From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

Key market themes

Booming start to 2020 for Australian equity investors

- The ASX200 is up almost +7% YTD making it the best performing developed market

- Optimism around the U.S / China trade deal and a liberal addition of monetary stimulus by the U.S Federal Reserve have fuelled returns into the new year

- Australian reporting season commences in a fortnight and we expect markets to get a wake-up call as corporate earnings further disappoint

- Already we have seen profit warnings from Downer (DOW), CIMIC (CIM), Insurance Australia (IAG), NIB (NHF), Kogan.com (KGN) and Nufarm (NUF)

Federal Reserve Repo boosting liquidity boosts animal spirits

- In endeavouring to bolster interbank liquidity last September, the US central bank have surprised many and boosted liquidity in the financial system by a staggering US $400m

- Equity investors are calling this ‘Quantitative Easing 4’ (QE4) and have rushed out of cash

- Next week’s US Federal Reserve meeting will provide a crucial update from the Fed as to their future intentions and is likely a binary outcome for markets. This is an important event.

Economic data released

Australian Employment not that good

- Australian December Employment figures looked sound at the headline level with 28,900 new jobs created, but all of them were part time

- The headline unemployment rate dipped to 5.1% and for all intents and purposes the market tried to take the number well, however we would note that Australia’s economy has barely added any full-time jobs (1,300 only) in the 5 months since July – not unlike 2016

- We have flagged the erosion in job advertisement figures during 2019 (-19% annually) and find I difficult to see the unemployment rate going anywhere but up in 2020

Australian Consumer Confidence near a 4-year low

- Australian Consumer Confidence for January fell again to be just off of a 4-year low which ought be unsurprising given the horrible bushfires the country has experienced this summer

- Incredibly respondents answered that they felt current conditions were virtually as bad as at any point since the GFC

Company News

Downer (DOW) profit warning

- DOW disappointed the market with its second profit downgrade this year, causing the shares to fall -20% on the news

- Once again the groups Engineering division was the source of the angst with a surprise deterioration in fixed price contract profitability and a subsequent need to provision for slower activity and restructuring of the division

- Though the headline downgrade was -20%, the core operational downgrade looks to be more like -10% on an ongoing basis

- The likely sale of Mining Services and Laundries in the coming 6 months will leave the group nearly net-cash and with the potential to commence a small buyback

- Having trimmed some of our holdings in the high $8’s, we will look more closely at adding to positions under $7 in the coming months

Webjet (WEB) takeover rumours continue to percolate

- The press this week suggested that the company had set up an independent committee to handle interaction with advisors and potential suitors who have been granted access to WEB’s financial statements

- The stock remains well bid on account of the bid speculation despite the business most definitely being impacted by the Australian bushfires

- We feel like there is very real potential in a bid emerging for the company in the coming months and advise holding positions

Boral (BLD) takeover rumours continue

- The press this week speculated that Irish construction giant CRH could be interested in acquiring BLD

- BLD has been a major disappointment to investors in recent years, but we think much of that is priced into the shares and would not be surprised to see the company bought or broken up.

Looking ahead

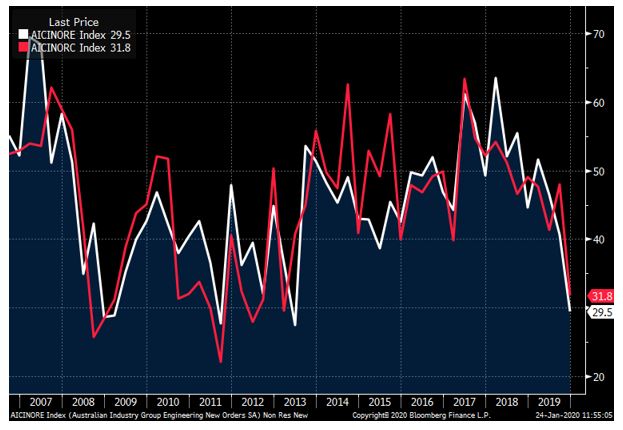

Australian Non-residential construction activity deteriorating

So much has been written about the residential housing slowdown and the ongoing infrastructure stimulus that we probably just assume that it’s only housing that has witnessed a significant slowdown in activity in recent months.

The major metropolitan transport projects along the eastern seaboard further perpetuate this belief, but as the chart below shows, new order activity in both the civil construction and engineering sector has collapsed to its worst monthly momentum in over 6 years.

Given these two sectors overwhelmingly dwarf housing construction it has the potential to be a major headache for the Australian economy in 2020 and beyond.

Slowing capacity addition in the resource and energy sectors are a major factor.

The Australian construction industry employs over 1.2m people and it is the third largest employer by sector, behind only healthcare and social services and retail.

Job advertisements are down -19% annually as of December already, and the signs on future capital formation from this valuable sector look rather concerning as we launch into 2020.

Commercial & Engineering New Order momentum deteriorating

Australian Industry Group New Orders – Commercial (red), Engineering (white)

| Monday | AU AUSTRALIA DAY HOLIDAY |

| Tuesday | AU NAB Business Confidence (DEC), US Consumer Confidence (JAN) |

| Wednesday | AU Westpac Leading Economic Index (DEC), AU CPI (Q4) |

| Thursday | US Federal Reserve meeting, US GDP (Q4) |

| Friday | AU Private Sector Credit (DEC), US Chicago PMI (JAN), US Michigan Consumer Sentiment (JAN) |

‘Big tech’ reports in the U.S this week, with Apple (AAPL), Ebay (EBAY), Facebook (FB), Microsoft (MSFT) and Amazon (AMZN) all reporting.

Of more significance we think will be the US Federal Reserve meeting on Thursday night and the Democrat caucus in Iowa on Monday week.

With all the optimism surrounding the Fed’s recent liquidity injection, markets run the risk of being disappointed by a more circumspect Fed in this regard.

Chinese New Year commences this weekend also and leaves much of Asia out of action all of next week.

Australian reporting season kicks off in a fortnight.

Thursday 5pm values

| Index | Change | % | |

| All Ordinaries | 7200 | +20 | +0.3% |

| S&P / ASX 200 | 7087 | +23 | +0.3% |

| Property Trust Index | 1680 | +15 | +0.9% |

| Utilities Index | 8237 | -24 | -0.3% |

| Financials Index | 6245 | +14 | +0.2% |

| Materials Index | 11896 | -137 | -1.1% |

Thursday closing values

| Index | Change | % | |

| U.S. S&P 500 | 3325 | -4 | -0.1% |

| London’s FTSE | 7507 | -167 | -2.2% |

| Japan’s Nikkei | 23795 | -246 | -1.0% |

| Hang Seng | 27909 | -1147 | -3.9% |

| China’s Shanghai | 2976 | -99 | -3.2% |

Key dividends

| Date | Header |

| Mon 27 Jan 2020 | AUSTRALIA DAY HOLIDAY |

| Tue 28 Jan 2020 | N/A |

| Wed 29 Jan 2020 | N/A |

| Thu 30 Jan 2020 | N/A |

| Fri 31 Jan 2020 | N/A |

Monday 28 January 2020, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.