From Jonathan Bayes, consultant Chief Investment Officer, Bentleys Wealth Advisors

The US and China continue to progress towards completion of ‘phase one’ of their trade deal and both sides have made soothing remarks as indication to the milestones achieved.

Remarks out of unnamed officials in China did surface last week that indicated however that the Chinese side felt less inclined to be so confident insofar as to striking a longer-term arrangement that would encompass issues of government subsidies and enforcement of intellectual property rights.

For now, it would seem likely that both sides have a vested interest to progress ‘phase one’ (largely Chinese agricultural purchases), but that markets should feel less certain of further agreement, particularly as we draw closer to the next scheduled tariff hike in mid-December.

The closer we draw to the initial Democrat primaries in early February, the more likely domestic US politics will begin to have a bearing on financial markets and individual stocks and sectors exposed to potential legislative change.

We flagged up our caution for 2020 on this front several weeks ago, specifically highlighting the surging poll numbers for Senator Elizabeth Warren in the race for the Democratic nomination.

Warren is a left-leaning, consumer advocate with keynote policies on Medicare-for-all, a wealth tax and regulation of large monopolies in technology and the financial system.

Last week celebrated hedge fund investor Paul Tudor Jones was quoted as saying that US equity markets would fall -25% if Senator Warren was elected President in November 2020.

Economic data released

Australian September Building Approvals bounced +7.6% month on month, which we think has the potential to be encouraging.

Continued high auction clearance rates will lead to a strong national house price rebound in the months to come and this will be substantial tailwind for consumer activity in 2020.

US employment gains remained strong in October with a further 130,000 jobs added and a 3.6% unemployment rate

The US Federal Reserve cut interest rates to 1.50% as expected last week, but signaled that the economy was in a sound position and unlikely to need further adjustment lower in the near term

Observations from the past week

ANZ Bank (ANZ)

ANZ Bank shares fell over -6% last week after the company reported disappointing FY2019 profit figures that included a surprise reduction in the level of franking on its final dividend.

Falling interest margins caused cash profits to miss analyst estimates by -3-5% and the lack of Australian profitability meant the company could not fully frank its second half dividend (franked at 70% only)

Since the start of the year ANZ profit estimates have fallen by over -12% and it is hard to see the trend changing any time soon, particularly with the impact of falling RBA cash rates yet to be fully reflected in group earnings (the bank hedges interest rates ahead of time meaning that it can protect profits for a limited period of time through hedge gains).

Investors should expect a further 12 months of bank earnings disappointment and the potential for additional dividend cuts in 2020 and 2021 as low interest rates erode the domestic business model.

We remain significantly underweight Australian banks in our recommended portfolios.

Afterpay (APT)

Afterpay shares have fallen over $10 from a high above $37 mid way through October to be near $27 today and we believe there is increasing merit in adding to positions around these levels.

Whilst the UBS research report that called APT a SELL last month has many merits, we believe the ongoing operational momentum within APT will continue to outperform broker forecasts and that the next news-flow from the company will likely be very strong.

Google trend’s points to exceptionally strong search engine activity for APT in the United States, which augers well for activity on the platform over the high-volume Thanksgiving and Christmas sales period in that country.

APT will hold their AGM next week on the 13th of November and its quite likely the company could further update the market on recent operational performance.

Pendal (PDL)

Pendal will report full year 2019 profit on Wednesday and whilst we know the year has been a weak one from the group, we are hopeful that the company can provide grounds for greater optimism looking into 2020.

The valuation on the group is increasingly undemanding at 13x current earnings, alongside a net cash balance sheet and 7% partially franked annual dividend yield.

Any sign that core UK, European and Global equity franchises are beginning to outperform their benchmarks and PDL shares will be quickly +10-15% higher.

What’s interesting?

