about the ‘reach for yield’ and how investors are being forced up the risk curve in search of returns able to compensate for falling low-risk cash and government bond returns.

One such example continues to be in Australian banking shares where investors have again bid up the price of shares in each of Commonwealth Bank (CBA), Westpac (WBC), National Australia (NAB) and ANZ (ANZ).

Share prices are at their highest levels in 18 months despite the collapse in local interest rates which will make future profit growth all the more difficult as the margins on which the banks can lend collapses.

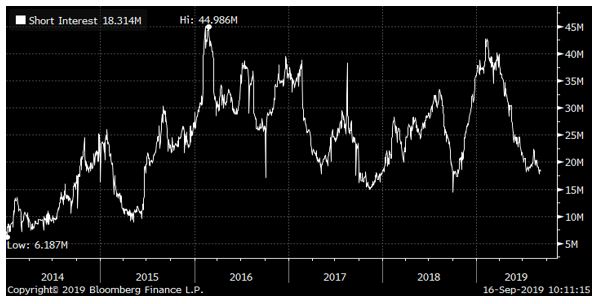

The chart below shows the collapse in short selling interest in Australia’s #1 bank, the Commonwealth Bank (CBA), to near its lowest in 4 years in spite of earnings risks being as acute as an at any point in the last 5 years.

Investors seem willing to ignore the trajectory for future earnings, which is almost assuredly down, in order to placate their near-term income needs.

We think this is a big mistake and that the recent rally provides an opportune time, yet again, for reducing exposures to Australian banks.

Australia’s leading banks analyst, Jonathan Mott from UBS, is predicting that CBA will be forced to cut its dividend per share by 2021 by over +10% leaving the stock on a future dividend yield at current prices ($82) of only 4.6% full-franked.

Commonwealth Bank (CBA) short interest levels near 4-year lows indicate investors are ignoring medium-term earnings risk

Looking ahead

- Monday – US Empire Manufacturing (Sep)

- Tuesday – AU RBA Meeting Minutes, US NAHB Housing Sentiment (Sep)

- Wednesday – AU Westpac Leading Index (Aug), US Building Permits (Aug)

- Thursday – AU Employment (Aug), US Federal Reserve meeting, US Philadelphia Fed Business Outlook (Sep)

- Friday – N/A

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 6777 | +25 | +0.4% |

| S&P / ASX 200 | 6669 | +22 | +0.3% |

| Property Trust Index | 1600 | -12 | -0.7% |

| Utilities Index | 8026 | +131 | +1.7% |

| Financials Index | 6464 | +168 | +2.7% |

| Materials Index | 13375 | +161 | +1.2% |

| Energy Index | 10584 | +53 | +0.5% |

Friday Closing Values

| Index | Change | % | |

| U.S. S&P 500 | 3007 | +29 | +1.0% |

| London’s FTSE | 7367 | +85 | +1.2% |

| Japan’s Nikkei | 21988 | +683 | +3.2% |

| Hang Seng | 27353 | +663 | +2.5% |

| China’s Shanghai | 3031 | +31 | +1.0% |

Key Dividends

| Mon 16th September 2019 | Div Ex-Date – N/A

Div Pay Date – CBAPD, CBAPE, CBAPF, CBAPG, CBAPH, Qualitas Real Income Fund (QRI) |

| Tue 17th September 2019 | Div Ex-Date – N/A

Div Pay Date – NABPB, NABPF |

| Wed 18th September 2019 | Div Ex-Date – Webjet (WEB)

Div Pay Date – WBCPI |

| Thu 19th September 2019 | Div Ex-Date – Cochlear (COH), Crown (CWN, WBCPG

Div Pay Date – REA (REA), Rio Tinto (RIO), RESMED (RMD) |

| Fri 20th September 2019 | Div Ex-Date – ANZPE, ANZPF

Div Pay Date – AGL (AGL), ANZPG, ANZPH, NABPE, Platinum (PTM), Tabcorp (TAH), Woodside (WPL) |

Tuesday 17th September 2019, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.