From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Economic data released

Australian Business and Consumer Confidence both bounced last month from 5-year and 4-year lows respectively. We think this bounce is relevant as it backs up the bounce in service sector activity last month as recorded in the Australian Industry Group data.

US Small Business Confidence for October steadied however two forward-looking sub components continued to fall. Both the ‘job openings and ‘corporate profitability’ readings continued to fall, with job openings at an 18-month low and signaling a future easing in the U.S’ strong employment market. Business earnings dipped to be just shy of its 2-year low recorded early in 2019.

Observations from the past week

Afterpay (APT) shares surged ahead last week after yet another encouraging trading update from the group.

APT shares rose +18% on the week as investors cheered the record October subscriber growth (15,000 new users) and rising penetration rates within the longer-term users (averaging 22x a year compared to only 7x a year from new users).

Loss rates continue to improve as does in-store penetration which is now up to 23% of Australian/New Zealand sales.

Beyond the business operations, APT impressed with the appointment of ex-Facebook Chief Marketing Officer Gary Briggs to the board, a tie-up with online retail behemoth E–Bay in Australia and then a private placement of $200m in new shares to well-credentialled technology venture capital firm Coatue Technologies at $28.50 to fund APT’s global expansion and development of new data analytic products.

As a guide to the significance of the E-Bay agreement, APT currently have around 40,000 merchants on their platform globally, where E-Bay boast 40,000 of their own on the Australian site alone.

The company continues to impress and we remain very confident of further share price gains.

We fortunately added to APT in our model portfolios in the low $27’s in recent weeks.

What’s interesting?

Last week we reported that October saw a jump to an 11-month high in Australian service sector activity and this week we flag a rebound in October readings for both Consumer and Business Confidence.

Admittedly, both the NAB Business Confidence and Westpac Consumer Confidence figures are lurking at 5-year and 4-year lows respectively, however there is much pessimism around on the local economy and we firmly believe we are at the trough and that the economy will begin to improve as we peer into 2020.

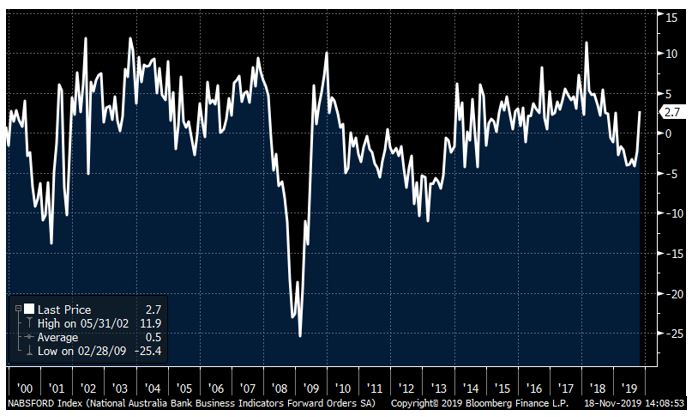

The chart below shows the NAB Business Confidence survey sub-index on ‘Forward Order’s’ which last month jumped to its highest level in over a year.

Low interest-rates, future tax cuts and a rebounding residential property market make it very difficult to look into 2020 without anything but relative optimism after what has been a year where Australian consumers have stayed firmly in their shell.

Australian Business Forward orders jumped to a 12-month high in October

Looking ahead

- Monday – NAHB Housing Confidence (Nov)

- Tuesday – AU RBA Meeting minutes, US Building Permits/Housing Starts (Oct)

- Wednesday – AU Westpac Leading Index (Oct), AU Skilled Vacancies (Oct), US Federal Reserve meeting minutes

- Thursday – US Philly Fed Business Outlook (Nov)

- Friday – AU CBA Manufacturing & Service PMI’s (Nov), US Markit Manufacturing & Service PMI’s (Nov), University of Michigan Consumer Confidence (Nov)

It will be a quiet week for new information, albeit we are looking to the Webjet (WEB) AGM on Wednesday for an update on current trading.

Beyond this week and looking towards this end of the year, we still have AGM’s from each of IOOF (IFL), Pendal (PDL), Nufarm (NUF), Woolworths (WOW) and three of the four major banks excluding Commonwealth Bank (CBA).

The Federal Government will likely make its mid-year economic and financial update (MYEFO) before Christmas, with speculation rising that the government could pull forward the 2022-23 tax cuts by a year or two.

We think this happens and is supportive of our increasingly positive view on the local economy.

Telstra (TLS) will also hold an investor update next week.

On the international front, the UK election is scheduled for December 12th and the first Democratic caucus is penciled in for February 3rd 2020.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 6898 | +62 | +0.9% |

| S&P / ASX 200 | 6793 | +67 | +1.0% |

| Property Trust Index | 1650 | +16 | +1.0% |

| Utilities Index | 8166 | -30 | -0.4% |

| Financials Index | 6219 | -37 | -0.6% |

| Materials Index | 13418 | -56 | -0.4% |

| Energy Index | 11296 | +240 | +2.2% |

Friday Closing Values

| Index | Change | % | |

| U.S. S&P 500 | 3120 | +35 | +1.1% |

| London’s FTSE | 7302 | -104 | -1.4% |

| Japan’s Nikkei | 23303 | -150 | -0.6% |

| Hang Seng | 26326 | -1521 | -5.5% |

| China’s Shanghai | 2891 | -87 | -2.9% |

Key Dividends

| Mon 18th November 2019 | N/A |

| Tue 19th November 2019 | AGM – A2 Milk (A2M), Wisetech (WTC), Sonic Healthcare (SHL), Woodside (WPL), QANTAS (QAN)

|

| Wed 20th November 2019 | AGM – Webjet (WEB), Platinum (PTM)

|

| Thu 21st November 2019 | AGM – QUBE (QUB) |

| Fri 22nd November 2019 | AGM – RESMED (RMD)

|

Monday 18 November 2019, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.