From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Key market themes

Australian economic data remains very soft and has given us precious little to hang our hat on insofar as our confidence in a 2020 economic rebound.

Today’s ANZ Job Advertisements for November fell again and are down -12.6% on last year, and the November Building Permit figures for private houses also fell, this time to their lowest absolute figure in almost 7-years.

Being this deep into the year, it seems likely we will have to wait until the new year for tangible signs of a bottoming, however we still feel confident its likely.

Rising Australian house prices will help perceptions of household wealth – house prices for Australia’s 5 capital cities have now risen 15-week on the trot – and an increasing likelihood that the Federal Government could bring forward personal income tax cuts at the May Budget will likely spur a turning point during 1H 2020.

Economic data released

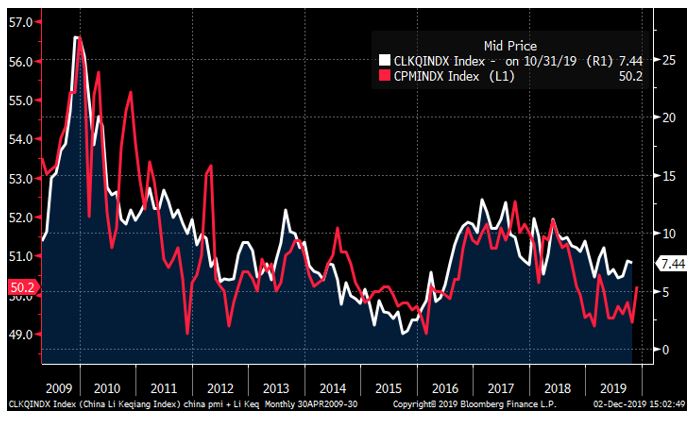

November Chinese manufacturing continued to improve with the official data coming in at its best level since Q1 and the unofficial Caixin manufacturing index further rising on last month’s level to its highest rate since early 2017. Conditions in China remain tight, but this data reminds us that impacts on industrial demand from the trade war have been ongoing for over 18 months and not news.

Australian November Job Advertisements continued to fall and are now -12.6% YoY. Employment is likely to remain a soft spot until deep into 2020.

Australian November Building Permits failed to fire, falling again on the month to be down -23.6%. The absolute number of private house permits fell to its lowest level since 2013 and the figure for apartments is similarly soft. Given the typical delay between permitting and construction of 3-6 months, these figures put any prospect of rebounding domestic residential construction before winter next year as slim.

Observations from the past week

Westpac (WBC) shares remained under pressure last week as analysts tried to gauge the likely level of civil penalties the bank would be forced to pay as compensation for their alleged contraventions of Anti-Money Laundering legislation.

The best guess seems to point to a figure of $1bn to $2bn in total, which unfortunately cancels out the benefit of the group’s earlier $2.5bn capital raise and leaves the bank in the likely position of once again being capital constrained under the new regulations, both here and in New Zealand.

WBC shares have underperformed their peer group by -5-7% over the past 3 months and it would seem unlikely to expect this to turn anytime soon. However, with the stock under $25 and offering a forward yield of around 6% its quite likely the stock will find absolute support from yield-hungry domestic investors the closer it trades towards $21-23.

Telstra (TLS) shares were one of the strongest performers last week, with the share rising +8% after a well-received investor day that saw both 2019 operational guidance confirmed and a ray of hope that mobile division profitability was set to improve.

Several major investment banks upgraded the stock to BUY, though notably, target prices barely reached $4.00 indicating that perhaps the rally says as much about the dearth of absolute opportunity elsewhere in the market as it does about TLS.

Whilst we remain HOLDERS of TLS in portfolio’s we have long held the view that the stock is worth somewhere in the $4.00 to $4.50 range depending on a variety of assumptions.

We think this target will be reached, but caution against extrapolating last weeks share price jump, particularly given the risks of a Federal Court overturning the ACCC’s decision to block the merger of mobile players TPG Telecom (TPM) and Vodafone in the new year.

What’s interesting?

For the second month in a row we have seen a positive surprise in Chinese manufacturing data, with this month’s official PMI surprising with a jump back into positive month-on-month activity and supporting the jump in unofficial figures released a month ago for October activity.

The chart below shows in red the official China Purchasing Manager data for manufacturing businesses with the jump above 50 in November a move to positive monthly performance.

The white chart is the so-called Le Keqiang index, named after the current Chinese Premier who once famously told a US Ambassador that he didn’t trust the official GDP figures and hence followed rail cargo volumes, electricity consumption and bank lending.

The white chart is a clever index of those three indicators.

China industrial activity showing signs of a bottom

Looking ahead

- Monday – AU AIG Manufacturing Index (Nov), CBA Manufacturing Index (Nov), ANZ Job Adverts (Nov), AU Building Approvals (Oct), CH China Caixin PMI (Nov), US Manufacturing PMI (Nov), US ISM Manufacturing (Nov),

- Tuesday – AU RBA Meeting,

- Wednesday – AU AIG Services Index (Nov), CBA Services Index (Nov), AU GBP (Q3), US ADP Employment (Nov), US ISM Non-manufacturing (Nov)

- Thursday – AU Retail Sales (Oct)

- Friday – AU AIG Construction Index (Nov), US Employment Report (Nov), US Michigan Consumer Sentiment (Dec)

A very quiet week on the corporate front this week with only Nufarm (NUF) of note holding their AGM this week.

The following week however expect fireworks at Westpac’s (WBC) AGM, and Pendal (PDL) will also hold theirs next Friday.

On the international front, the UK election is scheduled for December 12th and the first Democratic caucus is penciled in for February 3rd 2020.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 6947 | +131 | +1.9% |

| S&P / ASX 200 | 6845 | +136 | +2.0% |

| Property Trust Index | 1667 | +43 | +2.6% |

| Utilities Index | 8158 | +190 | +2.4% |

| Financials Index | 6074 | +42 | +0.7% |

| Materials Index | 13609 | +248 | +1.9% |

| Energy Index | 11677 | +465 | +4.1% |

Friday Closing Values

| Index | Change | % | |

| U.S. S&P 500 | 3140 | +30 | +1.0% |

| London’s FTSE | 7346 | +20 | +0.3% |

| Japan’s Nikkei | 23293 | +181 | +0.8% |

| Hang Seng | 26346 | -249 | -0.9% |

| China’s Shanghai | 2872 | -13 | -0.5% |

Key Dividends

| Mon 2nd December 2019 | N/A |

| Tue 3rd December 2019 | N/A |

| Wed 4th December 2019 | N/A |

| Thu 5th December 2019 | AGM – Nufarm (NUF)

Ex-Div – Pendal PDL), CBAPD, CBAPE, CBAPF, CBAPG |

| Fri 6th December 2019 | AGM – RESMED (RMD) |

Monday 2 December 2019, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.