Key economic releases last week

- Aus preliminary retail sales rose 0.2% MoM, marginally above the 0.1% consensus.

- US consumer spending rose 0.2% MoM, slightly below expectations.

- US personal consumption expenditure increased by 0.3% MoM for both core and headline readings, which is slightly lower than expected. The YoY growth for both also decreased slightly to 4.6% and 5% respectively. Although progress has been made towards the 2% inflation target, the monthly rate is still too high.

- China’s PMIs exceeded expectations, indicating further expansion in both manufacturing and non-manufacturing sectors. The non-manufacturing reading was particularly strong, suggesting a strong recovery in consumer demand. However, the recovery in manufacturing is relatively slower.

- The EU’s preliminary CPI showed that both core and headline MoM readings were higher than expected, with core rising by 1.2%. This is a worrying sign as inflation is still increasing in Europe.

Key releases for the week ahead

- RBA policy meeting

- US ISM PMIs

- China Caixin PMIs

- US jobs data

Chart of the week

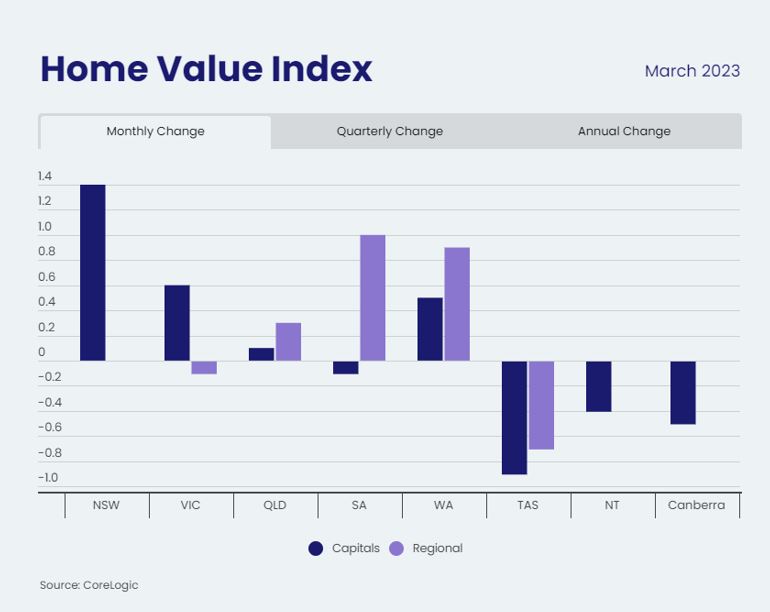

In a surprising result, Australian real estate posted positive gains in March defying higher interest rates. CoreLogic’s national Home Value Index (HVI) increased by 0.6% in March, marking the first month-on-month rise since April 2022. Sydney (+1.4%) and Melbourne (+0.6%) led the national result. However, not all areas saw gains, as Tasmania, the Northern Territory, and Canberra posted falls. Low property listings, a structural undersupply of housing, surging migration, and a tight rental market are among the factors supporting property values. It remains unclear whether the bottom has been reached, with higher rates still filtering through the system and the ‘fixed-rate mortgage cliff’ playing out.

Should the housing market have reached its floor and begin to experience a sustained rise, it could have significant effects on consumer spending patterns. The economic theory of the wealth effect posits that individuals are inclined to increase their expenditures when the value of their assets, including housing, appreciates. As a significant fraction of a person’s wealth is usually tied up in their property, an upward trend in the housing market may have a considerable influence on how people spend their money, with potential ramifications for inflation, economic growth, and business activity.

–

Monday 03 April 2023, 2.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.