From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Investment update

The focus has turned to ‘re-opening’ with each country moving at its own pace and in its own way.

This gives us cause for optimism at a human level, but from an investment perspective we remain unmoved in our caution.

The easing in ‘shelter-in-place’ regulations across many U.S states will be closely watched as indeed will the relative success or failure of progressively easing in rules across parts of Europe, notably Germany, Austria and Denmark.

Our central premise remains that until such time as a vaccine is developed, economies will be forced to operate with far less operational efficiency than previously.

Resilience will become the operative word, replacing ‘efficiency’ as the most oft-used term by executives.

Balance sheets will be less encumbered by debt, savings rates will escalate and broad-based demand will struggle to recover until such time as society feels confident that their daily activities will not run the risk of incurring the virus.

We continue to advocate for a cautious portfolio view and continue to address holdings which we believe could be compromised due to economic or balance sheet leverage.

We remain highly watchful of the US corporate bond market and the potential for rolling downgrades there causing more significant pressure.

Similarly the situation in Europe is worth closely watching given the material sovereign debt burden held by the likes of Italy, Spain and France and the need for their stronger northern European neighbours to support these countries with the funds needed to recapitalise their ailing economies.

Observations for the past week

National Australia Bank $3.5bn capital raising

- NAB this morning announced a $3.5bn capital raising at $14.15, a discount of around 20% to book value

- The raising may cause mixed emotions amongst retail investors since the NAB have chosen to raise only $500m via share-purchase plan through retail investors, however the offset is that NAB have paid out a 30c dividend for the March half year (worth $900m) that they otherwise might not have.

- The raising will take NAB Tier 1 capital up to 11.2% and back in line with its major peers ANZ (ANZ) and Commonwealth Bank (CBA)

- At first glance, excluding the additional software capitalisation charges previously announced and a fresh $828m in addition to collective provisioning, group profits look light on, driven by mark-to-market losses in the capital markets group, however expenses look in line

- Whilst the bank will give more detail at their results next week, the bank outlined their expectations for the Australian economy which include a return to pre-COVID levels of economic growth in early 2022 (2 years away) and a peak in domestic unemployment mid-2020 at 11.7%

China slowly returning to some sense of normal

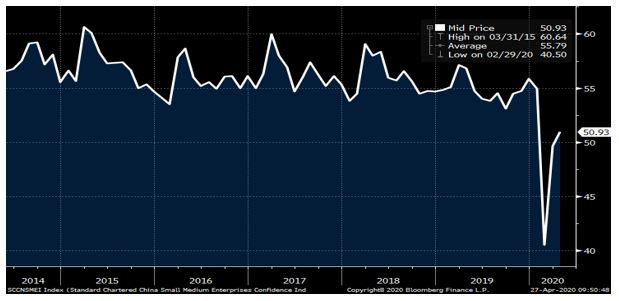

- The April Standard Chartered Business Confidence figure for small & medium sized enterprises was released last week (see chart below) and showed a rebound back to modest month-on-month growth

- Corporate anecdotes continue to support the notion that there is a resumption of activity occurring, however it is not all smooth sailing as Korean exports to China in the first 20 days of April are down 27% annually and machine tool orders are also unmoved at their lows

- Traffic data in major cities shows citizens back at work, but activity on the weekends remains well down indicating a continued social reticence to engage beyond close social circles

- This Thursday we get April Chinese manufacturing data which will be closely watched

Looking ahead

| Monday | US Dallas Fed (APR) |

| Tuesday | US Consumer Confidence (APR), US Richmond Fed Manufacturing (APR) |

| Wednesday | Alphabet (GOOG), US GDP (Q1), US Federal Reserve meeting |

| Thursday | ANZ (ANZ), Apple (APPL), Facebook (FB), Microsoft (MSFT), Amazon (AMZN), Twitter (TWTR), Ebay (EBAY), AU Private Sector Credit (MAR), CH PMI (APR), US Weekly Jobless Claims, US Weekly Consumer Confidence, US Chicago PMI (APR) |

| Friday | AU AIG Manufacturing Index (APR), Corelogic National House Prices (APR), US ISM Manufacturing (APR) |

This week is a major week for investors with our first real glance at April economic activity around the world plus the release of important corporate earnings from major technology and industrial corporates in the United States and Europe.

China April PMI on Thursday will be a feature as will be US manufacturing data released on Friday night.

In Australia, the release of interim profit results from ANZ (ANZ) and National Australia Bank (NAB) will be a focus, as will sales releases from the two major grocery retailers, Coles (COL) and Woolworths (WOW).

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 5300 | -244 | -2.4% |

| S&P / ASX 200 | 5242 | -242 | -2.5% |

| Property Trust Index | 1083 | -90 | -8% |

| Utilities Index | 7604 | -126 | -1.6% |

| Financials Index | 4122 | -180 | -3.8% |

| Materials Index | 11485 | -295 | -2.6% |

Friday closing values

| Index | Change | % | |

| U.S. S&P 500 | 2836 | -48 | -1.7% |

| London’s FTSE | 5752 | -35 | -0.7% |

| Japan’s Nikkei | 19262 | -635 | -3.3% |

| Hang Seng | 23831 | -549 | -2.3% |

| China’s Shanghai | 2808 | -31 | -1.1% |

Key dividends

| Date | |

| Mon 27 April | n/a |

| Tue 28 April | n/a |

| Wed 29 April | Coles Q3 Trading Statement |

| Thu 30 April | Woolworths Q3 Trading Statement, ANZ Interim profits |

| Fri 1 May | Div Ex-Date – Betashares & Vanguard ETF’s |

–

Monday 27 April 2020, 1pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.