Key economic releases last week

- Australian headline inflation increased by 7% year-on-year and 1.4% quarter-on-quarter, which was slightly above consensus. The RBA’s preferred trimmed mean measure was below consensus at 6.6% YoY and 1.2% QoQ. Despite being well above the RBA target, the current run rate indicates that inflation has peaked and is now trending downwards.

- US consumer confidence was slightly below expectations at 101.3 (consensus was 104), which is slightly above the neutral level. Personal spending remained unchanged on a month-on-month basis.

- US personal consumption expenditures rose 0.1% MoM, below consensus for 0.3%, while the core reading was in-line with consensus at 0.3%. The current level of inflation is in line with the Federal Reserve’s target, but it needs to be sustained to be considered sustainable by the Fed.

- The preliminary reading of the US Gross Domestic Product (GDP) showed weak growth of 1.1% for the quarter, which was significantly lower than the consensus forecast of 2% growth.

- The European Union’s (EU) GDP grew by 0.1% for the quarter or 1.3% year-on-year, which was slightly below the consensus forecast of 0.2% and 1.4%, respectively.

Key releases for the week ahead

- RBA policy meeting

- US, EU, Australian PMIs

- US job data

- US Federal Reserve policy meeting

- ANZ job ads, Australian retail sales

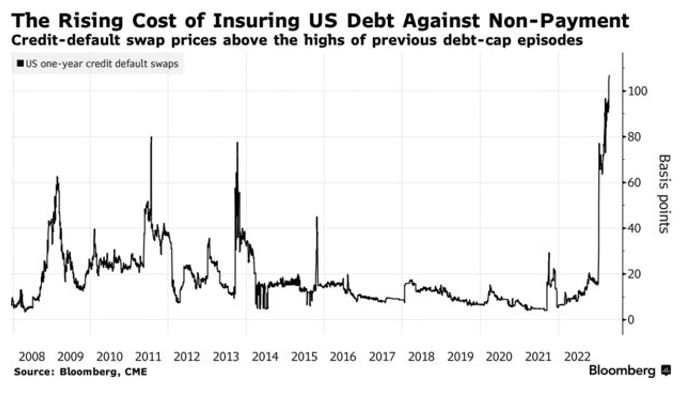

Chart of the week

The US debt ceiling is a limit set by Congress on the amount of money that the US government can borrow to pay its bills. It’s like a credit limit on a credit card. When the government reaches this limit, they cannot borrow more money until the limit is increased. If the limit is not increased, it could lead to a government shutdown or a default on the nation’s financial obligations.

In January this year, the US hit this debt ceiling. In response, The Department of Treasury undertook a set of temporary “extraordinary measures” to bide more time for Congress to raise this limit. The debt ceiling can only be raised by Congress voting to raise the limit. This process is often complex and contentious and subject to nasty political debate, with rival political parties looking to leverage this vote to negotiate various concessions.

The chart above from Bloomberg shows that credit default swaps (CDS) for the US government debt has gotten more expensive. CDS are like insurance policies that investors can purchase to protect themselves in case the US government is unable to pay back its debts. If the US government defaults on its debt, the CDS pays out to the investor. The cost of CDS reflects how risky the market thinks it is for the US government to pay back its debts.

It is highly likely that the US government will agree to raise the debt ceiling as not doing so could severely harm the economy. However, both the Democrats and Republicans are currently engaged in a contentious negotiation process, and the final terms of the agreement may include substantial spending cuts that could significantly impact the US economy. In the past, the financial markets have become more volatile and experienced a sell-off when negotiations drag on and the deadline to raise the debt ceiling approaches. So, we expect this issue to be at the forefront of investors minds over the upcoming months.

–

Monday 01 May 2023, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.