Key economic releases last week

- Australian retail sales rose by 0.2% MoM, below consensus for 0.3% growth.

- Australian monthly weighted mean CPI rose 5.2%, in-line with consensus.

- US consumer confidence fell more than estimated to 103, compared to consensus of 105.5. Retail spending rose 0.4%, in-line with consensus.

- US PCE inflation rose 4.5% YoY, less than consensus for 4.8%. The core reading rose 4.3% compared to consensus for 4.5%.

- US Q2 GDP rose 2.1%, in-line with consensus.

- EU preliminary inflation readings were lower than consensus, rising 4.3% YoY while the core reading rose 4.5%.

Key releases for the week ahead

- RBA policy meeting

- China PMIs

- US employment data

Chart of the week

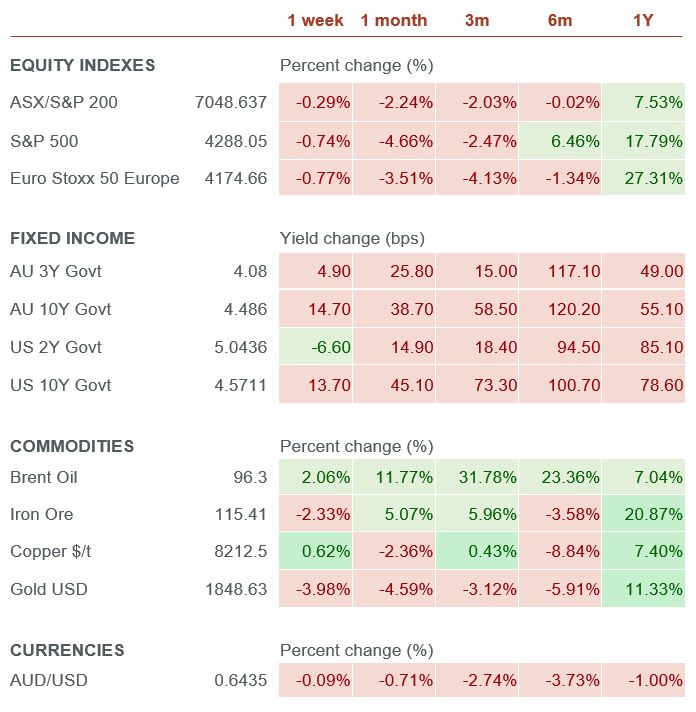

Bond yields have moved higher over the past couple of weeks as the US Federal Reserve published interest rate projections that showed it expects interest rates to stay higher than previously projected in 2024. Meanwhile, inflation figures have also bounced, driven by a rise in energy prices, dashing hopes for a straightforward path back towards target.

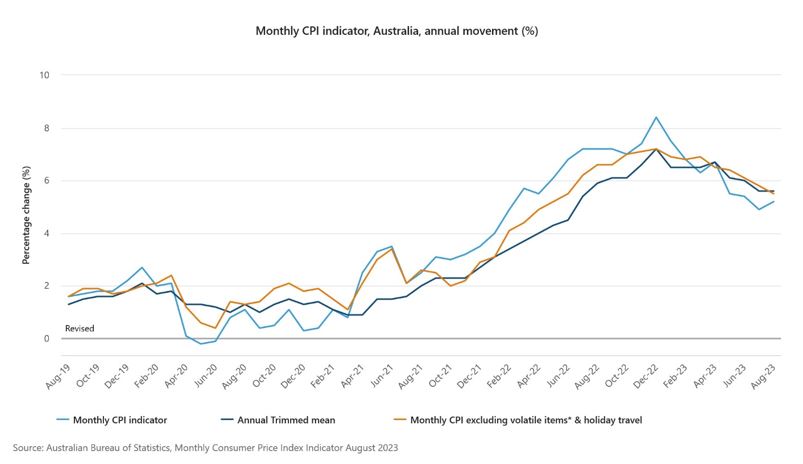

The monthly CPI indicator that was released last week showed a similar picture for Australia. The headline reading ticked higher from the previous reading, while the trimmed mean reading was flat, though the core reading indicated that sticky inflation continues to moderate.

We continue to expect that rates will remain higher for longer if economic growth remains resilient but we are likely close to or at the peak in the rate hiking cycle. With real interest rates back in positive territory and restrictive in most countries, we see a high bar for central banks to embark on another round of significant tightening, especially as quantitative tightening is set to continue as the Fed and ECB continue to reduce their balance sheet. As a result, though yields have pushed higher, we continue to see bonds as relatively attractive compared to other asset classes.

–

Tuesday 03 October 2023, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.