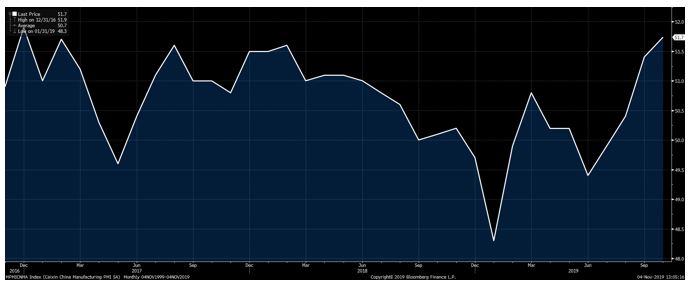

Whilst far from comprehensive, the bounce in Chinese manufacturing activity over the last quarter – by one measure at least – gives markets reason to speculate that after 18 months of industrial weakness brought on by the trade war, China’s manufacturing sector could finally be stabilizing.

The Caixin survey released on Friday saw the headline manufacturing index rise to its highest level since early 2017, and the new order sub-index jumped to its best level since as far back as 2013.

It is hard to get to carried away as indicators on activity remain well down, but in recent months there has definitely been a stabilization in monetary aggregates (M2 remains in the low 8% annual growth rate range) and in annual electricity production (an excellent guide on real activity).

Our portfolios are overweight emerging markets and have suffered modestly on account of this in 2019, but we are hopeful that if signs improve on the economic front in China, investment performance from several of our key funds should similarly improve.

China October Caixin Manufacturing rebounding

Looking ahead

- Monday – AU ANZ Job Advertisements (Oct), AU Retail Sales (Sep), Westpac (WBC) earnings

- Tuesday – AU Australian Industry Group Service sector activity (Oct), CBA Service sector activity (Oct), RBA Meeting, US Markit Service sector PMI (Oct), US JOLT Job Openings (Sep), US ISM Service sector activity (Oct)

- Wednesday –Pendal (PDL) FY19 earnings, Boral (BLD) AGM

- Thursday – AU Australian Industry Group Construction sector activity (Oct), AU Trade Balance (Sep), National Australia Bank (NAB) earnings, BHP (BHP) AGM

- Friday – AU RBA Statement on Monetary Policy, AU Home loans (Sep), US Michigan Consumer Sentiment (Nov)

This week our focus will be on the new economic data out from October, both locally and abroad, but also the Pendal (PDL) earnings numbers due Wednesday, the Boral (BLD) AGM statements on Wednesday.

Both Westpac (WBC) and National Australia Bank (NAB) will report full-year earnings this week, but we think the outcomes here will mirror those of ANZ (ANZ) last week and likely disappoint investors.

Friday 5pm values

| Index | Change | % | |

| All Ordinaries | 6779 | -62 | -0.9% |

| S&P / ASX 200 | 6669 | -70 | -1.0% |

| Property Trust Index | 1638 | -8 | -0.5% |

| Utilities Index | 8221 | -12 | -0.1% |

| Financials Index | 6245 | -200 | -3.1% |

| Materials Index | 13047 | +17 | +0.1% |

| Energy Index | 10961 | -44 | -0.4% |

Friday Closing Values

| Index | Change | % | |

| U.S. S&P 500 | 3066 | +43 | +1.4% |

| London’s FTSE | 7302 | -22 | -0.3% |

| Japan’s Nikkei | 22850 | +51 | +0.2% |

| Hang Seng | 27100 | +433 | +1.6% |

| China’s Shanghai | 2929 | -26 | -0.9% |

Key Dividends

| Mon 4th November 2019 | Earnings – Westpac (WBC) |

| Tue 5th November 2019 | N/A |

| Wed 6th November 2019 | AGM – Boral (BLD)

Earnings – Pendal (PDL) |

| Thu 7th November 2019 | Earnings – National Australia (NAB)

AGM – BHP (BHP) |

| Fri 8th November 2019 | Div Pay Date – Metrics (MXT/MOT) |

Monday 4 November 2019, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.